Tech stocks struggled in 2022 amid challenging macroeconomic condition, but last year's artificial intelligence (AI) boom lit a spark, and propelled many sector components to new heights. Most AI tech stocks have been raising the stakes by integrating AI into their products to survive and thrive in this fiercely competitive industry.

Among the many excellent AI investment opportunities, my top two growth picks for this year are Alphabet (GOOGL) and Advanced Micro Devices (AMD). In 2023, Alphabet's stock gained 58%, while AMD shares surged 127%, outperforming the Nasdaq Composite's ($NASX) return of 44.5%. Following their recent strong quarterly results, Wall Street rates both stocks as a "strong buy," and experts are expecting more upside over the next 12 months.

The Case For Alphabet Stock

Since 2017, Alphabet has integrated AI into its products, including Gmail, Photos, Maps, and more. Now that AI has progressed, the company plans to offer more advanced products to its customers. GOOGL stock has surged 6.7% YTD, yet is down 3% from its all-time high.

Alphabet's Google Search continues to dominate the search engine market, with a share of around 92%. Despite challenges from the Department of Justice and peer Microsoft (MSFT) questioning its monopoly last year, Google Search's revenue increased by 8% year-over-year to $175 billion in 2023.

Alphabet's other growth driver is Google Cloud, which ranks third in the overall cloud computing market. Cloud revenue rose 26% YoY to $33 billion in 2023. YouTube ad revenue also increased 7.7% for the year to $31.5 billion.

Talking about the results, CEO Sundar Pichai stated, “We are pleased with the ongoing strength in Search and the growing contribution from YouTube and Cloud. Each of these is already benefiting from our AI investments and innovation. As we enter the Gemini era, the best is yet to come.”

Alphabet's financial strength puts it in a better position to capitalize on AI than smaller players in the industry. It ended the fourth quarter with $110.9 billion in cash, cash equivalents, and marketable securities, with a long-term debt of $13.2 billion. It also had a free cash flow of $69.5 billion at the end of the quarter.

