/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

When a company beats on every major financial metric and then raises the bar even higher, investors tend to pay attention. That's what happened with Applied Materials (AMAT) on Feb. 12, when the semiconductor equipment maker delivered fiscal first-quarter earnings that sent shares surging more than 8%. Applied Materials blew estimates while signaling that the boom in artificial intelligence spending is driving unprecedented demand for its manufacturing tools.

For investors wondering whether to buy AMAT stock after this rally, the answer depends on your view of how long the AI wave will last. Wall Street analysts seem pretty convinced it's going to be a long ride.

Applied Materials Delivers Across the Board

Applied Materials reported revenue of $7.01 billion in fiscal Q1 (ended in January), topping analyst estimates of $6.88 billion. Adjusted earnings per share came in at $2.38, above the consensus estimate of $2.21. That's nearly an 8% beat, driven by the company's "disciplined cost control" and strong demand for advanced semiconductor tools.

Profit margins stayed healthy, too. EBITDA hit 31.9%, and EBIT came in just under 30%, showing that Applied Materials can maintain profitability even as the semiconductor industry navigates an uneven spending environment.

Management expects fiscal second-quarter revenue between $7.15 billion and $8.15 billion. The midpoint of that range is well above analysts' expectations. Normalized earnings per share guidance of $2.44 to $2.84 also topped forecasts.

CEO Gary Dickerson made it clear during the earnings call that this momentum isn't just a one-quarter story. AMAT expects its semiconductor systems revenue to grow more than 20% this calendar year, with the second half weighted even more strongly than the first.

AI Reshapes Chip Spending

Dickerson explained that AI has reached what he calls a "tipping point," where the technology delivers real productivity gains and a return on investment for users. That's creating a race among companies to build out AI infrastructure, which translates directly into demand for semiconductor manufacturing equipment.

"The race to build out AI infrastructure is driving unprecedented spending on semiconductors, semiconductor manufacturing capacity and research and development," Dickerson said on the call.

The fastest-growing markets right now are leading-edge logic chips, high-bandwidth memory DRAM, and advanced packaging. These are precisely the areas where Applied Materials holds strong market leadership.

In leading-edge logic, Applied Materials is the number one process equipment provider. The company expects to capture more than 50% of its served market in gate-all-around transistors and wiring.

In DRAM, particularly high-bandwidth memory used in AI applications, Applied Materials is also the market leader.

Here's a key detail that many investors might miss:

- HBM DRAM requires customers to start three to four times more wafers to deliver the same number of bits as standard DRAM.

- As the industry moves from HBM3 to HBM4, that multiplier increases.

- More wafer starts mean more equipment sales for Applied Materials.

CFO Brice Hill noted that the company has been preparing for this surge. Applied Materials has nearly doubled its system manufacturing capacity over the past several years and built up inventory by about $500 million to meet increased demand.

Wall Street Raises AMAT Stock Price Target

Analysts across Wall Street upgraded their outlooks on Applied Materials following the earnings report.

Wells Fargo analyst Joe Quatrochi highlighted that the company's expected 20%-plus growth in semiconductor systems revenue was "well ahead" of prior Street estimates of 11% year-over-year (YoY) growth. He maintained an “Overweight” rating with a $435 price target.

Evercore ISI analyst Mark Lipacis expects the valuation gap between Applied Materials and peers such as ASML (ASML), Lam Research (LRCX), and KLA Corp. (KLAC) to narrow as equipment spending accelerates through 2027. He has an “Outperform” rating and a $400 price target on the stock.

Bank of America analyst Vivek Arya delivered perhaps the most bullish take, calling it the "time to shine" for Applied Materials.

"As the largest semicap with the broadest portfolio, AMAT has strong leverage to this multi-year WFE cycle focused in leading-edge F/L and DRAM to support outsized AI demand," Arya wrote in a note to clients.

He raised his price target to $420 from $350 and reiterated his “Buy” rating. Arya estimates Applied Materials will gain about 100 basis points of market share in calendar year 2026.

Capacity Constraints Could Extend the Cycle

One interesting dynamic that emerged from the earnings call is that cleanroom space, not customer demand, is limiting how fast equipment makers can grow right now.

Hill explained that leading-edge foundry, logic, and DRAM capacity are essentially full. Prices have increased, and customers are giving Applied Materials longer-term visibility to ensure the company has operational capacity in place for their manufacturing ramps.

Multiple new factory projects are scheduled to come online in 2027, which should open up additional capacity. That suggests the strong demand environment could extend well into next year.

The Bottom Line for AMAT Stock Investors

Valued at a market cap of $281.6 billion, AMAT stock has returned 222% to shareholders over the past three years.

