With a market cap of $50.7 billion, Electronic Arts Inc. (EA) is a leading interactive entertainment company that develops, markets, publishes, and distributes video games and live services across console, PC, and mobile platforms. Founded in 1982 and headquartered in Redwood City, California, EA operates one of the industry’s most valuable portfolios of owned and licensed intellectual property.

Shares of the video game company have outperformed the broader market over the past 52 weeks. EA stock has increased 51.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.4%. However, shares of the company are down 1% on a YTD basis, compared to SPX’s 1.4% gain.

Focusing more closely, shares of the video game maker have also exceeded the State Street Communication Services Select Sector SPDR ETF Fund’s (XLC) 12.9% return over the past 52 weeks and a marginal YTD gain.

Electronic Arts has outpaced the broader market over the past year primarily due to resilient performance from its core sports franchises, including EA Sports FC and Madden NFL, which continue to drive high-margin recurring revenue through live services and in-game monetization. Investors have also responded positively to the company’s stable cash flows, disciplined cost management, and strong digital mix, which supports profitability even amid uneven industry-wide game release cycles.

For the fiscal year ending in March 2026, analysts expect Electronic Arts’ EPS to grow 31.6% year over year to $6.38. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

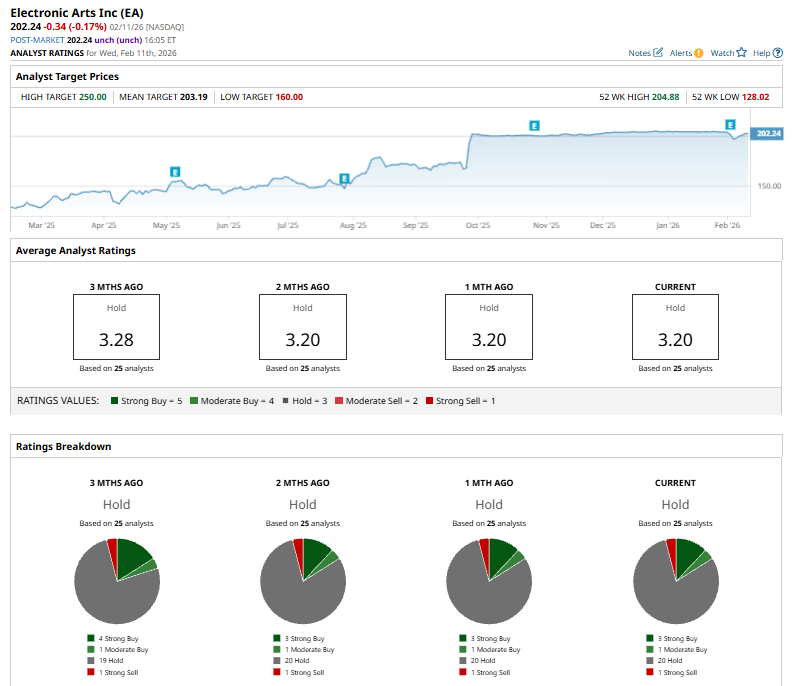

Among the 25 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” 20 “Holds,” and one “Strong Sell.”

This configuration is bearish than three months ago, with four “Strong Buy” ratings on the stock.

On Feb. 5, Citi analyst Jason Bazinet reduced his price target on Electronic Arts to $202 from $207 while maintaining a “Neutral” rating on the stock.

The mean price target of $203.19 represents a marginal premium to EA’s current price levels. The Street-high price target of $250 suggests a 23.6% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)