/AI%20(artificial%20intelligence)/shutterstock_1147164695.jpg)

Artificial intelligence (AI) has become a disruptive force in many industries, and this is just the beginning. Most tech stocks skyrocketed last year, fueled by the AI rush. AI advancements are continuing into 2024, with the potential to boost revenue and profits for leading players in the tech industry. Here, we look at two magnificent stocks that are well-positioned to continue driving the AI revolution.

Taiwan Semiconductor

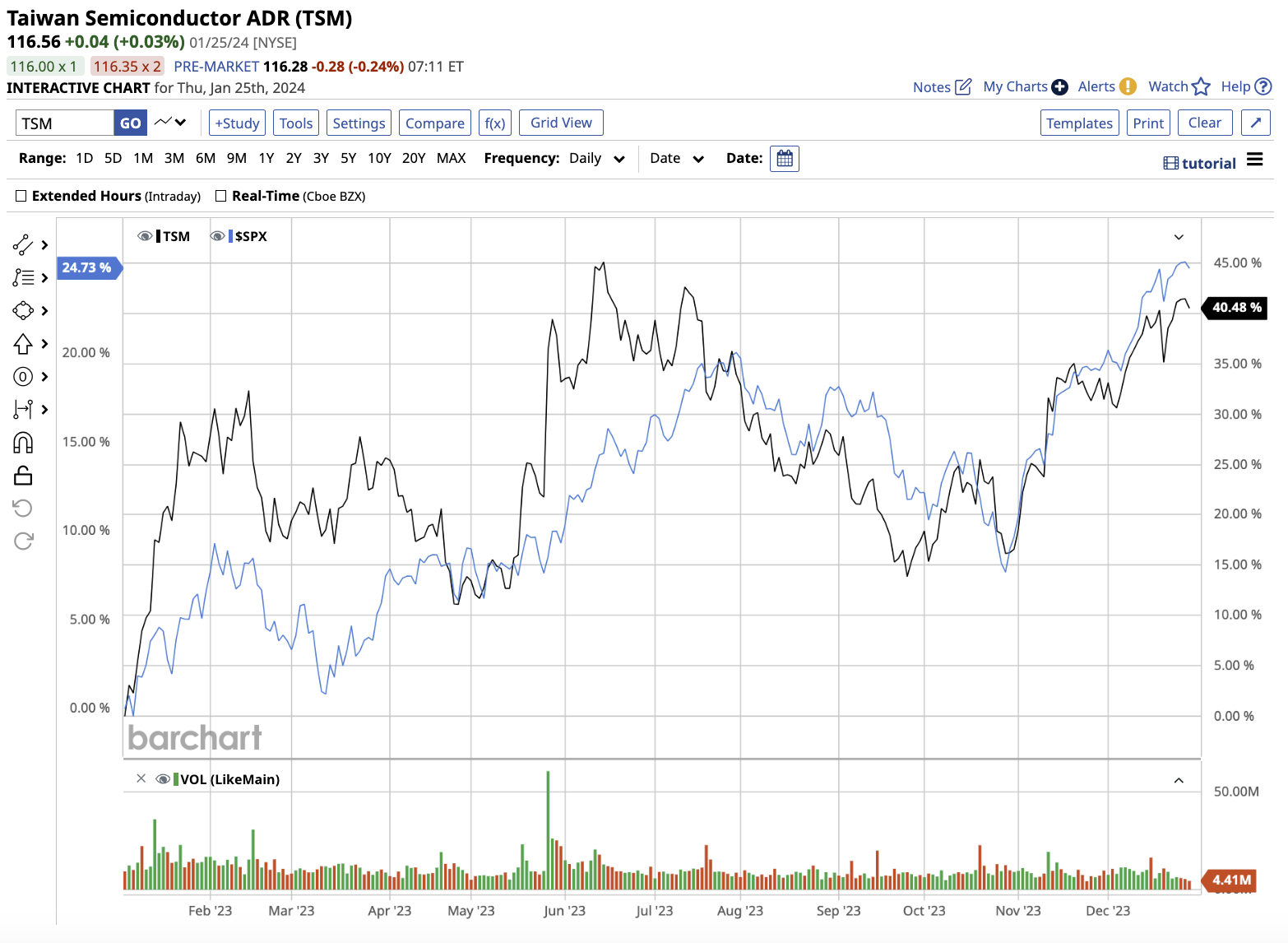

Taiwan Semiconductor (TSM), also known as TSMC, has emerged as a major player in the semiconductor industry. TSMC's advanced semiconductor technologies, such as its 5-nanometer and 3-nanometer process nodes, are critical components in a wide range of devices, including smartphones, autonomous vehicles, data centers, and edge computing devices. The stock gained 40% last year, compared to the S&P 500 Index’s ($SPX) gain of 25%.

Last year, weakness in the smartphone, data center, and Internet of Things (IoT) markets affected the company’s overall performance. Total revenue for the year dropped 8.7% to $69 billion. Gross margin for the year also declined to 54.4%.

Management expects smartphone seasonality to have a slight impact in the first quarter of 2024. However, revenue could be in the $18 billion to $18.8 billion range, representing a 7% to 12% increase over the same quarter last year.

Gross margins for the year could range between 52% and 54%. Meanwhile, Wall Street expects $18.39 billion in revenue for the quarter.

Looking ahead, analysts predict that TSMC's revenue and earnings in 2024 will increase by 24% and 21%, respectively. This increase could be attributed to the rising demand for its advanced 5-nanometer and 3-nanometer chips.

Without a doubt, the competition to develop smaller and more powerful chips is fierce. However, the opportunities are also vast. As AI becomes more integrated into our daily lives, the demand for advanced semiconductor solutions will only increase, providing more growth opportunities for larger players such as TSMC. According to management, long-term global manufacturing expansion could result in gross margins of 53% or higher.

