/Microsoft%20Logo%20on%20Building%20over%20Nordstrom%20Store.jpg)

Microsoft Corp (MSFT) will release its Dec. qtr. earnings (fiscal Q2) on Tuesday. Analysts will be looking at how the company is monetizing its AI activities. They will be also scrutinizing the company's operating and FCF margins.

In any case, short-put income plays are now very popular for shareholders. This is based on a contrarian reaction to how far the stock has moved up.

For example, MSFT stock is now over $400 at $403.93. It's already up 7.4% this month alone from $376.04 at the end of December 2023.

But this rise has also pushed its put options premiums higher.

Traders are expecting a post-earnings release dip in the stock. Whether that happens or not, short sellers can now take advantage of these high premiums. They can sell short out-of-the-money (OTM) puts in nearby expiry periods.

Shorting OTM Puts for MSFT Stock

I discussed this strategy in my last Barchart article on Jan. 12, “With Microsoft's Value at $518 Per Share, Investors Can Short Puts for Extra Income.” At the time, two weeks ago, MSFT stock was at $385.88 and the $375 strike price puts that were to expire in 2 weeks on Jan. 26 were trading for $1.74.

Since MSFT closed well over $400 those puts expired worthless. That made the trade very profitable for the short sellers, especially if they were already MSFT shareholders. It brought in 0.464% (i.e., $174/$17,500) for every 1 put contract shorted.

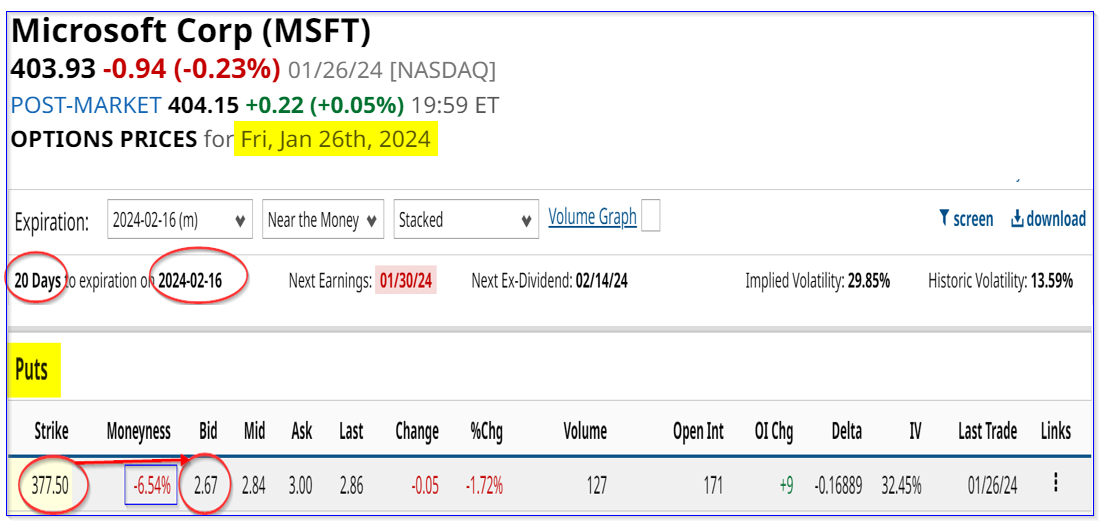

That is equal to over 50% of the MSFT stock's annual dividend yield (i.e., 0.74%). Moreover, shareholders can enhance this yield by shorting the $377.50 strike price put expiring on Feb. 16, (i.e., 3 weeks from now) for $2.75 per contract.

That works out to a yield of 0.728% (i.e., $275 for the $37,750 invested in this play per contract). Moreover, if this trade can be repeated for the next quarter (i.e., 4 times) the investor can make an expected return (ER) of $1,100 or 2.91% for the 37,750 invested.

That is a very good yield indeed. It helps protect the downside for existing shareholders in MSFT stock. Nevertheless, analysts are still very positive on MSFT stock.

Analysts See Upside in MSFT Despite Its Rise

In my last article, I suggested that MSFT stock could be worth $518.10 per share. That is over $114 higher than Friday's close and represents a further 28.3 upside in the stock.

My target price is based on the company making an average free cash flow (FCF) margin of 37% over the next year. Last quarter its FCF margin was 36.6%.

For example, for the quarter ending Dec. 30, analysts project $61.1 billion in revenue. Therefore, analysts will be looking to see if the company generates at least $22.36 in FCF (i.e., a 36.6% FCF) and hopefully as much as $22.6 billion (i.e., 37%).

Other analysts have more modest price targets. For example, the average of 44 analysts surveyed by Refinitiv (shown on Yahoo! Finance) is $422.98 per share. That is just 4.72% over Friday's (Jan. 26) closing price of $403.93.

However, AnaChart.com, a new sell-side analyst tracking service, shows that the average target of 35 sell-side analysts it tracks is $449.90 per share. That is $45.97 per share higher and 11.38% over the prior close.

This is much closer to my FCF-based target price. It highlights that the majority of analysts still see significant upside in MSFT stock, despite its recent rise.

The bottom line here is that shareholders can potentially make money holding MSFT shares, especially if they short OTM puts for extra income.

More Stock Market News from Barchart

- 2 Magnificent Growth Stocks to Buy for 2024 And Beyond

- KO vs. PEP: Which Dividend Aristocrat is a Better Buy Right Now?

- Interest Rates: 30-Year Yields are Calling Out Powell's Cuts

- Why Is Disney Stock So Low, While Netflix Stock Is Soaring?

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)