Texas Pacific Land Corporation (TPL) is a land and resource management company headquartered in Dallas, Texas, with a history dating back to its founding in 1888. TPL is one of the largest private landowners in Texas, and generates most of its revenue from oil and gas royalties, land easements, water services, and related resource activities rather than producing hydrocarbons itself. The company’s market cap is around $28.5 billion.

TPL has underperformed the broader market over the past year but outpaced significantly this year, with a slump of 7.5% over the past 52 weeks and substantial gains of 44.1% in 2026. Meanwhile, the S&P 500 Index ($SPX) has soared 14.4% over the past year and is up 1.4% on a YTD basis.

Narrowing the focus, Texas Pacific also lagged behind the State Street SPDR S&P Oil & Gas Exploration & Production ETF’s (XOP) 9.3% surge over the past 52 weeks but outpaced its 16.7% rise on a YTD basis.

The stock is seeing momentum amid a strategic pivot into non-energy, high-growth infrastructure, specifically a partnership with Bolt Data & Energy to develop data centers on its vast West Texas acreage. This move toward AI-linked digital infrastructure provides a new revenue stream, diversifying the company beyond its traditional oil and gas royalty model, which has faced volatility. Additionally, strong investor sentiment has been reinforced by consistent insider buying from major shareholder Horizon Kinetics.

For the fiscal year ended in December 2025, analysts expect the company’s EPS to grow 5.3% to $6.92 on a diluted basis.

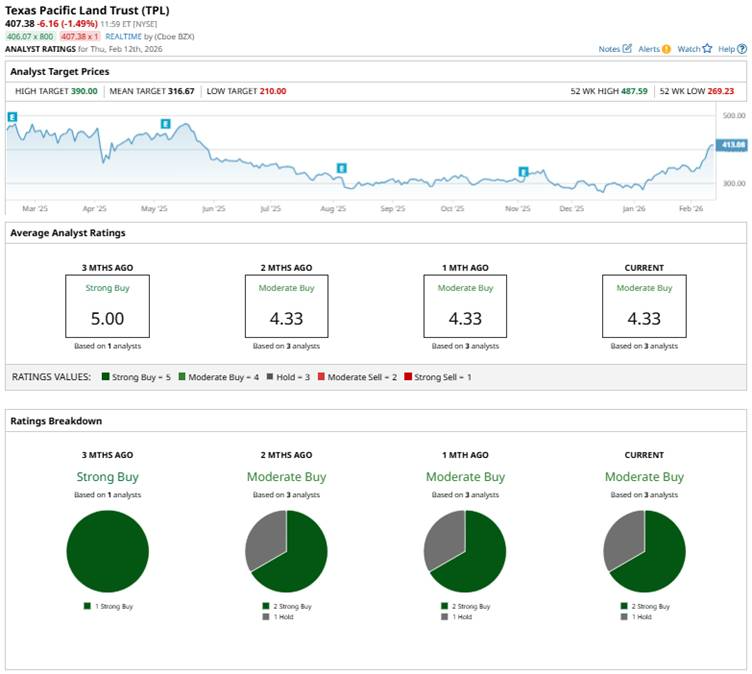

Among the three analysts covering TPL, the consensus is a “Moderate Buy.” That’s based on two “Strong Buy” ratings and one “Hold.”

This configuration is slightly more bullish than three months ago, when there was just one “Strong Buy” rating.

This month, Texas Capital Securities reaffirmed its “Buy” rating on TPL and maintained a $390 price target, citing reports of potential data center development as a key growth catalyst.

TPL currently trades above its average price target of $316.67 and Texas Capital’s Street-high price target of $390.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)