/Cincinnati%20Financial%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $25.5 billion, Cincinnati Financial Corporation (CINF) provides a broad range of property and casualty insurance products through its Commercial Lines, Personal Lines, Excess and Surplus Lines, Life Insurance, and Investments segments. It also offers annuities, investment services, commercial leasing and financing, and insurance brokerage services.

Shares of the Fairfield, Ohio-based company have outpaced the broader market over the past 52 weeks. CINF stock has increased 19.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. However, shares of the company are down marginally on a YTD basis, lagging behind SPX’s slight gain.

Focusing more closely, the insurer stock has outperformed the State Street Financial Select Sector SPDR ETF’s (XLF) marginal return over the past 52 weeks.

Despite posting better-than-expected Q4 2025 adjusted EPS of $3.37 on Feb. 9, shares of Cincinnati Financial Corporation fell 3.3% the next day as investors focused on a weaker combined ratio of 85.2% versus 84.7% a year earlier. The decline was also driven by a 13% drop in new business written premiums to $331 million, reflecting cautious underwriting in a competitive market.

For the fiscal year ending in December 2026, analysts expect CINF’s EPS to rise 6.5% year-over-year to $8.47. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

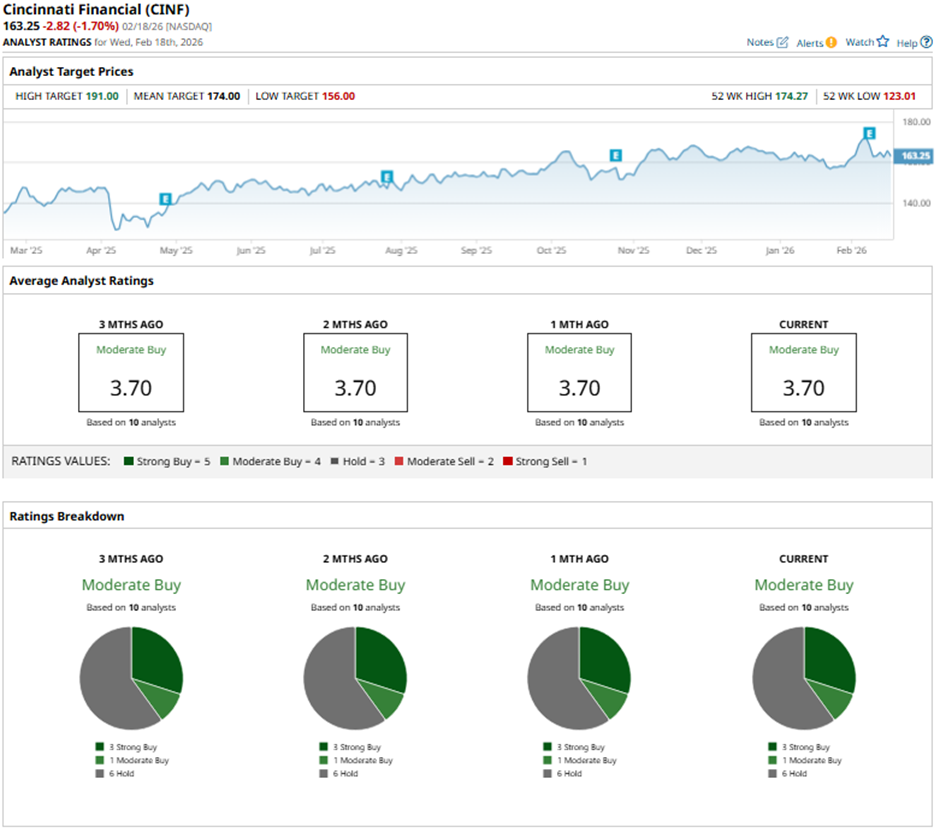

Among the 10 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Feb. 11, Piper Sandler analyst Paul Newsome maintained a “Hold” rating on Cincinnati Financial, setting a price target of $157.

The mean price target of $174 represents a 6.6% premium to CINF’s current price levels. The Street-high price target of $191 suggests a nearly 17% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)