- Some of the loudest voices in agriculture continue to raise the ante when it comes to predicting the unpredictable, or in other words how high December 2023 corn futures could rally during this weather market.

- The commercial side of the corn market has been concerned about 2023 supplies for a long time, as indicated by the continued weak carry in the 2023-2024 forward curve.

- Short-covering from the noncommercial side has fueled the $1-plus gain in December corn over the last four weeks.

If you’ve been following U.S. agriculture-related social media this 3-day holiday weekend, and if you are reading this you likely have, then you know things have gotten hysterical. It seems everyone feels confident making predictions about the 2023 December corn contract (ZCZ23) hitting $8, or maybe $9, with others thinking that’s only the start. What seems to be missed is the grain and oilseed sector sees a weather market almost every year, with the generally tendency being these moves last an average of about 6 weeks. Guess what happens then? Yes, buying dries up and the various contracts start to go back down.

Let’s establish a few definitions before we get too deep into the discussion. A ‘weather market’ is when a commodity, usually a production ag commodity of some sort, starts to draw the attention of investment traders due to hot and dry weather forecasts sparking concern over production. Another way to think about this is in terms of a “supply-driven market”, meaning prices move higher at great speed as hysteria over possible short supplies starts to spread. In the grand scheme of things, supply-driven market rallies are usually short lived, say 6 week or so. The other side of the coin is a demand-driven market when commodities increase in value, usually at a slower pace, and stay at those new price ranges for a longer period of time. It is also important to remember every market has two sides, both commercial (those traders actually involved in the underlying cash market) and noncommercial (funds, investment traders, etc.). What is usually forgotten is it is the latter group that tends to set the trend of a market, which is why Newsom’s Market Rule #1 states, “Don’t get crossways with the trend” due to Newton’s First Rule of Motion applied to markets, “A trending market will stay in that trend until acted upon by an outside force, with that outside force usually noncommercial activity”.