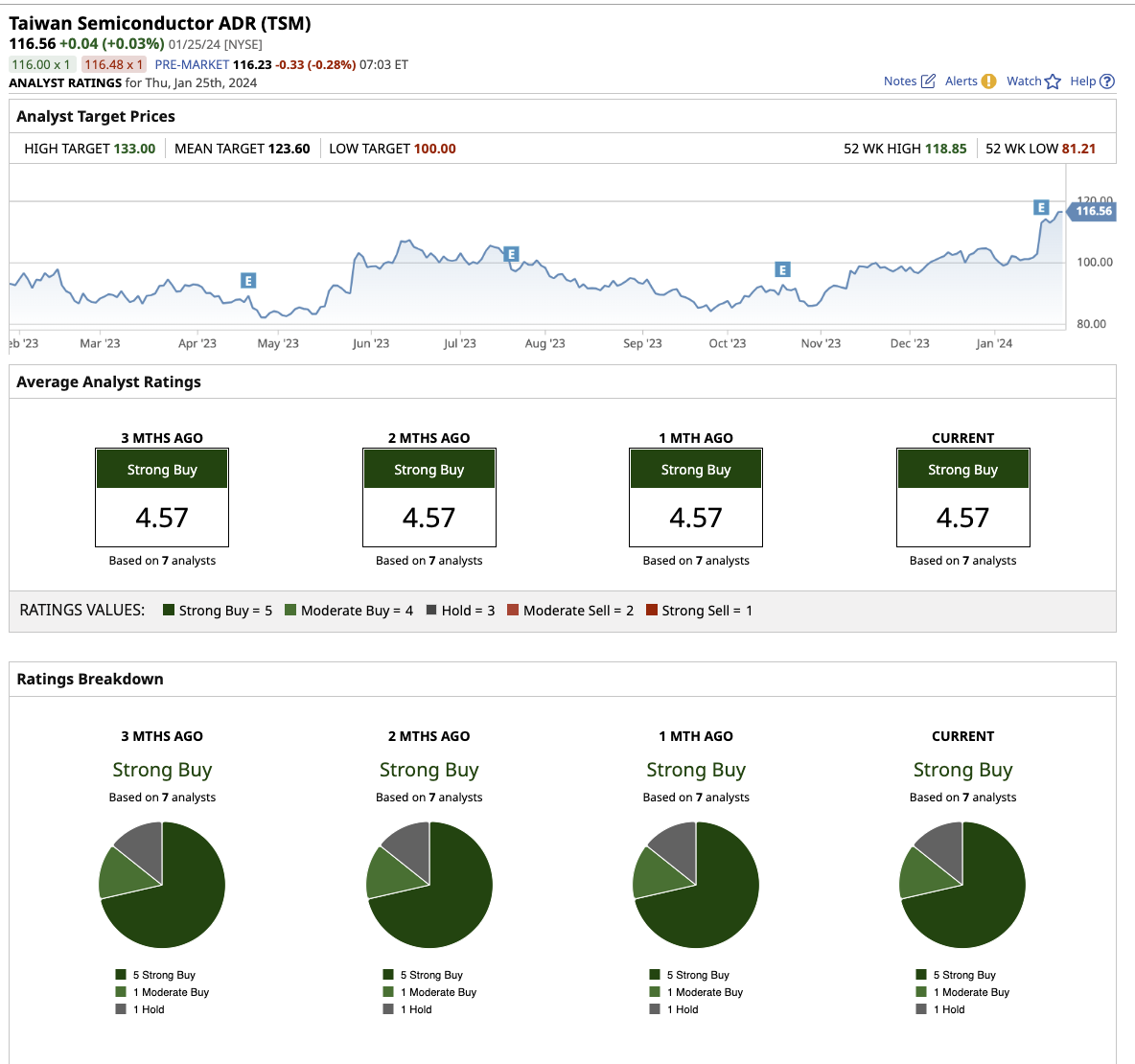

Overall, Wall Street is bullish about TSM, rating it a “strong buy.” Out of the seven analysts covering the stock, five rate it a “strong buy,” one rates it a “moderate buy,” and one recommends a “hold.”

The mean target price for the stock is $123.60, which is 5.3% above current levels. The high target price of $133, however, implies 13.4% upside potential.

Micron Technology

Founded in 1978, Micron Technology (MU) has grown from a semiconductor design consulting company to one of the leading providers of memory and storage solutions.

