/Tesla%20Dealership%20with%20Cars%20in%20Lot.jpg)

While Tesla (TSLA) is still the leader in the U.S. electric vehicle (EV) market, it lost the crown of biggest EV seller to China’s BYD (BYDDY) in Q4. Previously, BYD overtook Tesla in 2022 in terms of total deliveries, which includes EVs and plug-in hybrid vehicles (PHEVs), and is widely expected to sell more EVs than Tesla in 2024.

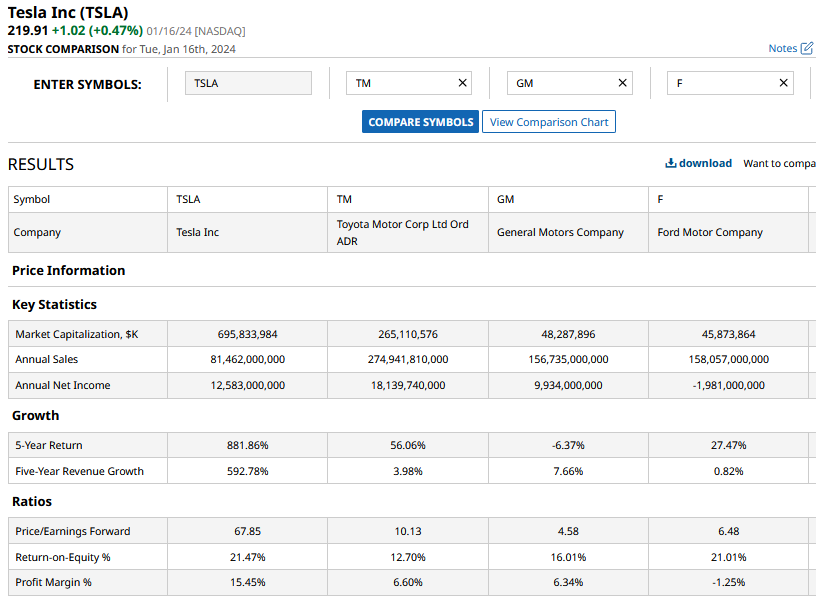

Meanwhile, when we look at the valuations, there is a big disconnect. Despite selling more EVs than Tesla, BYD’s market cap is below $80 billion, while Tesla is valued at around $700 billion. Why is BYD valued so cheaply compared to Tesla, and is there a way to capitalize on this? We’ll discuss in this article.

How Did BYD Become the Global EV Behemoth?

In 2011, Tesla CEO Elon Musk scoffed at the possibility of BYD becoming a Tesla competitor. However, the world’s richest person has since changed his views about BYD, as well as Chinese EV companies in general. On multiple occasions, he has praised China's EV startups, and believes that a Chinese company could become the “next Tesla.”

Notably, Berkshire Hathaway (BRK.B), led by the legendary Warren Buffett, is among the biggest backers of BYD. While the conglomerate has been selling shares gradually, it still holds just under an 8% stake in BYD per the most recent filings.

What's Behind the Valuation Disconnect Between Tesla and BYD?

To be sure, Tesla’s valuations represent a premium not only to BYD, but to every other automaker on the planet, as well. For instance, its current market cap is well over twice that of Toyota Motors (TM), whose 2023 deliveries were over five times that of Tesla.

At its peak, Tesla was valued at over $1.2 trillion – a milestone no other automaker has even come remotely close to. Even now, Tesla’s market cap is more than the combined market cap of the world’s leading automakers.

To understand the “valuation disconnect” between Tesla and other automakers, we need to first look at their perception and business model. Tesla bulls, as well as Musk, don’t consider Tesla as an automaker, and instead believe that the bulk of the company’s valuation comes from its software business.

Tesla offers autonomous driving features, and has Autopilot as well as the more advanced full self-driving (FSD). By Musk’s assertion, the company’s valuation is linked to the autonomy of its cars. Here, it's worth noting that the FSD is not “fully” autonomous, as the name might suggest.

