/Veralto%20Corp%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of around $23 billion, Veralto Corporation (VLTO) is a global provider of water analytics, water treatment, and product quality solutions, operating through its Water Quality and Product Quality & Innovation segments. It serves industries such as municipal utilities, food and beverage, pharmaceuticals, and industrials through well-known brands including Hach, Trojan Technologies, Videojet, Esko, X-Rite, and Pantone.

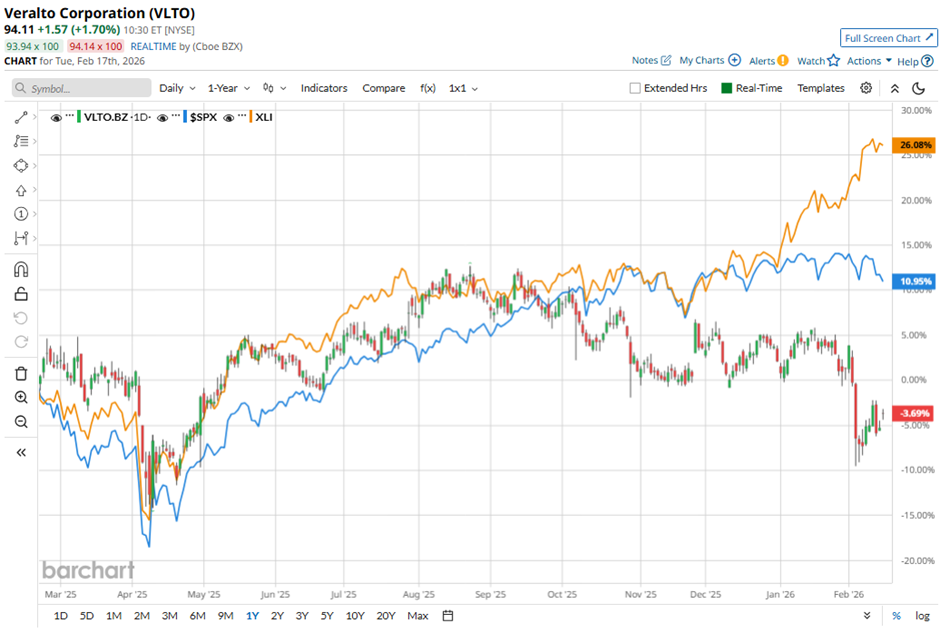

Shares of the Waltham, Massachusetts-based company have lagged behind the broader market over the past 52 weeks. VLTO stock has decreased 3.6% over this time frame, while the broader S&P 500 Index ($SPX) has returned 11.5%. Moreover, shares of the company are down 5.3% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the water and product quality services provider have also underperformed the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.9% return over the past 52 weeks.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $1.04 on Feb. 3, shares of VLTO tumbled 6.2% the next day. Investors were also disappointed by 2026 guidance, with Q1 adjusted EPS projected at $0.97 - $1.01 and full-year EPS of $4.10 - $4.20, which signaled slower sequential growth. Further weighing on sentiment were forecasts for flat-to-low single-digit core sales growth early in 2026 and only ~25 basis points of margin expansion, falling short of expectations for stronger acceleration despite the earnings beat.

For the fiscal year ending in December 2026, analysts expect Veralto’s adjusted EPS to grow 6.9% year-over-year to $4.18. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

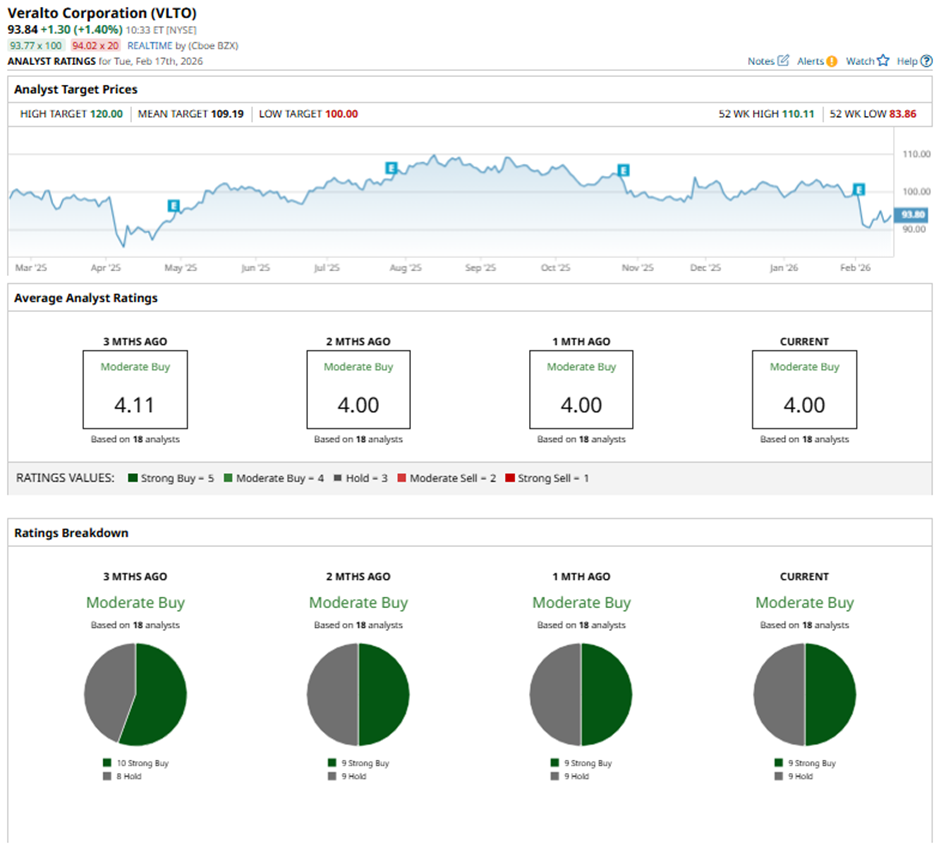

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings and nine “Holds.”

On Feb. 5, Stifel analyst Nathan Jones lowered Veralto Corporation’s price target to $118 while maintaining a “Buy” rating.

The mean price target of $109.19 represents a premium of 16.4% to VLTO's current levels. The Street-high price target of $120 implies a potential upside of 27.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)