- Weather markets are also supply-driven markets, instances when traders become concerned about reduced production due to adverse weather.

- In the case of corn and soybeans, weather markets tend to occur later in the summer and last roughly 6 weeks.

- This time around, given US corn supplies remain tight, traders seem to be more concerned about weather at a time when both markets tend to post seasonal highs.

As we head into Friday’s session, just before the US 3-day holiday weekend marking the unofficial start of summer, one of the more frequently asked questions is if it is too early for the grain and oilseed complex to be in a weather market? A look at seasonal studies for the various markets, particularly new-crop December corn and November soybeans, and the answer is along the lines of, “Yes, probably”. Normally this time of year we are talking about seasonal tops being formed, with Dec corn showing a tendency of posting a high weekly close the first week of June (next week) while November soybeans’ peak tends to occur the week after.

Let’s start with a general definition of a “weather market”. The idea is markets post strong rallies, usually lasting about 6 weeks, as traders buy into the idea hot and dry weather over the summer will create a short supply market. This is different than a rally driven by new or increased demand, with short supply/weather markets usually ending about the time rain clouds start to form or combines begin to roll.

I’ll get into corn and soybeans in more detail momentarily but want to touch on wheat first. As I discussed last time, the Kansas City (HRW) wheat market could already be considered a weather market, based on the strong inverse in its forward curve. However, wheat’s reputation is well earned meaning it has been slow to draw investment buying interest on the idea that even late May rains could change the 2023 crop’s fate. It won’t, but that was what seemed to hold the July contract (KEN23) back until late this week.

