/Deere%20%26%20Co_%20John%20Deere%20tractor-by%20Yackers1%20via%20iStock.jpg)

Deere & Company (DE), headquartered in Moline, Illinois, manufactures and distributes a range of agricultural, construction, forestry, and commercial and consumer equipment. With a market cap of $160.9 billion, the company supplies replacement parts for its own products and for those of other manufacturers. Deere also provides product and parts financing services.

Shares of this global agricultural giant have outperformed the broader market over the past year. DE has gained 29.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.4%. In 2026, DE stock is up 31.6%, surpassing the SPX’s 1.4% rise on a YTD basis.

Zooming in further, DE’s outperformance is also apparent compared to First Trust Indxx Global Agriculture ETF (FTAG). The exchange-traded fund has gained about 26.6% over the past year. Moreover, the stock’s returns on a YTD basis outshine the ETF’s 17.3% gains over the same time frame.

On Nov. 26, 2025, DE shares closed down by 5.7% after reporting its Q4 results. Its EPS of $3.93 fell short of Wall Street expectations of $3.96. The company’s net sales were $10.6 billion, exceeding Wall Street forecasts of $10 billion.

For the current fiscal year, ending in October, analysts expect DE’s EPS to fall 9.1% to $16.82 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

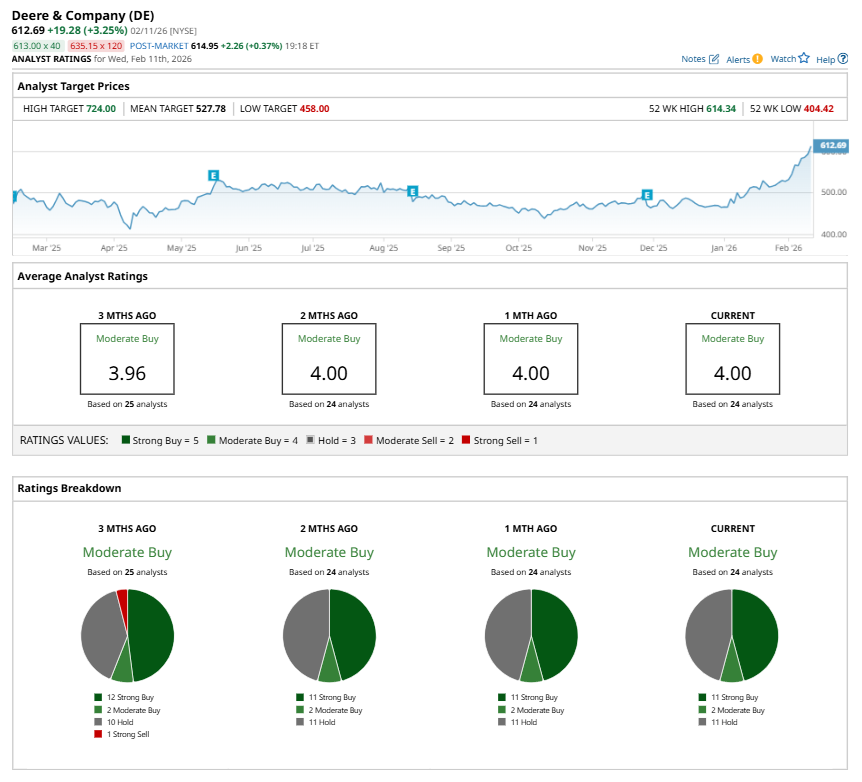

Among the 24 analysts covering DE stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, two “Moderate Buys,” and 11 “Holds.”

This configuration is more bullish than three months ago, with 12 analysts recommending a “Strong Buy,” and one analyst suggesting a “Strong Sell.”

On Feb. 4, Adam Seiden from Barclays PLC (BCS) maintained a “Buy” rating on DE with a price target of $530.

While DE currently trades above its mean price target of $527.78, the Street-high price target of $724 suggests an upside potential of 18.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)