/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

Intel (INTC) has quietly turned into one of the market’s comeback stories in chips, and the narrative just got a fresh twist with talk of a $100 million commitment tied to SambaNova Systems. Wedbush now sees that potential deal as a meaningful step in reshaping Intel’s role in high‑end compute. This also adds a new catalyst to a stock that has already logged a powerful rebound over the past year.

At the same time, the broader setup for the industry is turning more interesting. A recent forecast projects global semiconductor revenues will push past $1 trillion for the first time in 2026. That milestone is expected to be driven largely by demand for computing and data‑storage chips tied to AI‑heavy workloads and next‑generation devices.

With that kind of growth on the table, the real question is whether a targeted $100 million bet can help Intel claim a bigger share of this cycle or if the story is already priced in. Let's dive in.

Intel’s Price, Performance, and Profit Picture

Intel is a Santa Clara‑based semiconductor company that designs and manufactures chips and platforms for PCs, data centers, networking, and AI infrastructure.

At a market value of roughly $250.9 billion, INTC currently trades at $48.08 as of Feb. 11, up 30.29% year‑to‑date (YTD) and 129.27% over the past 52 weeks.

Its forward price‑to‑earnings multiple sits near 689.86x versus a sector median near 24.20x, while its price‑to‑sales ratio of 4.75x compares with a sector median around 3.24x and bakes in a rich AI‑driven expectations premium.

INTC’s fundamentals still anchor that optimism in real cash flows. Their fourth‑quarter 2025 report, released on Jan. 21, showed revenue of $13.67 billion versus analyst expectations of $13.41 billion, a 4.1% year‑on‑year (YoY) dip but a 2% beat that showed resilient demand in a challenged environment. This translated into adjusted EPS of $0.15 versus the $0.08 consensus, an 80.7% beat that highlighted improving operational efficiency.

They also delivered adjusted operating income of $1.21 billion against estimates of $839.5 million, with an 8.8% margin that marked a 43.5% upside surprise and signaled progress in rebuilding profitability as Intel positions for AI‑centric growth. The company’s latest quarter also showed an operating margin of 4.2%, up from 2.9% a year earlier, while free cash flow improved to $2.22 billion from ‑$1.5 billion in the same quarter, a meaningful swing that allows management more room to fund AI initiatives

Intel’s Strategic Growth Deals

Intel’s growth story is increasingly being written around a series of concrete strategic moves. The chipmaker is reportedly on track to buy SambaNova Systems, an AI chip startup that sells full‑stack AI racks similar to Nvidia’s (NVDA) DGX systems and Groq’s GroqRack. This would immediately give Intel a way to compete in enterprise AI appliances and tap existing traction in finance, healthcare, defense, and government.

The story does not end there, because Intel is also working to turn its foundry ambitions into long‑dated revenue streams. Nvidia is said to be exploring the use of Intel’s foundry services for its 2028 “Feynman” GPUs, a potential collaboration that follows a late‑2025 pact where Nvidia agreed to co‑develop AI CPUs and GPUs with Intel and took a $5 billion equity stake.

Another important piece is Intel’s renewed push into GPUs. The company has confirmed a fresh GPU initiative led by newly hired chief GPU architect Eric Demers and senior data center executive Kevork Kechichian. This move signals its intent to re‑enter accelerated computing, a space still dominated by Nvidia and AMD (AMD).

What Analysts Are Saying About INTC Stock

Intel’s next earnings are penciled in for April 23, and the setup is still choppy for near-term profits. For the March 2026 quarter, the average EPS estimate sits at -0.11 versus -0.02 a year earlier, implying -450.00% YoY growth. By fiscal year December 2026, the average estimate flips to $0.07 from -$0.12, implying +158.33% YoY growth and a cleaner earnings base.

That earnings path matters as Intel just picked up a major headline from Tigress Financial analyst Ivan Feinseth, who issued a Street-high $66 price target. His call framed Intel as a “compelling multi-year upside story,” tied to manufacturing progress and an AI pivot. Feinseth also pointed to strength in Q4 results, including a reported 9% increase in data center and AI revenue.

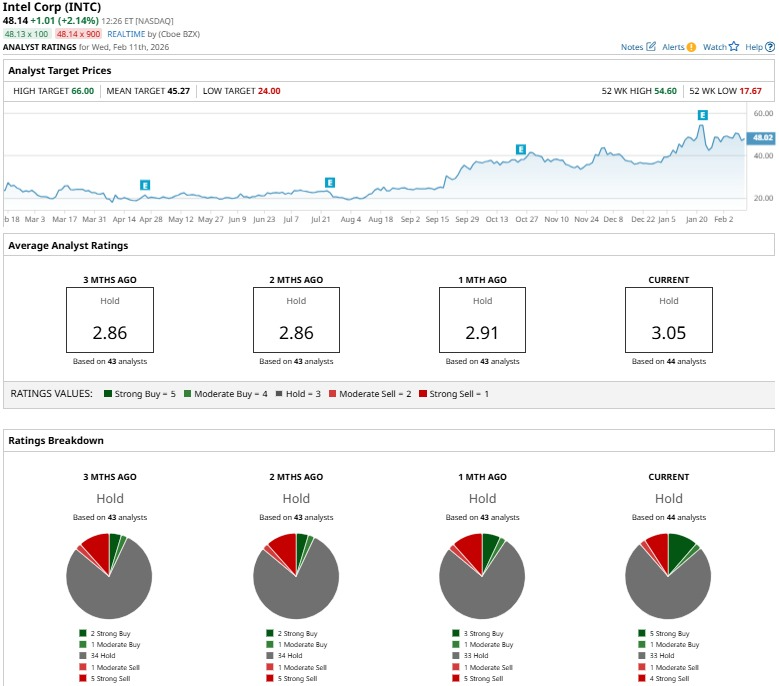

Still, the broader consensus is noticeably more reserved. Across 44 analysts, the consensus rating sits at “Hold,” not an outright buy signal. Another check on expectations is the average target price, which is placed at about $44.27, implying roughly -7.9% from the current price.

Conclusion

Intel’s potential $100 million stake in SambaNova does not magically fix every problem for the chipmaker, but it sharpens the story and shows the company is finally spending real money to close its gap in high‑value computers. Combined with stabilizing fundamentals, improving cash flow, and long‑term levers in foundry and GPUs, that capital deployment looks more like a calculated swing than a headline grab.

Overall, the shares appear more likely to grind higher over the next few years than to revisit old lows, assuming management converts these moves into cleaner EPS and margin trends.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)