/HCA%20Healthcare%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

HCA Healthcare, Inc. (HCA), headquartered in Nashville, Tennessee, stands as a leading U.S. healthcare provider. It operates hospitals, ambulatory surgery centers, freestanding emergency rooms, and physician clinics across multiple states, employing a vast workforce dedicated to high-quality patient care, innovative treatments, and compassionate services. The company has a market capitalization of $120.82 billion.

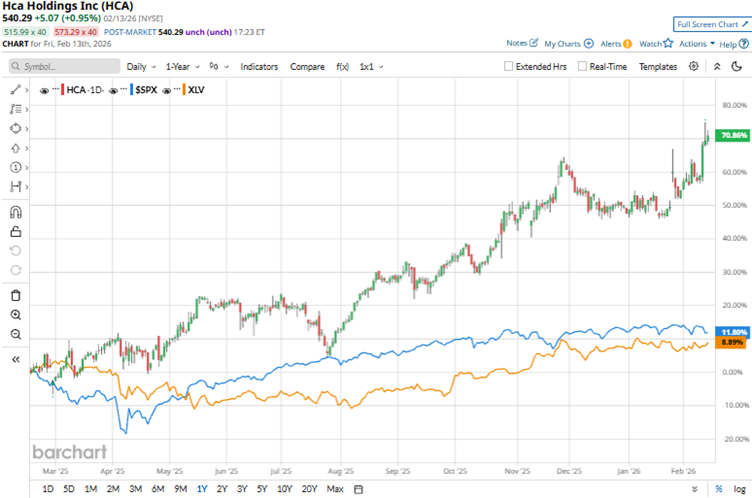

On the backs of robust fundamentals and share buybacks, HCA’s stock has been gaining. Over the past 52 weeks, the stock has increased 67.8%, while it is up 15.7% year-to-date (YTD). HCA’s shares had reached a 52-week high of $552.90 on Feb. 12, but are down 2.3% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 11.8% over the past 52 weeks but is down marginally YTD, indicating that the stock has outperformed the broader market. Next, we compare the stock with its own sector. The State Street Health Care Select Sector SPDR ETF (XLV) has increased 7.7% over the past 52 weeks and 1.9% YTD. Therefore, the stock has outperformed its sector over these periods.

HCA Healthcare’s stock gained 7.1% intraday on Jan. 27, as the company reported robust fourth-quarter results. Its revenue increased 6.7% year-over-year (YOY) to $19.51 billion. HCA also announced an additional share repurchase program for up to $10 billion of its outstanding common stock and increased its dividend. The company’s adjusted EPS for the quarter was $8.01, up 28.8% YOY and better than what Wall Street analysts had expected.

For the current quarter, Wall Street analysts expect HCA’s EPS to increase 11.2% YOY to $7.17 on a diluted basis. Moreover, EPS is expected to increase 7.1% annually to $30.20 for fiscal 2026, followed by a 10.4% improvement to $33.35 in fiscal 2027. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

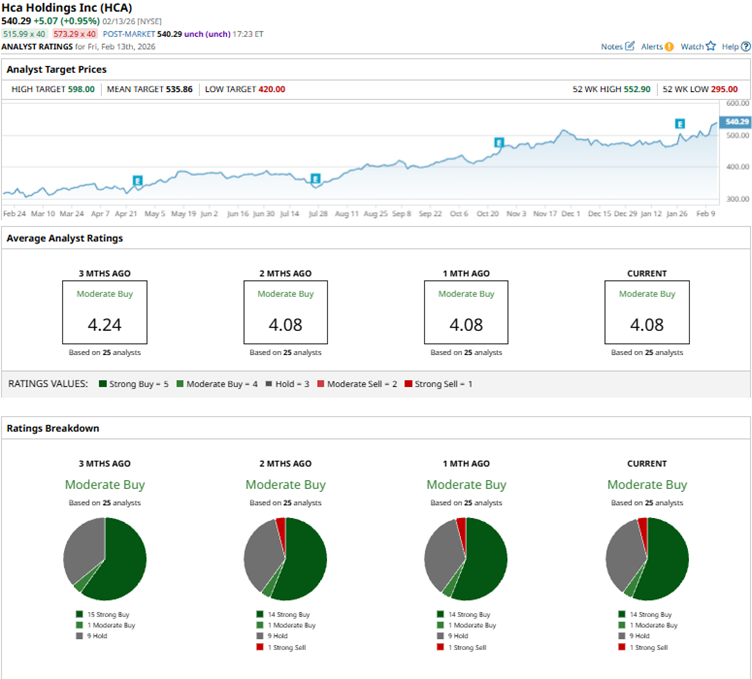

Among the 25 Wall Street analysts covering HCA’s stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Strong Sell.” The ratings configuration has become less bullish than three months ago, with 14 “Strong Buy” ratings, down from 15.

Post the fourth-quarter results, Argus Research, represented by analyst David Toung, maintained a “Buy” rating on the stock, while raising the price target from $530 to $560, indicating continued confidence in the company’s performance. HCA’s mean price target of $535.86 indicates a marginal downside over current market prices. However, the Street-high price target of $598 implies a potential upside of 10.7%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)