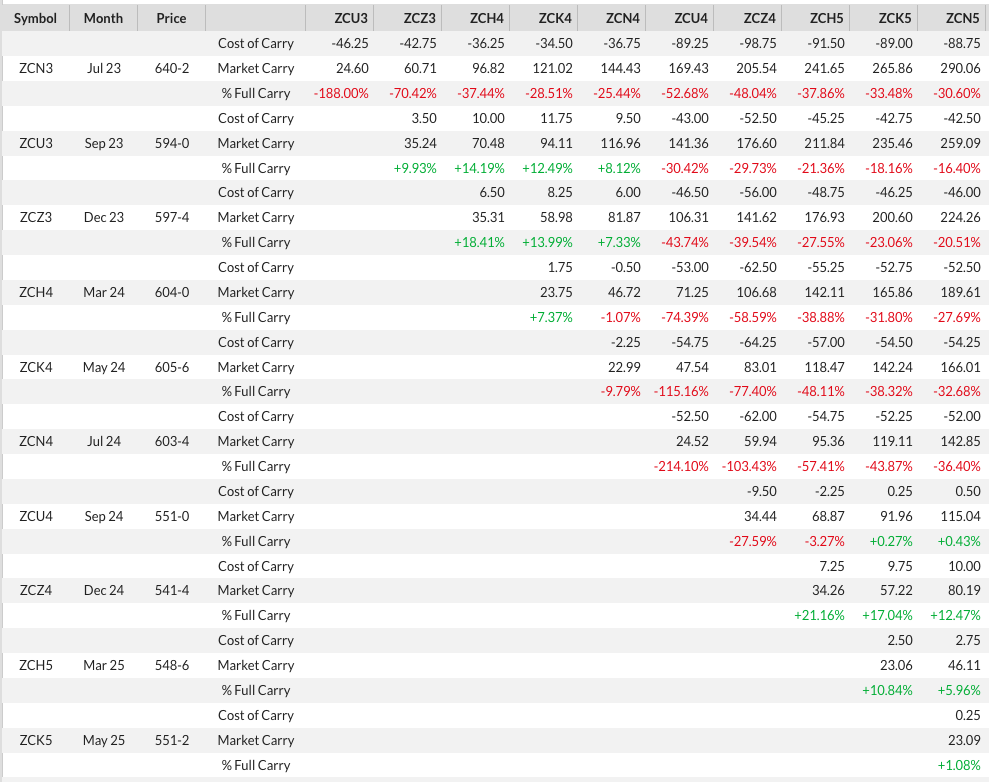

For brevity, I’m going to confine this piece to the 2023 corn market. A look at the contract’s weekly chart shows it posted a recent low of $4.9075 the week of May 22. Since then, the contract has posted four weeks of a solid rally, culminating with last Friday’s high of $5.98 and close of $5.9750 (note the contract hasn’t even hit $6.00 on this run yet). What sparked the rally? First let’s look at the commercial view of supply and demand. At the end of April, the December-March futures spread covered 31% calculated full commercial carry (cfcc) while the Dec23-July24 forward curve (series of futures spreads) covered 27% cfcc, with 33% or less considered bullish. So, we know the commercial side was already concerned about the 2023 crop, particularly with 2022-2023 supplies actually tighter than what has been reported. Fast forward to the end of May and we see the Dec-March covered 28% with the Dec23-July24 finishing the month at 21%. In other words, the commercial side grew a bit more bullish last month, but not dramatically so. A look at the Barchart Cost of Carry tables from last Friday’s shows the Dec-March covering 18% while the Dec23-Jul24 finished at 7% cfcc. Again, the commercial side was growing more bullish, but not in a hysterical way.

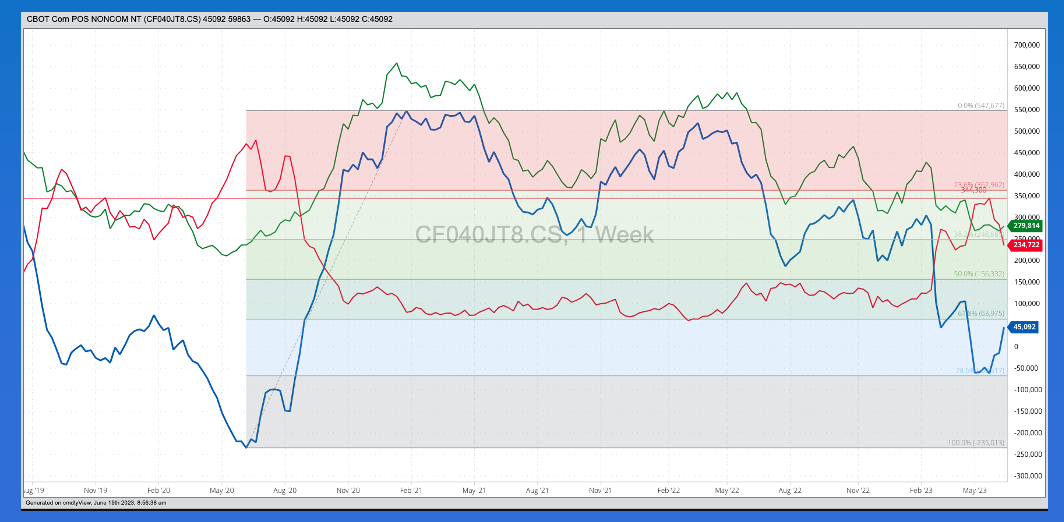

But what the other side of the new-crop corn market, the noncommercial side? A look at the CFTC Commitments of Traders report data (legacy, futures only) shows noncommercial traders held a net-short futures position (blue line on chart) of roughly 62,300 contracts as of Tuesday, May 23. The most recent set of CFTC numbers shows this same group now holds a net-long position of about 45,100 contracts, a switch of 107,400 contracts. What’s important here is how this switch came about. During that time span the noncommercial short futures position (red line) decreased by 110,425 contracts while long futures (green line) actually decreased by 3,070 contracts. Therefore, the rally in corn futures has come from covering shorts, not as bullish a scenario as if the investment side had been adding new longs.

How has the commercial side reacted to this spike rally of more than $1.00 the past 4 weeks? What I’m hearing is new-crop basis bids are collapsing across the Plains and Midwest, meaning merchandisers are letting the noncommercial side source next year’s supplies for them. Again, this is not as bullish as if those in the cash grain market were pushing harder for supplies while the market was rallying.

I’ll leave you with a couple thoughts from some friends of mine. First, a cattleman in central Nebraska continues to tell me, “The US couldn’t sell cash corn (ZCPAUS.CM) when it was $6, who thinks it is going to sell more when it hits $7 or $8?” Second, a large farmer from Iowa talked about things that were “seemingly not helpful at this moment”. His list included nearly all technical and fundamental factors. What would be helpful, he added? Rain.

My friend is absolutely right. As I’ve talked about countless times in the past, ag production markets are weather derivatives. We can see that in the reaction of investment traders. In the end, though, any question of supply comes down to what can be produced, meaning for the most part – Rain.

More Weather News News from Barchart

- How High Will Tesla Stock Climb?

- Midwest Drought: How High Will Wheat, Soybeans, and Corn Prices Rise?

- Sharp Friday Gains for Wheat Futures

- Weather Driven Rally Boosts Beans into 3-Day Weekend

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)