Headquartered in Pittsburgh, Pennsylvania, Westinghouse Air Brake Technologies Corporation (WAB) designs locomotives, propulsion platforms, braking systems, and mission-critical rail components that keep global freight and transit networks moving on schedule.

With a market cap of approximately $44.4 billion, it pairs heavy engineering with digital intelligence, turning rail infrastructure into a data-driven, service-backed ecosystem.

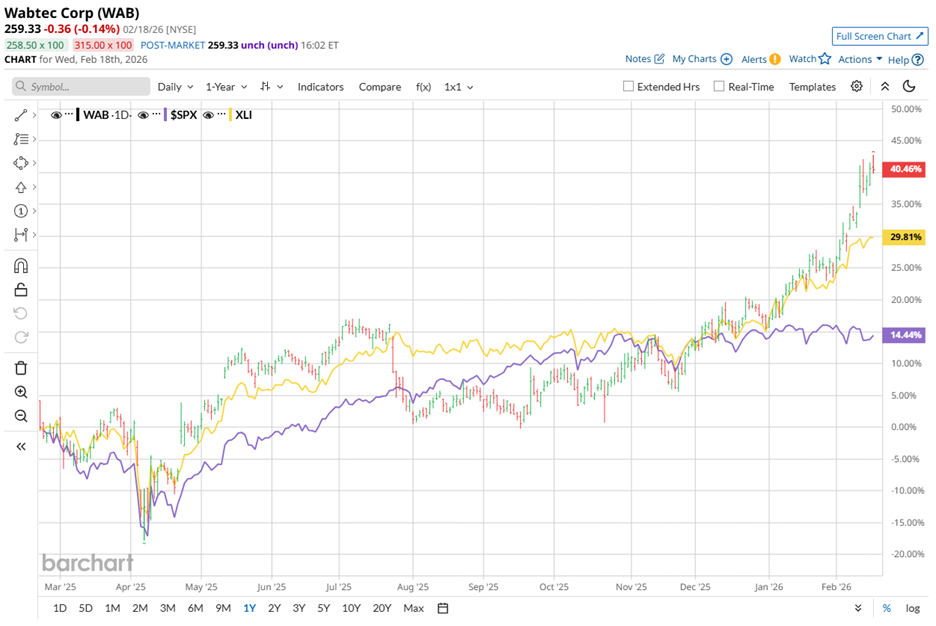

Over the past 52 weeks, Wabtec’s shares have climbed 37.7%, comfortably ahead of the 12.3% gain delivered by the S&P 500 Index ($SPX) during the period. Year-to-date (YTD), the stock has advanced 21.5%, while the broader index has eked out only a modest rise.

Even within its own arena, the company holds its ground. The State Street Industrial Select Sector SPDR ETF (XLI) gained 26.3% over the past year and stands up 12.8% YTD. Against that backdrop, Wabtec’s performance reflects competitive strength.

Those results became unmistakable on Feb. 11. The stock rose 3.2% after management reported fourth-quarter 2025 revenue of $2.97 billion, reflecting 14.8% year-over-year growth and surpassing the $2.86 billion analyst estimate. Adjusted EPS grew 25% to $2.10, exceeding the $2.08 Street forecast.

That same day, management reaffirmed its strategic focus by confirming the successful completion of its acquisition of Dellner Couplers, a Swedish-based specialist in safety-critical train connection systems for passenger rail networks.

The transaction adds complementary technology and strengthens Wabtec’s passenger rail portfolio. At the same time, it positions the company for accelerated, profitable growth while deepening its presence in high-reliability systems.

For the full fiscal year 2026, ending in December, analysts expect diluted EPS to grow 15.6% year over year to $10.37. Notably, Wabtec has exceeded EPS estimates in each of the past four quarters, reinforcing management’s credibility in execution and strengthening investor confidence in forward guidance.

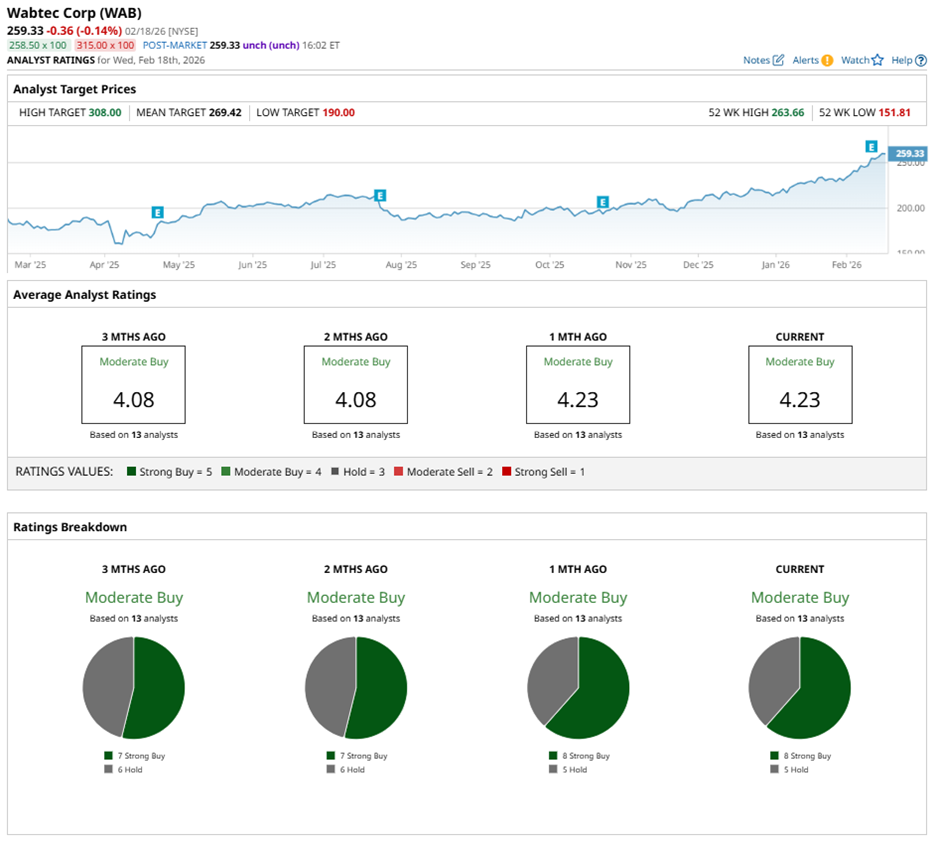

Wall Street continues to assign WAB stock an overall rating of “Moderate Buy.” Of the 13 analysts covering the stock, eight recommend “Strong Buy,” while the remaining five suggest “Hold.”

Analyst sentiment has strengthened meaningfully from three months ago, when seven analysts assigned the stock a “Strong Buy” rating.

On Feb. 13, Wells Fargo & Company (WFC) analyst Jerry Revich reaffirmed an “Equal-Weight” rating on WAB stock while sharply increasing his price target to $270 from $224. A day earlier, Stephens & Co. analyst Brady Lierz maintained an “Overweight” rating and lifted his price target to $290 from $230, reflecting positive sentiment towards the company's prospects.

That said, WAB’s average price target of $269.42 represents potential upside of 3.9%. Meanwhile, the Street-high target of $308 suggests a gain of 18.8% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)