Will low volatility stocks ever be sexy again?

Over the past decade, they have been “hot” for a few brief moments in time. But in general, the market has continued to move away from them. Maybe that’s about to change. Or, maybe it is just another tease from an area of the stock market that should make sense right now.

To me, the narrative around low-volatility stocks starts with the original tracking ETF, the Invesco S&P 500 Low Volatility ETF (SPLV), which debuted back in 2011. Its constituents often enjoy brief popularity when tech-driven panics hit.

But alas, they struggle to maintain momentum once the immediate fear subsides. I follow the Dow 30 (DIA) very closely, and I can tell you from the standpoint of tracking a tamer index of U.S. stocks, the flurries of outperformance typically end in disappointment.

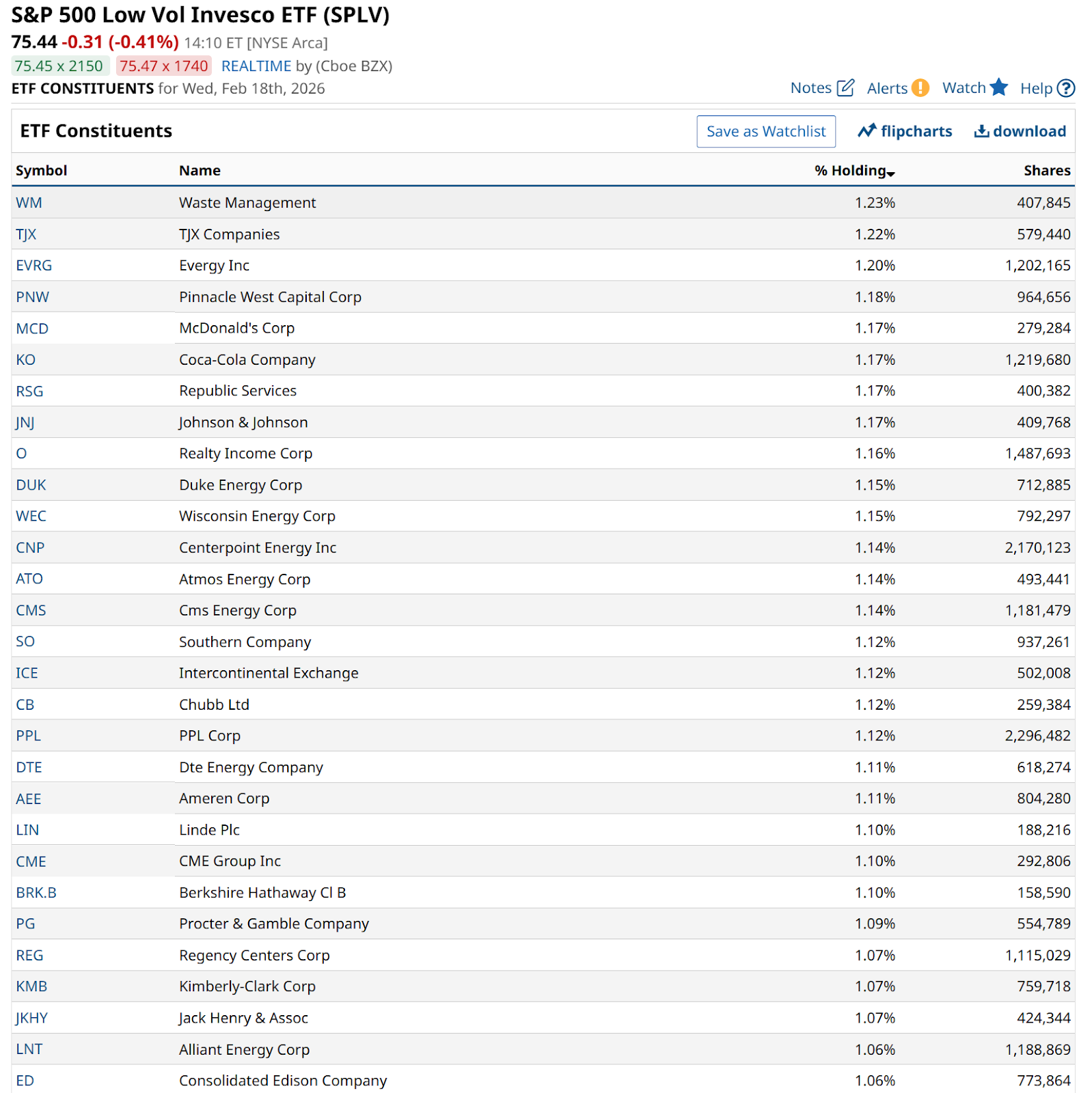

SPLV describes its portfolio as follows: “100 stocks from the SP 500 Index with the lowest realized volatility over the past 12 months.”

