- The weather market in new-crop corn and soybeans looks to have come to an abrupt end, at least for now.

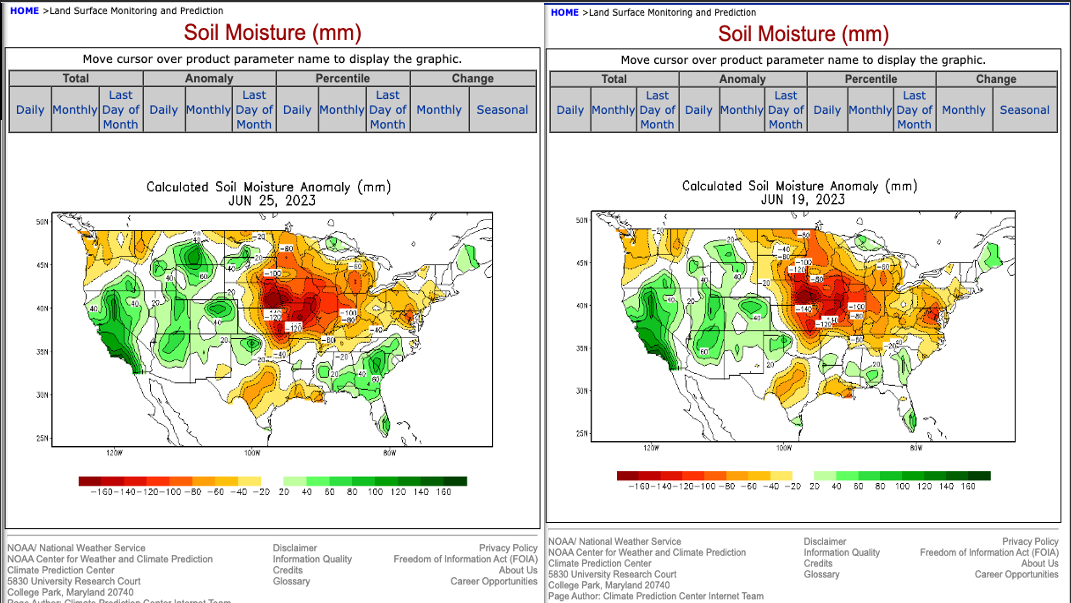

- The key issue of soil moisture deficits across the US Plains and Midwest has not been solved, needing more consistent and persistent rains over the weeks ahead.