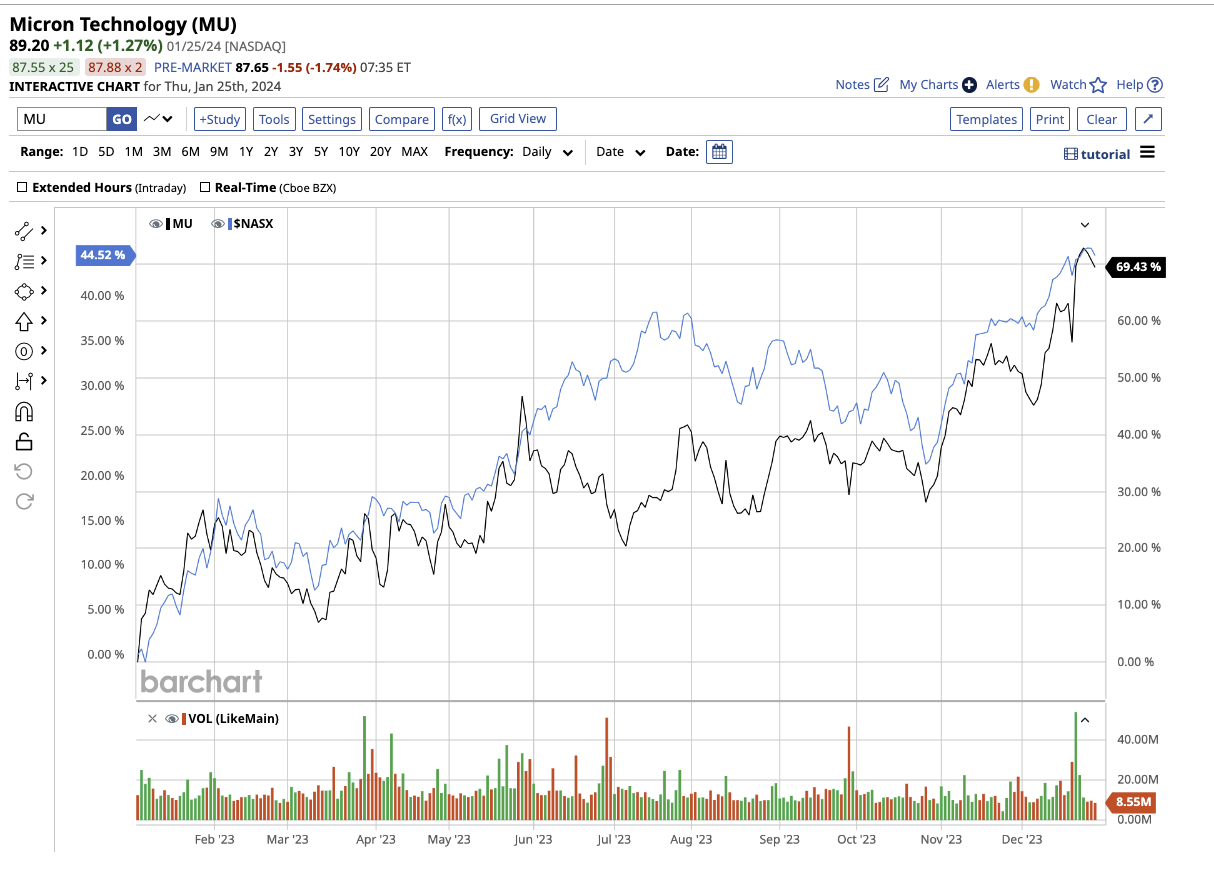

Micron specializes in the design and production of DRAM, NAND flash memory, and other semiconductor solutions. These are used in smartphones and laptops to data centers and autonomous vehicles. Micron’s stock soared 70.7% last year, outperforming the Nasdaq Composite’s ($NASX) gain of 44%.

AI boosted the chip market, and Micron's financials have already started improving. In the first quarter of fiscal 2024, which ended Nov. 30, total revenue increased 16% year-on-year to $4.7 billion. The company expects its fundamentals to improve throughout fiscal 2024. Micron anticipates second-quarter revenue of around $5.3 billion (plus or minus $200 million). This would represent an impressive 44% increase from the year-ago quarter. While the company reported a loss in the first quarter, it expects losses to narrow to $0.28 per share or to turn in a profit of $0.07 in the second quarter.

At the end of the first quarter, Micron had cash, marketable investments, and restricted cash of $9.84 billion, but also had a negative free cash flow of $333 million.

The smartphone and personal computing market is expected to recover this year, and increasing demand for memory and storage solutions in the AI era presents ample opportunities for Micron to continue its growth trajectory. These tailwinds may help Micron recover, boosting growth in fiscal 2025. On average, analysts foresee fiscal 2024 sales rising by 45.6% to $22.6 billion, followed by a 40% year-over-year increase to $31.6 billion in fiscal 2025.