So it is backward-looking, which has produced some unwanted dings in its track record. Because stocks with a history of softer price swings do not guarantee that the past will be prologue. Think of less volatile software stocks, or some service companies, which were once thought of as relatively stable. That is, until artificial intelligence competition issues arose in 2026.

SPLV has produced reasonable absolute returns, but relative to the S&P 500 Index ($SPX), it’s no contest. And since this portfolio comprises one out of every five stocks in that index, it can’t escape that comparison in the eyes of many investors.

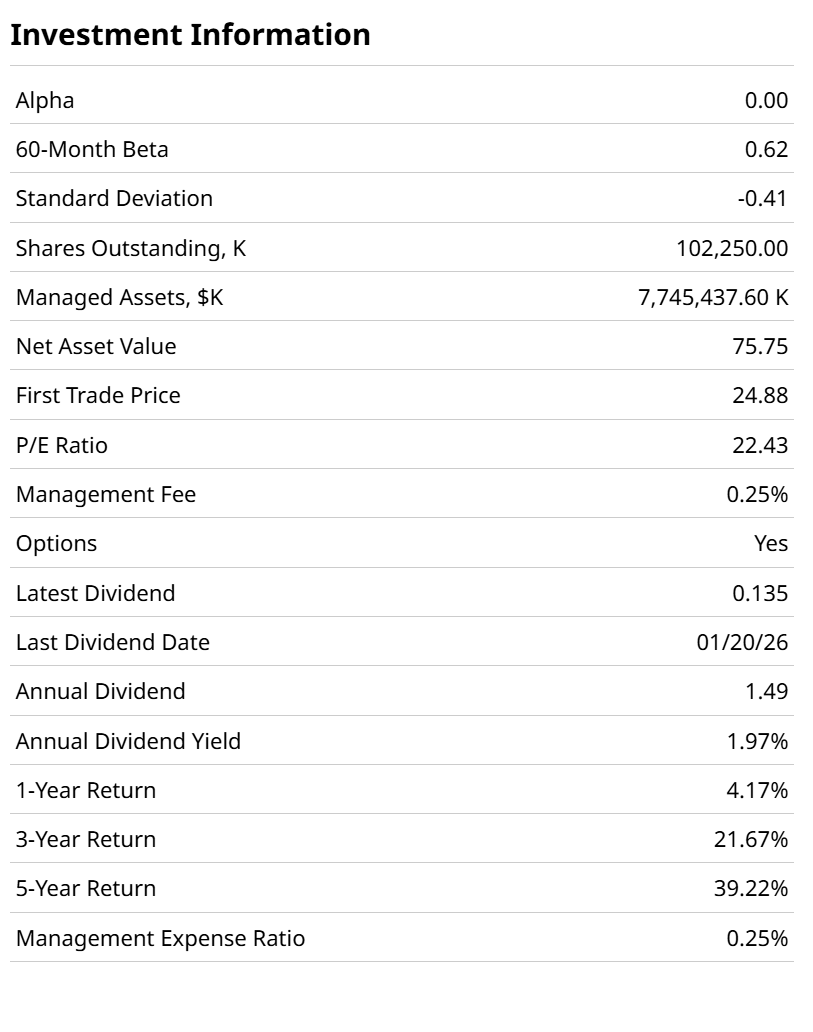

The ETF’s assets peaked just before the COVID-19 pandemic in 2020, at around $14 billion. Now, at roughly half that amount, it is back to its size as of about 10 years ago. As much as anything, that’s a statement on investor attitudes. Assets ballooned from just over $4 billion in 2017 to that aforementioned $14 billion level just three years later.