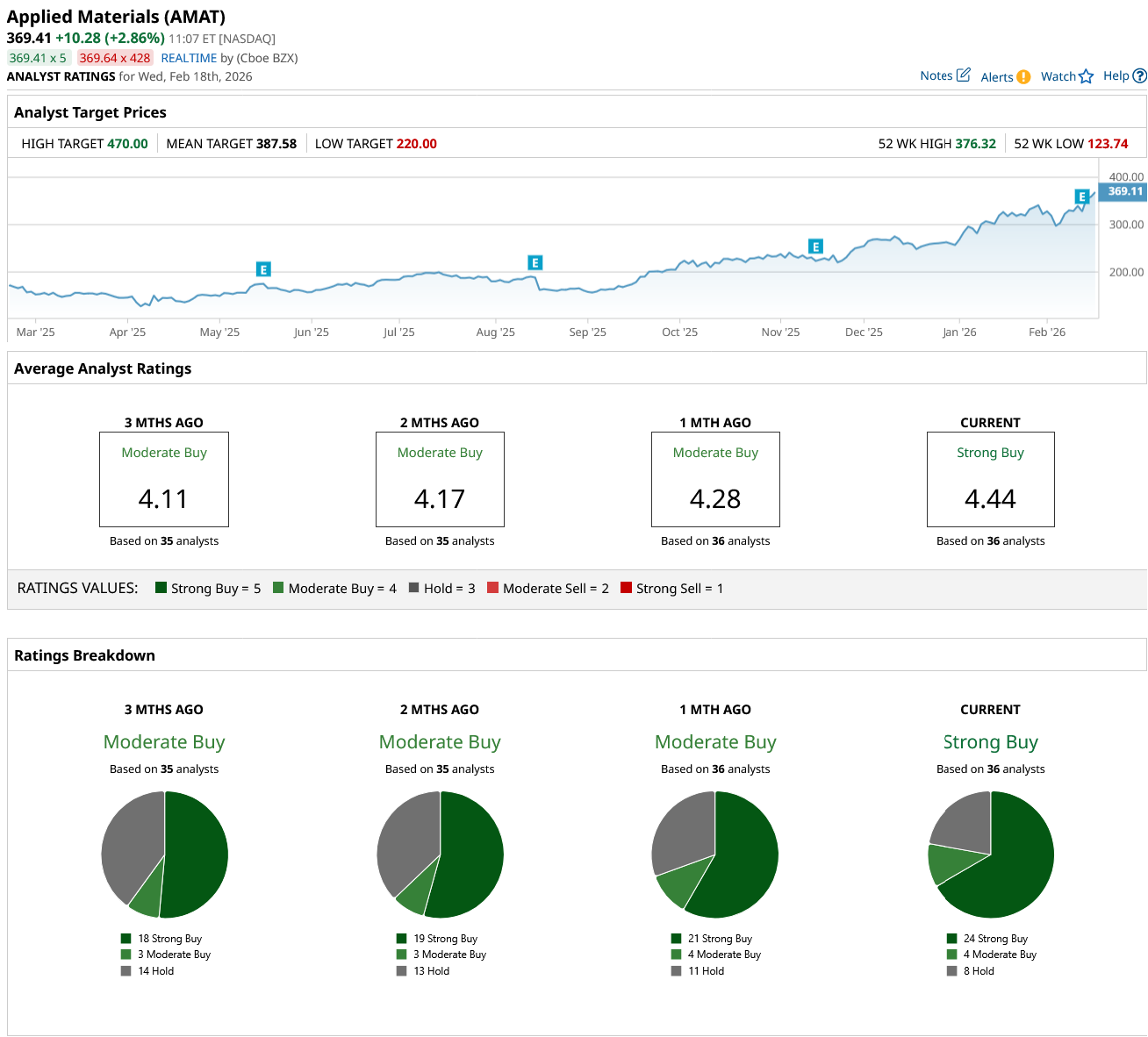

Out of the 36 analysts covering AMAT stock, 24 recommend “Strong Buy,” four recommend “Moderate Buy,” and eight recommend “Hold.” The average AMAT stock price target is $387.58, about 5% above the current price of $369.41.

AI is driving a multi-year investment cycle in semiconductor manufacturing, and Applied Materials is the largest equipment supplier with leadership positions in the fastest-growing segments.

The chipmaker’s guidance suggests this isn't a short-term bump. Management is talking about sustained growth through 2027 and beyond. Wall Street analysts are raising price targets and saying AMAT stock deserves to trade closer to its peers.

The risk is that Applied Materials shares have already run up significantly, and semiconductor equipment stocks can be volatile. If AI spending slows or customers delay factory builds, the stock could pull back.

But if you believe AI infrastructure buildout has years to run, Applied Materials looks well-positioned to capitalize on it. The company has just demonstrated it can deliver strong results in a challenging environment while preparing for even greater growth ahead.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)