/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Qualcomm Incorporated (QCOM) is starting 2026 on the back foot, as Wall Street grows uneasy about its long-term grip on the modem market. The latest blow came from Mizuho Securities, which downgraded the shares to “Neutral” and lowered its price target, citing rising competitive risks, most notably from one of Qualcomm’s largest customers. For years, Apple (AAPL) relied on Qualcomm’s modem technology to power iPhones, while Qualcomm chips also fueled a vast ecosystem of Android smartphones and Windows laptops competing directly with Apple’s devices.

Now, Apple’s growing confidence in its internal modem program signals a potential long-term shift that could chip away at one of Qualcomm’s most important revenue streams. And that’s not the only headwind. Slower growth expectations for the global handset market and elevated inventory levels across the supply chain have further cooled investor enthusiasm.

Additionally, Qualcomm is facing notable challenges in China, where ongoing antitrust investigations are creating operational uncertainty and adding another overhang to the stock’s narrative. Still, it’s not all caution tape. Investors have a key catalyst just ahead. Qualcomm is set to report fiscal 2026 first-quarter earnings after the market closes on Wednesday, Feb. 4. And with multiple overhangs already in focus, this upcoming report could play a pivotal role in shaping the stock’s next move.

About Qualcomm Stock

California-based Qualcomm develops technology that brings intelligent computing into more parts of everyday life. Drawing on four decades of innovation, the company works across areas like artificial intelligence (AI), high-performance yet power-efficient computing, and advanced wireless connectivity. Its Snapdragon platforms are used in many consumer devices, while Qualcomm Dragonwing products focus on helping businesses and industries improve performance, efficiency, and connectivity as digital demands continue to grow.

Currently sporting a market capitalization of about $161.9 billion, Qualcomm hasn’t exactly sprinted into 2026. The stock is down roughly 10.8% year-to-date (YTD), a sharp contrast to the broader S&P 500 Index ($SPX) which has climbed 1.9% over the same period. The slide looks even steeper from a longer view. Since peaking at $205.95 last October, shares have slid nearly 34.94%, leaving the chip giant deep in pullback mode.

Valuation is starting to stand out, too. Qualcomm’s shares currently trade at about 15.57 times forward earnings, a noticeable discount to the sector median of 29.23 times. That spread shows investors are taking a cautious stance, baking in concerns about competition and near-term demand. Yet it also suggests the stock could have meaningful upside if those fears prove overdone.

Qualcomm’s Q4 Earnings Snapshot

In November, Qualcomm delivered a strong finish to fiscal 2025, showing the business was still firing on multiple cylinders. Fourth-quarter revenue rose 10% year-over-year (YOY) to $11.3 billion, comfortably ahead of Wall Street’s $10.8 billion estimate. As usual, the QCT segment, home to chips for handsets, PCs, automotive systems, and Internet of Things (IoT) devices, remained the company’s largest growth engine.

Drilling down, handset revenue climbed 14% to $6.96 billion in the quarter. The automotive business accelerated even faster, with sales up 17% to $1.05 billion. Qualcomm’s IoT division also moved higher, generating $1.81 billion in revenue, a 7% increase from a year ago. The only soft spot was the licensing arm, QTL, where revenue slipped 7% YOY to $1.41 billion.

Even so, profitability impressed. Adjusted EPS came in at $3, up 12% from last year and well above the $2.88 consensus estimate. Reflecting on the performance, CEO Cristiano Amon highlighted that total QCT revenue excluding Apple for fiscal 2025 grew 18% YOY, while combined full-year Automotive and IoT revenue surged 27%.

Additionally, the CEO pointed to Qualcomm’s expanding opportunities beyond traditional markets, including the rollout of its automated driving stack and growing traction in data centers and advanced robotics. Innovation remains front and center. Qualcomm plans to roll out new AI accelerator chips, including the AI200 in 2026 and the more powerful AI250 in 2027, which is designed to be deployed in systems that can fill an entire liquid-cooled server rack.

Looking ahead, attention now shifts to fiscal Q1 2026 results, expected on Feb. 4. Qualcomm projects total revenue for the upcoming quarter to land between $11.8 billion and $12.6 billion, with QCT revenue forecast at $10.3 billion to $10.9 billion and QTL revenue between $1.4 billion and $1.6 billion. The company also expects non-GAAP EPS of $3.30 to $3.50, giving investors a clear view of its profit outlook as the new fiscal year begins.

How Are Analysts Viewing Qualcomm Stock?

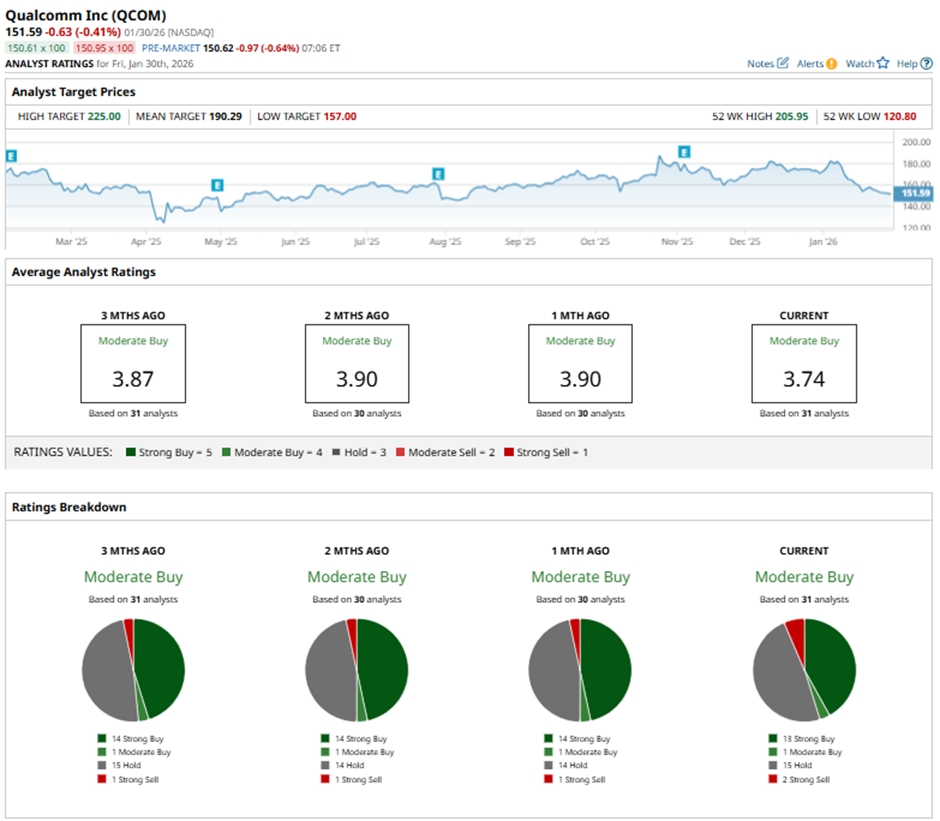

Despite the headwinds pressuring investor sentiment, analysts haven’t turned their backs on Qualcomm. The stock carries an overall “Moderate Buy” consensus rating, signaling that many on Wall Street still see meaningful long-term potential. Among the 31 analysts covering the company, 13 rate it a “Strong Buy,” one has a “Moderate Buy,” 15 recommend “Hold,” and only two suggest “Strong Sell.”

The price targets tell a similar story. The average target of $190.29 implies about 25.5% upside, while the Street-high target of $225 points to a possible 48.4% rally from current levels if the company delivers and sentiment turns more favorable.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)