Here’s a look at the top segment of what is an equal-weighted portfolio. That structure tends to dampen a lot of potential “star appeal” as we would see in a more focused ETF.

What has held back this style of management, which was once so popular? In a word: technology. A lack thereof.

As of the end of January, SPLV had less than a 4% tech allocation. Utilities, Financials, Consumer Staples, and REITs account for 65% of the ETF, with Industrials adding another 10%. So three-fourths of fund assets are in areas that are nice diversifiers. But the market’s attitude is “why diversify” when Magnificent 7 and AI are on the menu.

For many active traders, SPLV is currently the “boring” part of the portfolio that is starting to feel like a liability.

But that could be the very thing that brings SPLV, or at least parts of its portfolio, back. The sectors it concentrates in are actually being seen more as beneficiaries of an inevitable AI-driven economy. Utilities have rallied on assumptions about their role, plus, lower interest rates. Industrials are potential beneficiaries, as AI might be a source of cost-cutting (a.k.a. job cuts).

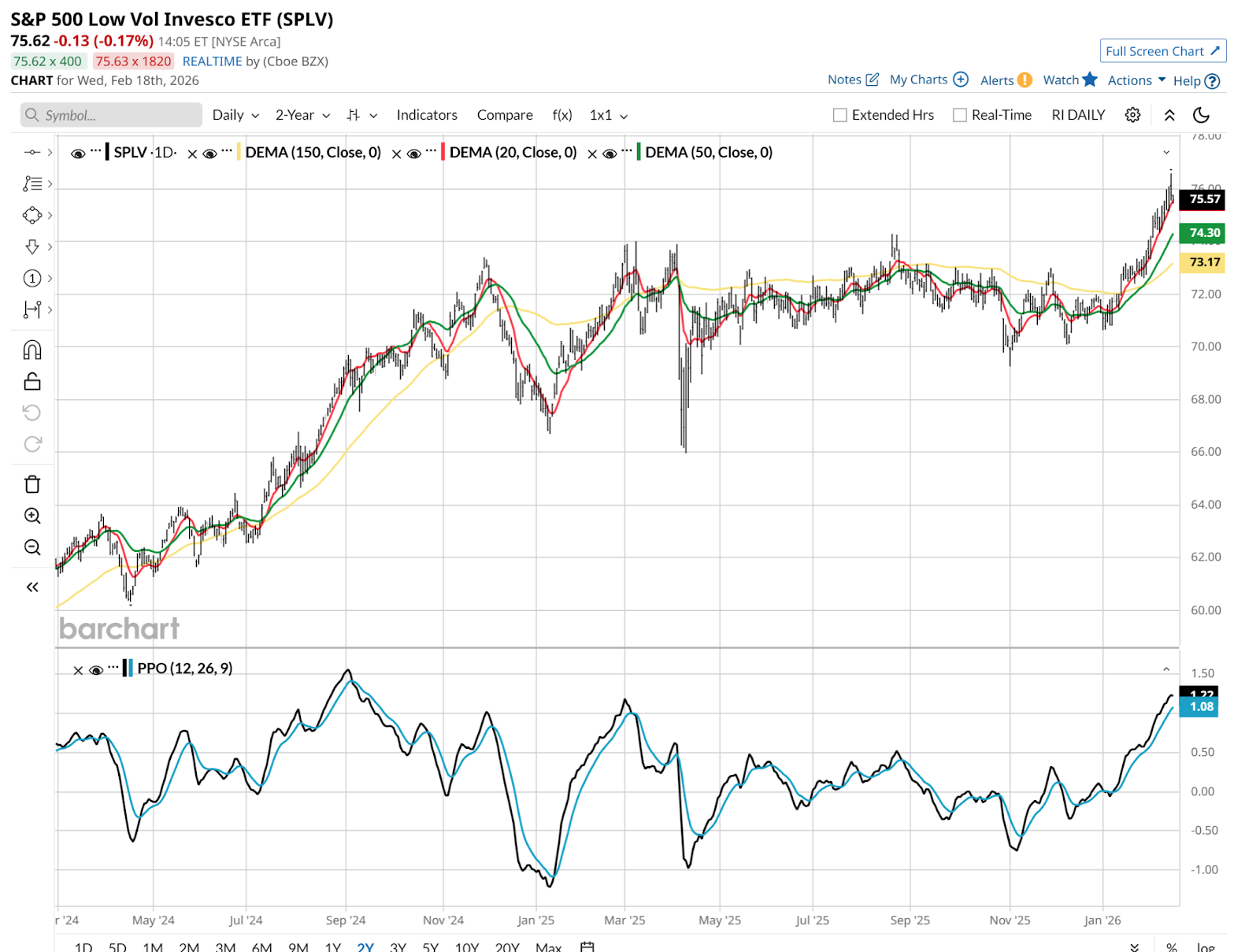

So, there’s reason to believe that SPLV could get some “run” on top of what we see in this chart. That’s only about a 6% rally, but it does bring SPLV to a new all-time high. Not that anyone has noticed. This also reminds us that there are different types of “all-time highs.” Some are part of a parabolic move, while others are just making up for lost time. Yet the same tag is applied to both.

