/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

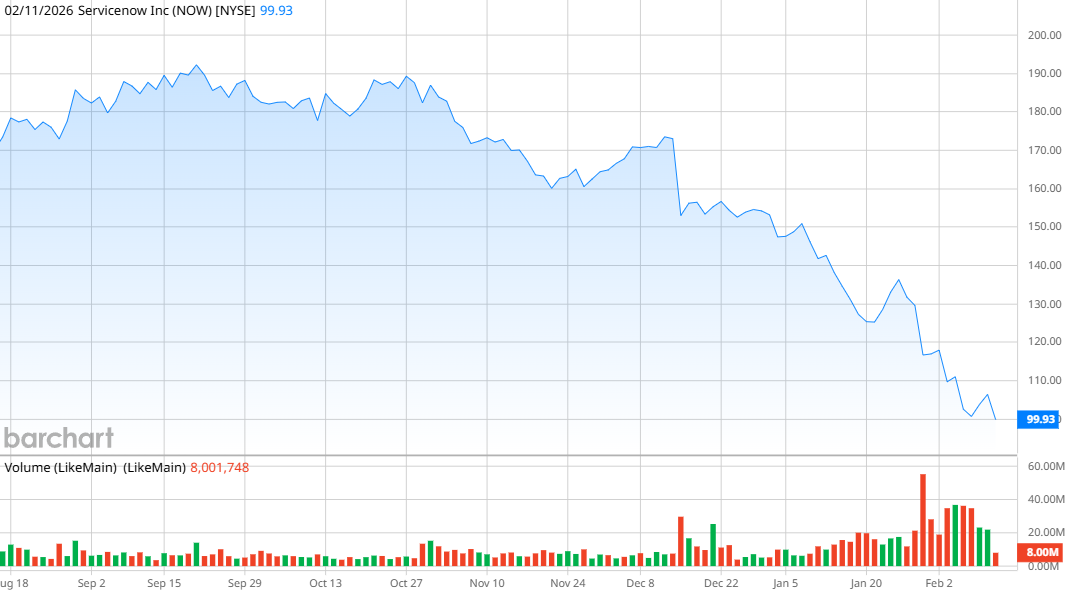

Software company ServiceNow (NOW) has had a rough 12 months, down nearly 50%. The company’s business strategy has come under fire as it expanded through a series of acquisitions, and analysts began questioning whether some of the company’s core services would be disrupted by emerging artificial intelligence (AI) platforms.

Dan Ives and Wedbush Securities are breathing some new life into the enterprise software company, however. Wedbush recently announced that it was reinstating ServiceNow to its IVES AI 30 Index, a grouping of stocks that makes up the Dan Ives Wedbush AI Revolution ETF (IVES).

Wedbush had removed ServiceNow in December 2025 amid a selloff of software stocks. Now, analysts are saying they “strongly disagree” with the idea that ServiceNow is a “structural loser” of the AI buildout. "With share prices falling ~50% over the past 12 months, we believe there is a disconnected valuation as AI will ultimately be a tailwind for existing implementations like ServiceNow with trillions of data points ingrained in enterprise infrastructure that will be difficult to replace by new AI entrants," Wedbush analysts said.

Should this change your view of NOW stock?

About ServiceNow Stock

Based in Santa Clara, California, ServiceNow provides cloud computing services to automate workflows and improve enterprise AI operations. The company’s platform connects departments, automates routine tasks, and streamlines operations. ServiceNow is also incorporating AI into its workflow to improve efficiency and automate decision-making.

While ServiceNow had been known for its organic growth, it notably began expanding through acquisitions in recent months. In December, the firm agreed to buy cybersecurity company Armis for $7.75 billion in cash. It also completed its $2.85 billion purchase of AI company Moveworks.

In addition, the price of NOW stock dropped as Anthropic released its latest version of its Claude AI assistant, which is designed to handle coding, enterprise workflows, and complex reasoning. Analysts expressed concern that products like Claude would compete directly with ServiceNow’s platform.

That contributed to ServiceNow’s steep fall, which includes a 29% drop in the last month. Meanwhile, the S&P 500 ($SPX) has been relatively flat.

However, the drop has also made ServiceNow stock more affordable than it has been in years. NOW stock’s forward price-to-earnings (P/E) ratio of 43 times is below its five-year P/E mean of 68.

