/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20on%20screen-by%20madamF%20via%20Shutterstock.jpg)

With a market cap of $19.6 billion, Expeditors International of Washington, Inc. (EXPD) is a global logistics provider offering airfreight, ocean freight, customs brokerage, warehousing, and end-to-end supply chain solutions across the Americas, Europe, North Asia, South Asia, and MAIR. It serves industries such as retail, electronics, healthcare, technology, and manufacturing with specialized services including trade compliance, cargo insurance, and shipment monitoring.

Shares of the Bellevue, Washington-based company have surpassed the broader market over the past 52 weeks. EXPD stock has increased nearly 30% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. However, shares of the company are down 1.7% on a YTD basis, lagging behind SPX’s marginal gain.

Focusing more closely, shares of the logistics services provider have outpaced the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.3% return over the past 52 weeks.

Shares of Expeditors International jumped 10.8% on Nov. 4 after the company reported Q3 2025 EPS of $1.64 and revenue of $2.89 billion, beating Wall Street expectations. Investors were encouraged by resilient operating performance amid a weak freight market, highlighted by 4% growth in airfreight tonnage, strong results in customs brokerage and fee-based services, and disciplined cost management despite ocean revenue pressure.

For the fiscal year that ended in December 2025, analysts expect EXPD’s EPS to rise 3.5% year-over-year to $5.92. Moreover, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

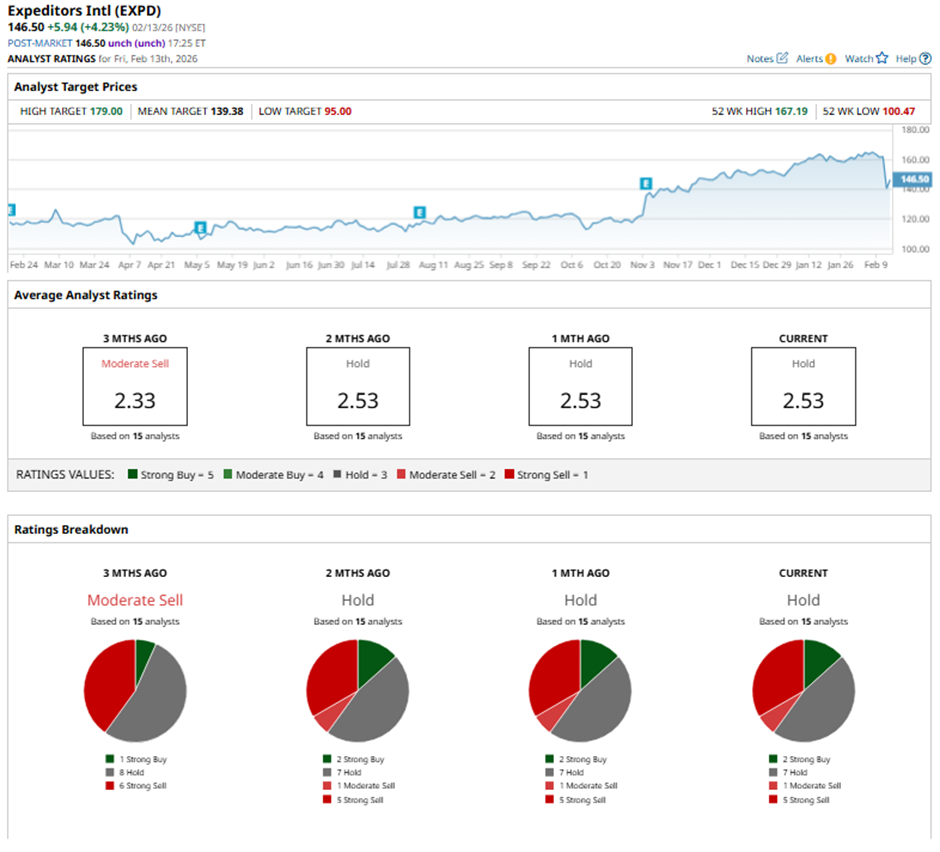

Among the 15 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buys,” seven “Hold” ratings, one “Moderate Sell,” and five “Strong Sells.”

On Jan. 15, Truist raised its price target on Expeditors International to $160 while maintaining a “Hold” rating.

As of writing, the stock is trading above the mean price target of $139.38. The Street-high price target of $179 implies a potential upside of 22.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)