Watchlist for a Real Hot Streak

To determine if low volatility stocks are about to become more than a momentary area of attraction, traders are watching two critical indicators:

- Market Dispersion: Low volatility typically outperforms when there is a large gap between individual stock returns, which usually happens during sustained market downturns.

- Volume Flows: While SPLV attracted more than $200 million in net flows over the last month, as noted earlier, long-term flows are deeply negative. That tells me that big money still views this as a tactical “rental” rather than a long-term “hold.”

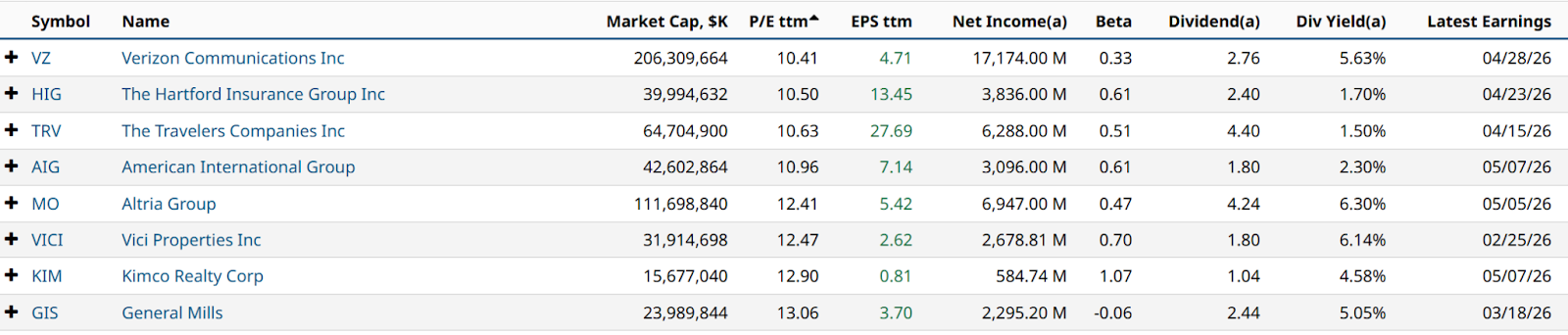

As with so many equity ETFs, I prefer to look at what’s inside SPLV, and go shopping there. Within a 100-stock portfolio, there are always places to do further research in hopes of finding some single stock gems.

Above, you see the top of a screen I did, after using Barchart’s tools to quickly take SPLV’s holdings and put them into a watchlist. I then sorted by low price-earnings ratio. Some of these stocks have decent dividends too.

That’s as good a place to start as any, in a market that is very much looking for direction.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)