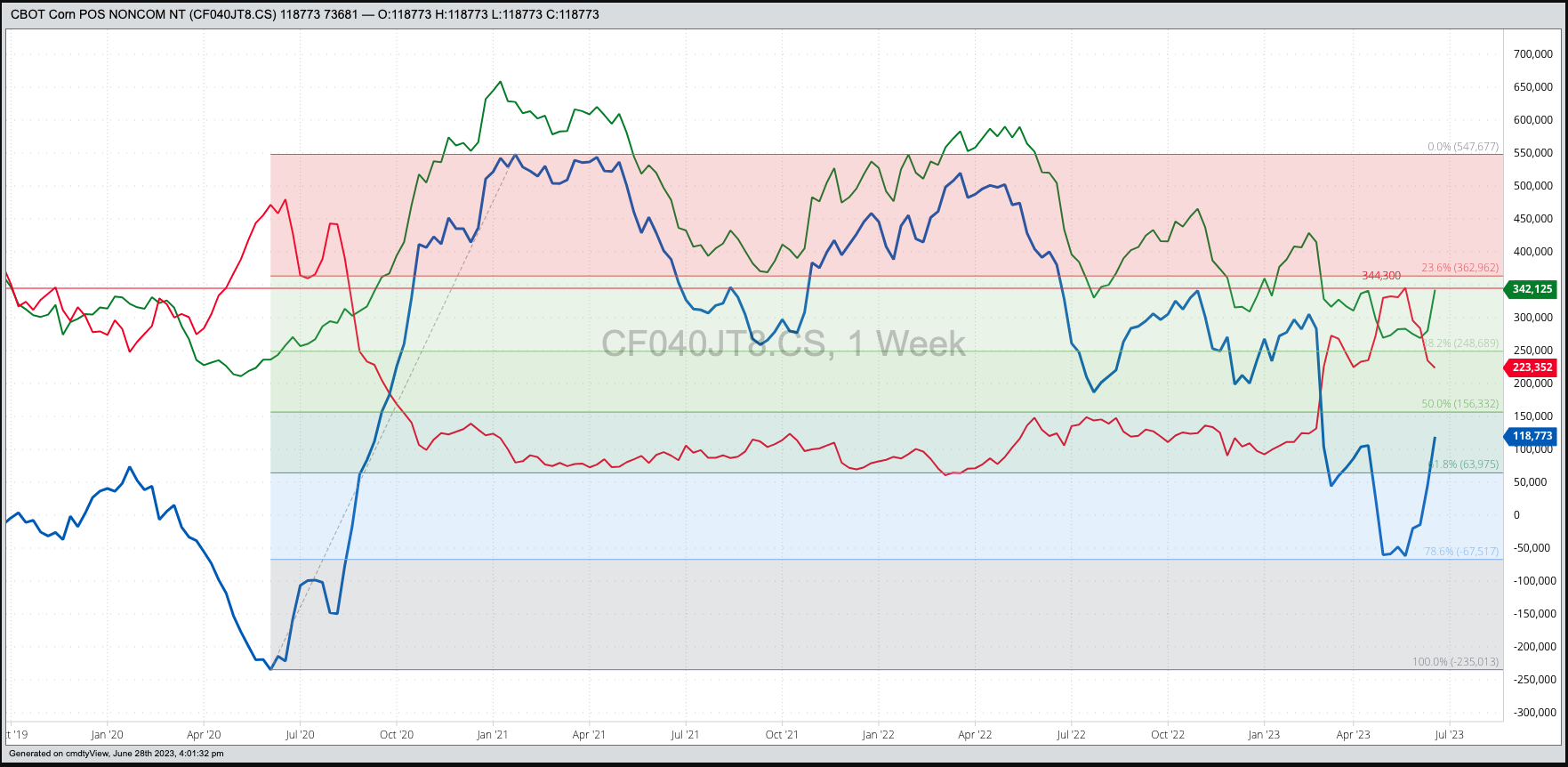

- Time will tell if noncommercial traders will come back to corn, and possibly soybeans, to the same degree seen over the last month.

There is a memorable scene in the 1991 movie “City Slickers” that I think about every year. Mitch (Billy Crystal’s character), a depressed city slicker who signs up for a Dude Ranch cattle drive ahead of his 40th birthday, starts the herd stampeding when he fires up his battery powered coffee grinder. The cattle run wild, as is usually the case in a stampede, before old cowboy Curly (Jack Palance) fires a single pistol shot in the air and stops the herd in its tracks. It is as good an illustration of a weather market in the grain and oilseed sector we will find.

As I talked about last time, weather markets in the grain and oilseed sector usually come with a great deal of hysteria. Like a cattle stampede. Yet despite all the chaos and carnage, most of them don’t last very long, both stampedes and weather markets. I mentioned in the previous piece the observed average length is roughly six weeks, though I haven’t collected the price data to substantiate this claim. Running a quick check I’ve seen weather markets run out of steam as quickly as four weeks and some have lasted eight weeks. The interesting thing about this one, based on the Dec23 corn (ZCZ23) weekly chart, is this is the sixth week of the move. For the record, the weekly chart for Nov23 soybeans (ZSX23) is not as clear on the week count.

Also mentioned in the previous piece is how weather markets tend to end abruptly, like an old cowboy firing his pistol in the air. In the case of grain and oilseed markets, though, all it takes is a forecast of rain. We saw this late last week, leading to a weekend of weather watching as a rain system moved eastward from the Plains across much of the US Midwest. Was it enough to change soil moisture deficits? No. But that didn’t matter, for noncommercial traders had already bought everything they wanted to, seemingly.

Last Friday’s CFTC Commitments of Traders report, and again I look at the legacy/futures only numbers[i], showed noncommercial traders had moved from a net-short futures position in corn of 62,267 contracts (as of Tuesday, May 23) to a net-long futures position of 118,773 contracts (as of Tuesday, June 20). This switch of 181,000 contracts pushed July corn to a rally of $1.17, September to a gain of $1.29, and December as much as $1.39 higher. But again, the forecasts changed, and the selling began. As of Wednesday’s close, both the hybrid September (an old-crop and new-crop issue) and more heavily traded new-crop December contracts had dropped 95.75 cents from last week’s highs.

Is the weather market in new-crop corn, and subsequently new-crop soybeans, over? It would seem so, but again we are talking about commodities meaning opinions can change quickly. As I said, the US has not solved the soil moisture deficit across the US Midwest, and it is going to take consistent and persistent rains over the coming weeks to do so. The cattle remain skittish, so the next person to hit the coffee grinder could start them running again.

[i] Granted, there has been a big increase in option trade of late in both corn and soybeans. However, I still contend option traders position themselves for a number of reasons besides being bullish or bearish, with the best I’ve ever met possessing an incredible understanding of all the Greeks involved in options.

More Grain News from Barchart

- Cocoa Prices Rally to 7-1/2 Year High on El Nino Concerns and Heavy Rain in West Africa

- NY Sugar Continues Lower on Strong Brazil Production

- Coffee Prices Fall Sharply on Technicals

- Wheat Pressing the Downside through Wednesday

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)