Investors might be having a really hard time even thinking about investing these days. The interest rate in the United States now sits at 5% - 5.25% as of May. What's more, inflation is still high, sitting at 4%. Add on that the Fed plans on likely increasing interest rates at least one more time in 2023.

This can be incredibly stressful for the millions of Americans that continue to drown in debt. In fact, the Federal Reserve Bank of New York stated that in the first quarter of 2023, Americans hit a new record high for credit card debt at $17.05 trillion. That's just credit card debt, so not including every other type of loan and debt repayment that Americans are subjected to on a yearly, quarterly or monthly basis.

So, let's address that. Here's how to get out of debt once and for all, and start investing with just three steps.

Make a budget, but don't do it all yourself

Making a budget is absolutely the first way any American is about to pay off their debt. If you're just going along as if you have the same amount of cash on hand that you did in 2020, think again. Even if you had a budget you made three months ago, odds are it no longer applies. Not when inflation and interest rates continue to hurt the bottom line.

But before you panic, stop and take a breath. There are about a million and one different applications and free online tools that Americans can use these days to help them create a budget and pay off debt. These tools will in most cases have a list of items for you to simply input all of your spending. The key here? Be honest and don't leave a single dollar out.

This budgeting tool is called Zero-Based Budget. To achieve this method, start by putting down your income, and subtracting every single expense from your income until it comes down to zero. Hopefully, after subtracting your essentials and non-essentials, you have cash leftover. All that cash can be put right towards your debt! Once you're out of debt, he same method can be used to put it towards savings. To find out more about the Zero-Based Budget, you can learn about it from this article. And before you start saving comes the next part of the debt repayment plan.

Pay it off, but have a plan

Once you have a budget in place and have assigned every dollar towards your income, it's time to get serious about all your debts that need to be repaid. If you're drowning in debt, it's likely you have more than once debt that needs to be repaid. From student loans to credit cards, lines of credit and car payments, line every single up. Not from the largest payment to the smallest, but the highest interest rate to the lowest.

In this case, it's likely that your first debt to repay will be your credit card payments. These interest rates are usually around 19%, and that can add up to an incredible amount. Even just a $1,000 debt on a credit card could turn into $1,190 after just a month. So throw absolutely every dime you can at those payments, while paying the minimum debt amount for all the other debts you have. When that debt is paid, move on to the next debt payment until it's down to zero, and so on. If the amount you pay towards your debt is the same each month, make it automatic through monthly automated contributions! Then you won't even be thinking about your debt, and it'll feel like it's shrinking on its own.

It might seem like paying down debt could take a long time through this method. But this consistent repayment can mean you're out of debt far sooner than you think. If you're able to throw $1,000 per month at your debt, there goes your credit card debt right away. From there, even a $20,000 student loan would mean you're out of debt in just over a year and a half!

It's important to note that one debt that isn't included are mortgages. Once you're through your debt payments and only have a mortgage payment left, certainly keep up with mortgage payments. However, continue your Zero-Budget Method and instead of throwing your cash at debt, throw it into a savings account.

Start saving, and start investing

Let's go back to the beginning for a second. One part of creating a budget should always be having an emergency fund. Now, that should ideally be around three to six months of your income, but you're trying to pay off debt. So that's not feasible. Instead, have about $1,000 set aside for an emergency fund just to start. However, this can be placed in a tax-free investing account such as a Roth IRA, where you can store that cash for an emergency. That way, if you suddenly need a new engine, sudden medical bills come your way, or any other sudden cost you'll have cash on hand to pay it off. That's instead of creating more debt after making so much progress.

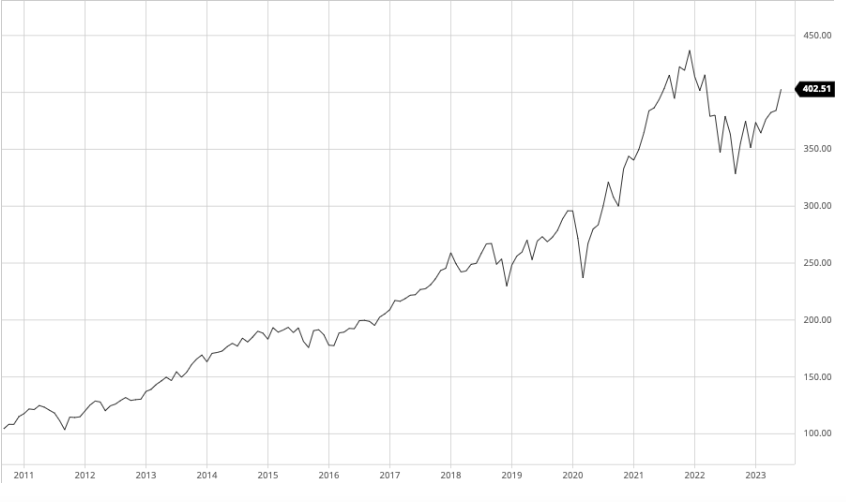

That $1,000 can then be invested into a safe exchange-traded fund (ETF) that has a long history of stable growth. This could include something like the Vanguard 500 Index Fund (VOO). This is a low cost ETF with a management expense ratio (MER) at just 0.03%. It therefore won't be eating up your investment through fees. Furthermore, as it tracks the S&P 500 ($SPX), it has a long history of stable, steady growth. Since 2010, shares have climbed 272%! That could turn any savings into a significant amount of cash on hand, all while you're paying down debt.

This is just one suggestion, but the best thing investors can do at this point, and throughout this process, is meet with their financial advisor. An advisor will help guide your investment and debt payments based on your exact situation. They can help choose the best application to guide your budget. They can help figure out the exact amount you can put towards debt and savings through automated contributions. And of course, they can help guide your investments to reach your long-term financial goals.

On the date of publication, Amy Legate-Wolfe did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)