In my January 15, 2026, Barchart article on the energy sector in Q4, 2025, and the prospects for 2026, I highlighted that NYMEX crude oil futures declined 7.94% in Q4 and were 19.34% lower in 2025, settling at $57.42 per barrel on December 31, 2025. I concluded the report with the following:

When it comes to crude oil, prices remain near the lows, and I expect lower lows over the coming weeks and months as increased U.S. and OPEC production, and the potential for U.S. control of Venezuelan crude oil, could put significant pressure on prices.

So far, I have been dead wrong as crude oil prices are higher in February 2026. I did not account for the potential for rising tensions between the U.S. and Iran and for threats to the Strait of Hormuz.

Geopolitics have lifted crude oil prices

While the U.S. military action in Venezuela to depose the Maduro regime could increase the flow of Venezuelan crude oil over the coming months and years, as Venezuela is the country with the most proven and probable petroleum reserves, the rising potential for hostilities in the Middle East has caused crude oil prices to rally in 2025.

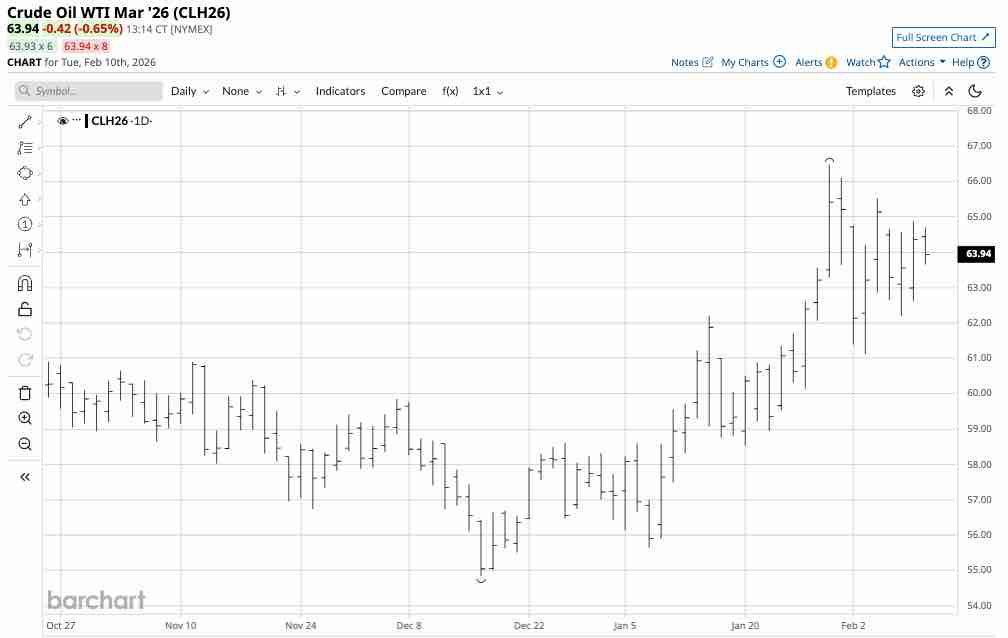

The daily chart of NYMEX WTI crude oil futures for March 2026 delivery shows the % rise from the $54.84 low on December 15, 2025, to the $66.48 per barrel high on January 29, 2026. At near $64per barrel on February 10, 2026, the crude oil price remains within striking distance of the latest high.

Peace or war could determine the path of oil prices over the coming months

U.S. and Iranian officials have been negotiating a path out of a stalemate over Iranian uranium enrichment and the government’s brutal treatment of protestors over the past weeks and months. Meanwhile, U.S. warships have moved toward Iran in a show of strength. U.S. President Trump has threatened Iran’s leadership that if they do not come to terms on a deal, the U.S. will likely take military action to force the government’s hand and move to replace the theocracy. Iran has threatened the U.S. with a regional war.

The Strait of Hormuz is a critical passage through which approximately one-third of global seaborne crude flows. Hostilities between the U.S. and Iran could cause a disruption through the Strait of Hormuz, creating a global oil and gas crisis, causing crude oil prices to spike higher.