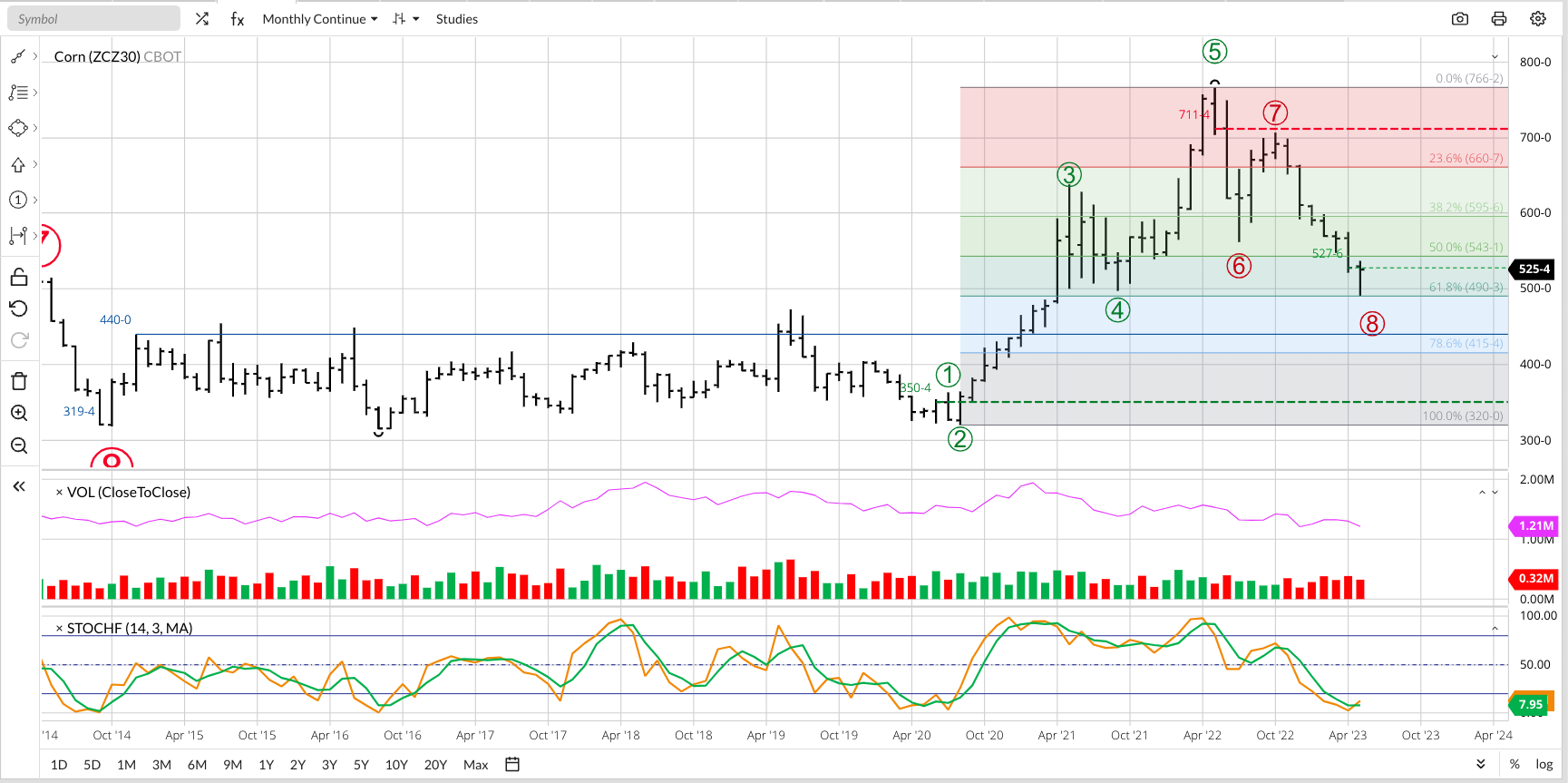

The corn market has had an interesting month of May with the Dec23 issue initially rallying above the April settlement of $5.2725 before falling to a low of $4.9075 on May 18. Since then, though, the contract has gained some upside momentum due to forecasts calling for a warmer and drier month of June across the US Midwest growing area. Heading into Friday’s session, Dec23 (ZCZ23) was priced near $5.25. What do we know about the 2023-2024 corn market?

- The Dec23 futures contract spent the six months from September through February buying acres away from November soybeans, as indicted by spread activity between the two contracts.

- Weather forecasters spent much of the late winter/early spring talking about how La Nina was breaking down and a El Nino was likely moving in, bringing better chances of summer precipitation to the US Midwest.

- We also knew US available stocks were tight, based on inverted old-crop futures spreads, historically strong basis, and correlations between national average cash prices and available stocks-to-use.

The only one of these three factors to have changed, as of late May 2023, is the weather. Given grain and oilseed markets (as well as softs and energies to a certain extent) are weather derivatives at heart, it makes sense Dec23 corn is in position to complete a bullish reversal pattern on its long-term continuous monthly chart this month. For the record, this chart moved into a long-term downtrend at the end of May 2022. As for futures spreads, the 2023-2024 market has covered a bullish level of calculated full commercial carry going back to at least August 2022 meaning the commercial side of the market believed the tight supply and demand situation was not going to be solved with the next crop.

As for soybeans, the long-term continuous November only monthly chart has shown a downtrend since the 2022 issue posted a bearish key reversal last June. After taking over the baton late last fall, Nov23 (ZSX23) has extended this long-term downtrend to a low of $11.6325 during May. Unlike Dec23 corn, Nov23 soybeans are not in position to complete a bullish long-term reversal this month, at least not as of this writing. That being said, the contract could complete an intermediate-term bullish reversal pattern on its weekly chart Friday, setting the stage for a long-term move down the road. The 2023-2024 soybean market is also fundamentally bullish, though the November-January futures spread has taken up residence near the threshold of 33% calculated full commercial carry, occasionally poking its head into neutral territory.

An interesting aspect of the two markets is noncommercial traders continue to hold a net-long futures position in soybeans, despite what has been reported as a record crop in Brazil. Meanwhile, the same group has moved to a sizeable net-short futures position in corn. This opens the door to additional support from short-covering buying as we move into the summer months.

More Grain News from Barchart

- SRW Left Behind on Thursday

- Soybean Futures Close Lower with BO Gains and Meal Losses

- July Corn Stood Out on Thursday

- Cocoa Prices Consolidate Below 6-3/4 year Highs

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)