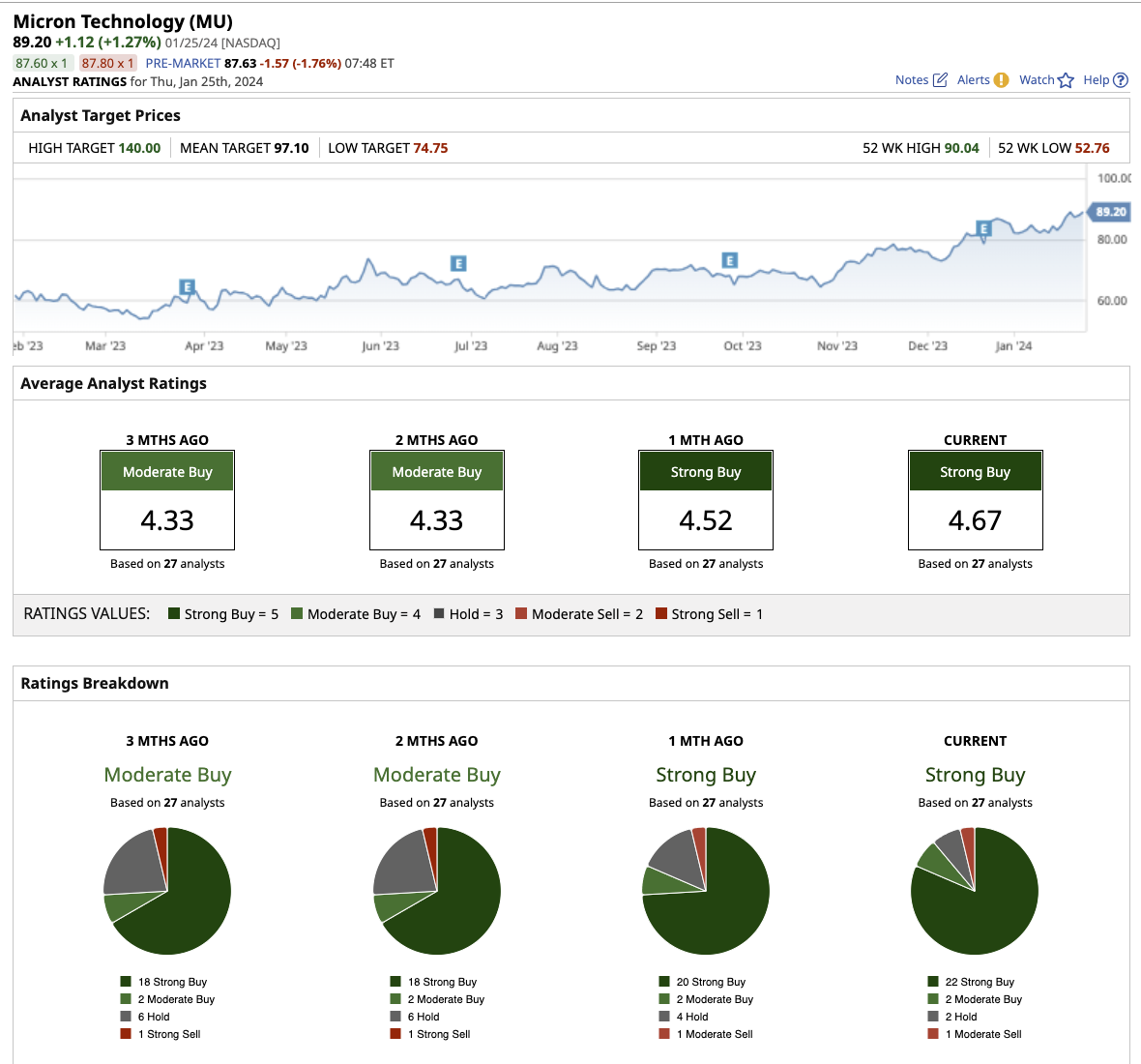

Overall, Wall Street rates Micron stock a “strong buy.” Out of the 27 analysts covering MU, 22 rate it a “strong buy,” two rate it a “moderate buy,” two recommend a “hold,” and one rates it a “moderate sell.” The average target price for the stock is $97.10, which is 10.4% above current levels.

Micron trades at 3 times forward sales, which is cheap compared to rivals Nvidia (NVDA) and Advanced Micro Devices (AMD) - which trade at forward price-to-sales ratios of 16x and 10x, respectively.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)