Levels to watch in the NYMEX futures

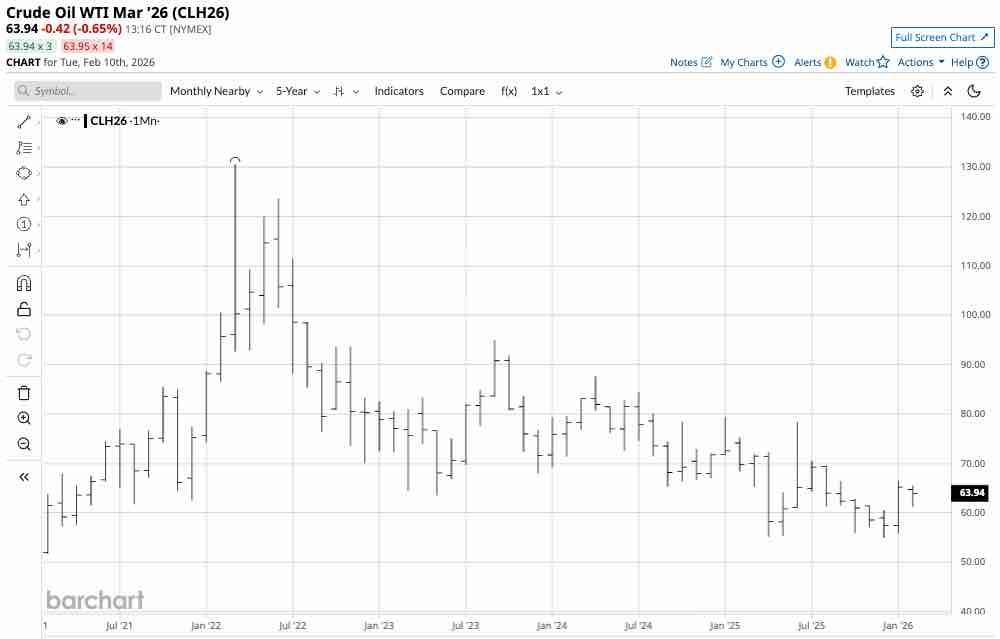

If the Strait of Hormuz becomes a warzone over the coming weeks or months, extreme volatility in crude oil prices could be on the horizon. NYMEX crude oil futures have been in a bearish trend since reaching the high of $130.50 per barrel in March 2022 when Russia invaded Ukraine.

As the monthly continuous contract chart shows, the first technical resistance level for the NYMEX futures is at the June 2025 high of $78.40 per barrel. A move above that level would end the four-year bear market in NYMEX crude oil futures. Technical support on the continuous contract is at the December 2025 low of $54.89 per barrel.

Expect volatility- Price spikes higher or lower are possible

The midpoint of the monthly technical support and resistance levels in NYMEX WTI crude oil is $66.65 per barrel. In mid-February 2026, the energy commodity was trading around that level. If talks with Iranian officials fail and hostilities break out, a spike above the $78.40 resistance level could send crude oil prices substantially higher. Meanwhile, successful talks that lead to a more peaceful solution and higher Venezuelan crude oil production could push the price lower, challenging the $54.89 per barrel support level.

The bottom line is that the odds favor a period where crude oil price volatility increases over the coming weeks and months.

UCO and SCO are ETFs that magnify the NYMEX crude oil futures price action

The most direct routes for a risk position in crude oil are NYMEX WTI futures and futures options, or ICE Brent futures and futures options. WTI and Brent are the leading benchmarks for petroleum trading.