ServiceNow Beats on Earnings

ServiceNow has a history of beating analysts’ expectations in its earnings reports, and that remained true in the fourth quarter. Revenue of $3.58 billion was up 19.5% from a year ago, while EPS of $0.92 came in better than analysts’ expectations of $0.88.

ServiceNow also reported that its remaining performance obligations at the end of the calendar year was $12.85 billion, up 25% year-over-year (YOY).

The company announced an expanded partnership to incorporate Anthropic’s Claude models into the ServiceNow AI platform, as well as a collaboration with OpenAI, the maker of ChatGPT, to develop agentic AI products. In addition, ServiceNow is working with Microsoft (MSFT) to develop agentic AI products within Microsoft Agent 365 and the ServiceNow AI platform.

"Q4 was another strong quarter, concluding a remarkable year of AI innovation, with emerging products like Now Assist, Workflow Data Fabric, Raptor, and CPQ all outperforming,” said President and CFO Gina Mastantuono. “Our recent strategic acquisitions create enormous new market opportunities and solidify our ability to put AI to work securely across every corner of the enterprise.”

ServiceNow issued Q1 guidance calling for subscription revenues of $3.650 billion to $3.655 billion. That would mark a 21.5% increase from the previous year.

What Do Analysts Expect for NOW Stock?

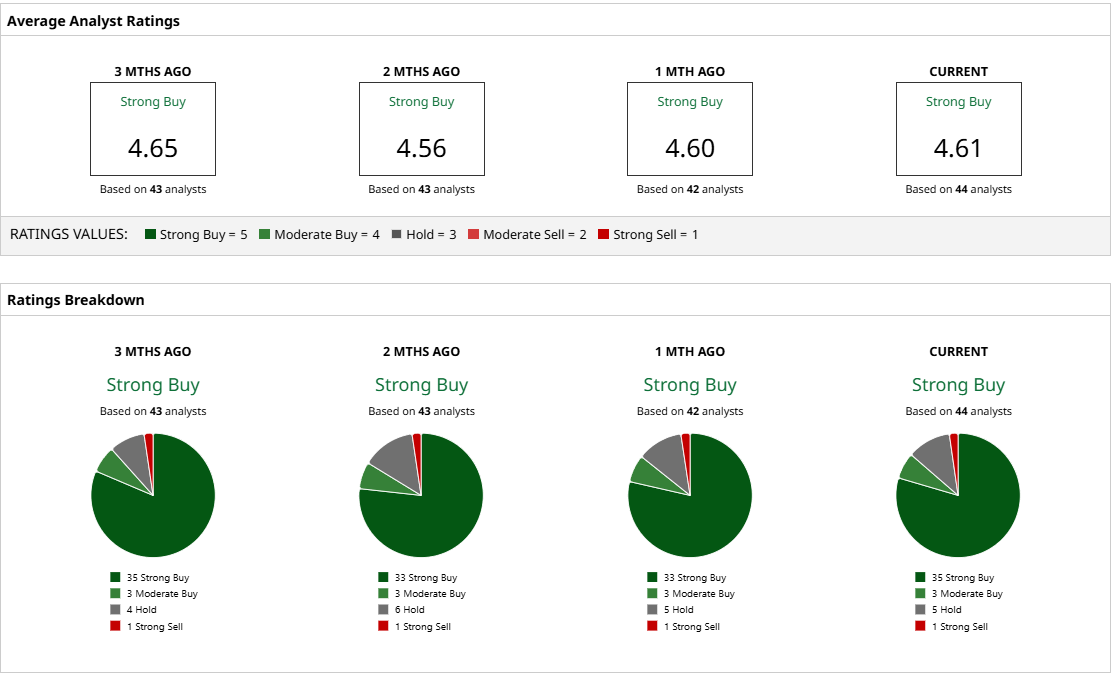

Despite the drop in NOW stock over the last year, analysts remain bullish. Of 44 analysts currently covering the stock, only one has a “Strong Sell” rating, and five suggest a “Hold” rating. The other 38 analysts have a buy ratings on the stock. Overall, NOW has a consensus “Strong Buy" rating.

The mean price target of $194.46 indicates that anaylsts project a massive 89% potential jump in NOW stock, with the high target of $260 implying a possible increase of 153%. Even the low target of $115 indicates that ServiceNow stock is due for a 12% jump.

ServiceNow stock appears priced to buy, with an attractive valuation, solid revenue projections, and powerful analyst sentiment. Now with Ives’ endorsement, NOW stock looks like a strong contender for any portfolio.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)