Tesla Is More of an AI and Tech Play

Cathie Wood – arguably the biggest Tesla bull - has set a base case 2027 target price of $2,000 on Tesla. Even her bear case target price is $1,400, while the bull case target price is $2,500.

Her optimism revolves around Tesla’s autonomous driving business, which she believes accounts for two-thirds of the company’s value. Specifically, ARK Invest believes that Tesla could generate revenues of around $200 billion from robotaxis by 2027.

Tesla is also working on the Dojo supercomputer. Last year, Morgan Stanley analyst Adam Jonas, a long-standing Tesla stock bull, created quite a furor when he said that the Dojo could add $600 billion to Tesla’s market cap. Separately, Tesla is developing the Optimus humanoid, and recently released a video of it folding a shirt.

Why Is BYD Valued So Low?

There are multiple reasons why BYD is valued so low relative to TSLA. First, the company does not have a premium positioning like Tesla, and its cars start as low as $11,000. Second, and on a related note, its margins are below what Tesla generates. Despite the aggressive price cuts over the last few quarters, Tesla still managed an operating margin of 8% in Q3 2023, which is higher than most automakers.

Finally, while Tesla gets a valuation premium due to the software business, and the very fact that it is led by the charismatic (though controversial) Musk – BYD is in the penalty box for being a Chinese company. The valuations of Chinese companies have plunged over the last couple of years, thanks to the economic policies of President Xi Jinping and escalating tensions with the U.S.

BYD Is Not Working on L4 Cars

Last year, BYD said that fully autonomous cars are “basically impossible,” and that the technology has a better utility in factories than in cars. However, the company is now looking to invest $14 billion in developing smart cars, including features to rival Tesla's Autopilot.

BYD also has cost leadership, and is looking to grow its business both domestically as well as internationally.

Analysts Prefer BYD Over Tesla

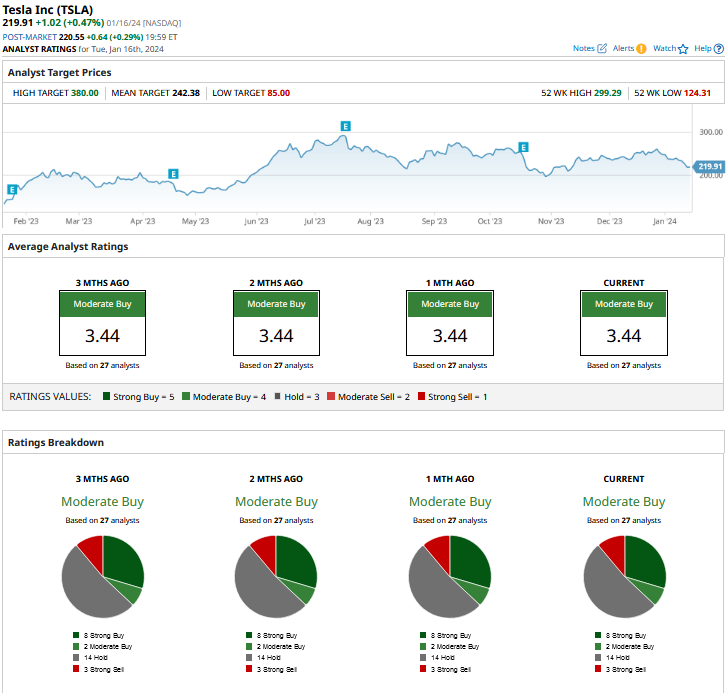

While the most outspoken Tesla bulls might have other thoughts, the consensus view on Tesla is not too wildly bullish. It has received a consensus rating of “Moderate Buy” from analysts, and its mean target price of $219.91 is 13% above current prices.

In contrast, analysts are much more bullish on BYD, and see a much bigger upside potential in the company over the next 12 months.

To be sure, looking solely at analysts’ estimates might not be a prudent strategy – especially for Tesla, which often trades above its mean target price. However, given BYD’s current valuations – it trades just over 10x the expected 2025 earnings – the stock looks quite attractive. While BYD might not achieve lofty Tesla-style valuations anytime soon, the stock's current valuations look too tempting to ignore - even in light of the increased risk of investing in Chinese stocks.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.