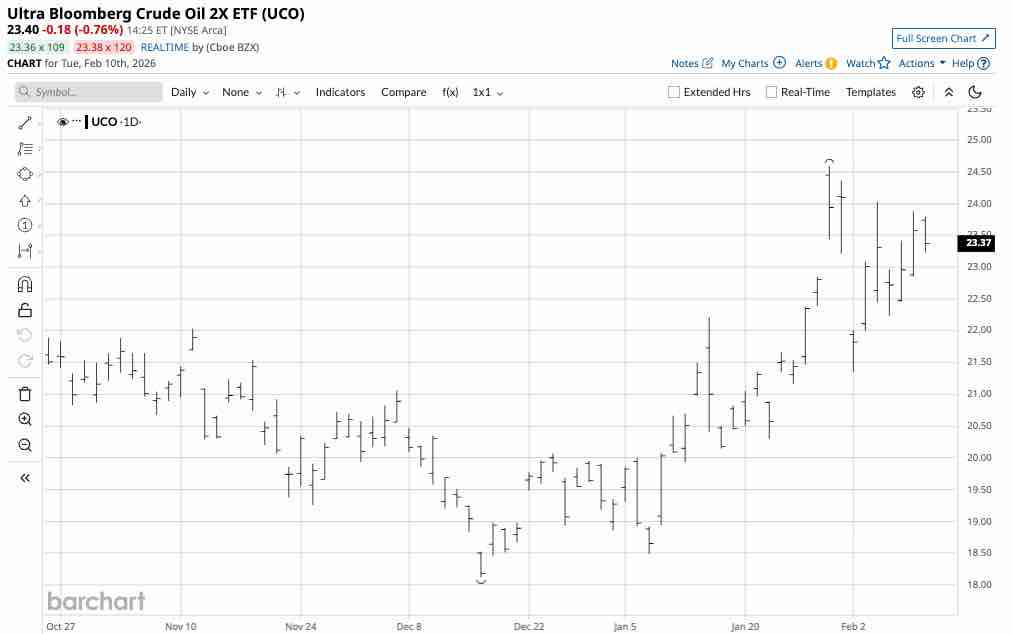

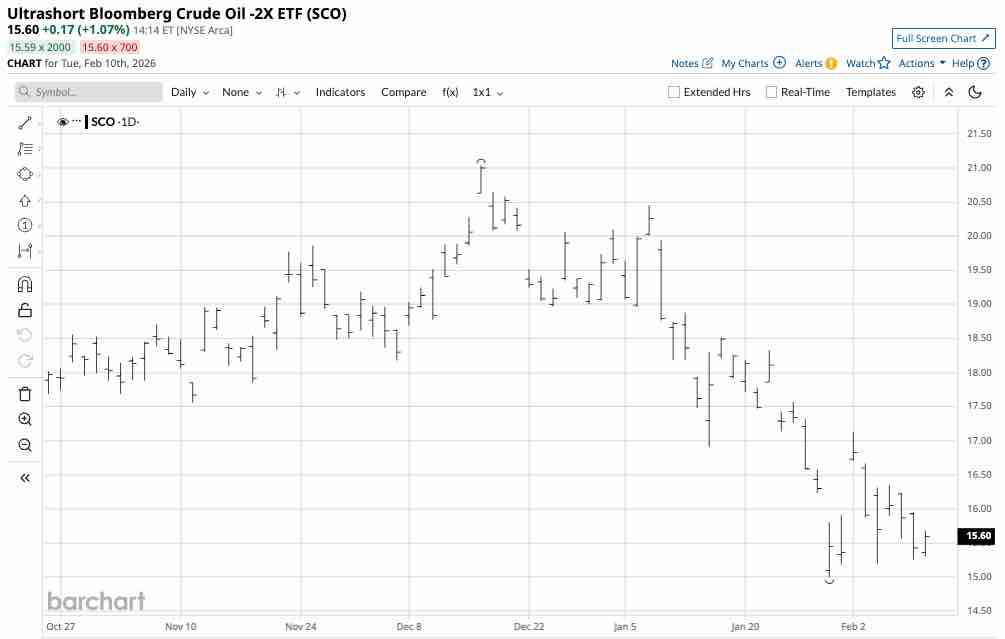

The U.S. Oil Fund (USO) and the U.S. Brent Oil Fund (BNO) are unleveraged ETFs that track WTI and Brent futures, respectively. Meanwhile, the Ultra Bloomberg Crude Oil 2X ETF (UCO) and the Ultrashort Bloomberg Crude Oil -2X ETF (SCO) magnify the price action in NYMEX crude oil futures.

The most recent rally in NYMEX crude oil futures lifted the price of March NYMEX crude oil futures by 21.2% from $54.84 on December 16, 2025, to $66.48 per barrel on January 29, 2026.

The chart shows that over the same period, the leveraged UCO ETF rose 35.8% from $18.12 to $24.60 per share.

At $23.39, UCO had over $425.38 million in assets under management. UCO trades an average of over 3.75 million shares per day and charges a 0.95% management fee.

Over the same period, the bearish SCO ETF fell 28.7% from $21.04 to $15.00 per share.

At $15.59, SCO had over $116.65 million in assets under management. SCO trades an average of over 2.0 million shares per day and charges the same 0.95% management fee.

UCO and SCO can be valuable trading tools if crude oil price volatility increases over the coming weeks and months. Two drawbacks of leveraged ETFs are that, while crude oil futures trade around the clock, UCO and SCO trade only during U.S. stock market hours, so they can miss highs or lows when the market is closed. Additionally, the leverage comes at a steep price: time decay. If crude oil futures move against expectations, leveraged ETFs can incur large losses. Moreover, stable prices will cause the leveraged ETFs’ values to decline due to time decay.

Expect volatility in crude oil prices as increased production from Venezuela could be bearish, while the situation with Iran could turn explosive.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.