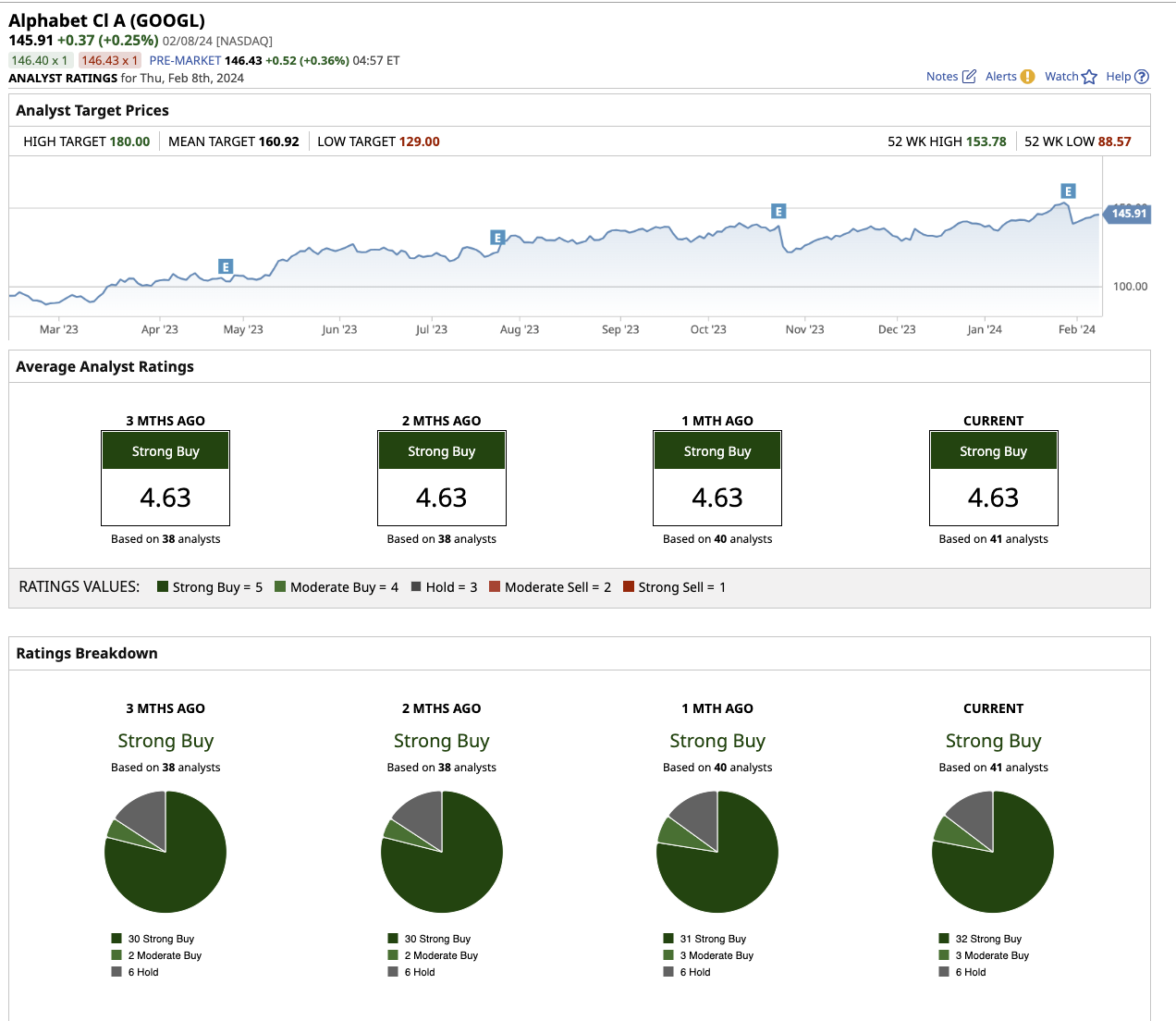

Out of the 41 analysts covering Alphabet stock, 32 have a “strong buy” recommendation, three recommend “moderate buy,” and six recommend “hold.” Based on analysts' average price target of $160.92, Wall Street sees potential upside of about 8% in the next 12 months. The Street-high target is $180.

Analysts predict that Alphabet's revenue and earnings will grow by 11.4% and 16.1%, respectively, in 2024. It is currently trading at 21 times forward earnings, while Amazon (AMZN) and Microsoft have forward price-to-earnings (PE) ratios of 40x and 35x, respectively. Alphabet appears to be a reasonably priced hyper-growth stock to buy now on the dip.

The Case for Advanced Micro Devices Stock

While Nvidia (NVDA) has long dominated the semiconductor space, AMD has made significant strides to establish a strong market position. Last year, the company's fundamentals improved as demand for its graphic processors increased, and AMD's recent fourth-quarter and full-year results reaffirmed the company's stronghold in the semiconductor space.

AMD shares are up 17% YTD, outperforming the S&P 500 Index's ($SPX) gain of 5.4%.

AMD's data center segment is recovering strongly. In the fourth quarter, the segment's revenue increased 38% year-over-year to $2.3 billion, driven by more rapid customer adoption of AMD Instinct GPUs and 4th Gen AMD EPYC CPUs. AMD's client segment sales increased by a whopping 62% to $1.5 billion, thanks to an increase in AMD Ryzen 7000 Series CPU sales. However, the gaming segment appears to be still struggling, with sales slipping 17% YoY in the quarter.

Although embedded segment sales fell 24% in Q4, management remains confident in the segment's long-term growth trajectory. AMD also expanded its AI software ecosystem by acquiring AI software leader Mipsology and open-source AI software expert Nod.ai last year.

Total revenue in the fourth quarter came in at $6.2 billion, up 10% year-over-year. Diluted earnings per share (EPS) of $0.41 in the quarter were substantially higher than $0.01 in the prior-year quarter. Earnings arrived in line with consensus estimates, while revenue topped expectations.

According to management, strong “quarterly AMD Instinct GPU and EPYC CPU sales and higher AMD Ryzen processor sales” drove the quarter's increase in total revenue and earnings.

As the AI era unfolds, demand for high-performance graphic processors will increase, which bodes well for AMD's long-term growth prospects. Analysts predict that revenue and earnings will increase by 13.8% and 37.7% year-over-year in 2024, respectively.

Overall, Wall Street has assigned a “strong buy” rating to AMD. Out of the 33 analysts covering the stock, 27 rate it a “strong buy,” one recommends a “moderate buy” and five say it’s a “hold.”

Based on its average target price of $184.37, the stock has 6.8% upside potential in the next 12 months. Moreover, its high target price of $270 implies a potential upside of 56% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)