U.S. natural gas futures did not post the same all-time peaks as the energy commodity in the U.K. or the Netherlands in 2022. In a December 20, 2022, article on Barchart, I wrote, “As the war in Ukraine continues to rage in late 2022 and relations between Moscow and its European neighbors have deteriorated, expect natural gas volatility to continue. We could see a series of price implosions and explosions over the coming months as natural gas is an energy commodity in the crosshairs of the current geopolitical landscape. Natural gas offers lots of volatility for traders, but it is not a market for the faint of heart.” Natural gas did not experience any price explosion, as the implosion that began at the August 2022 high continued. On December 20, 2022, nearby NYMEX natural gas futures were at the $5.387 per MMBtu level, almost half the price at the August high. On February 7, 2023, after the price had more than halved again, it was sitting at the $2.50 per MMBtu level.

Buying the dip cost natural gas bulls a fortune

A fourteen-year high bullish sentiment gripped the market when nearby NYMEX natural gas futures rose above the $10 per MMBtu level in August 2022. However, the bullish trend ran out of upside steam, causing many market participants to buy the dip because of sky-high European prices going into the winter season. The dip turned into price carnage as natural gas dropped to the lowest level since December 20202 and nearly one-quarter of the level at the August high.

The chart highlights the plunge that took nearby March natural gas futures to the latest $2.341 per MMBtu low on February 3. Buying on the dip was a losing proposition as the energy commodity continued to make lower lows as the price sunk into a bearish abyss.

In August, a new record high in U.S. natural gas appeared possible- Six months later, a new low could be in the cards

Since U.S. natural gas became a more international energy commodity over the past years, with LNG exports traveling far beyond the North American pipeline system, the supply concerns and record highs in European and Asia prices caused an overwhelmingly bullish sentiment to descend on the NYMEX natural gas futures market even when the price turned lower from the $10 per MMBtu level. Many market participants believed the price would recover and challenge the 2005 $15.78 per MMBtu record high.

After failing to reach the 2005 peak of the 2008 $13.694 high, natural gas now threatens a test of the June 2020 $1.44 low, the lowest price in a quarter of a century. Below, the all-time bottom since natural gas began trading on the CME’s NYMEX division in 1990 was in January 1992 at $1.04 per MMBtu.

Crude oil taught us that zero is not an absolute bottom

Henry Hub natural gas futures prices on NYMEX are a benchmark with local prices across the U.S., often trading at premiums or discounts to the nearby futures price. Over the past three decades, regional prices routinely exceeded the $15.78 high and, in some cases, fell to zero or below.

When it comes to the path of least resistance of NYMEX natural gas prices over the coming weeks and months, the NYMEX crude oil market taught market participants that zero is not necessarily an absolute low.

The chart of nearby WTI crude oil futures on NYMEX shows the April 2020 brief plunge to negative $40.32 per barrel as those holding long positions could not store the petroleum and had to sell at any price to liquidate risk positions. The move to a negative price in crude oil is a warning to natural gas market participants that a price at $0.00 per MMBtu is not the downside potential. As of February 7, 2023, the trend in natural gas remained bearish even though the price was on a path to test the $2 level.

U.S. inventories have turned bearish

Over the past months, natural gas in storage across the United States was below last year’s level and the five-year average. Over recent weeks, that trend changed.

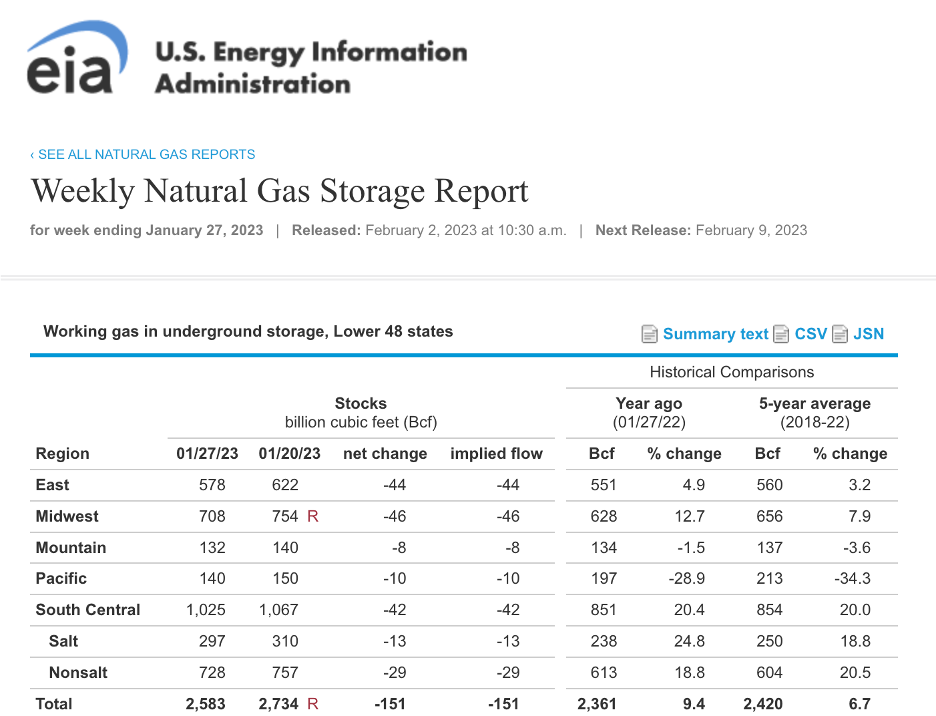

Source: EIA

The chart shows at 2.583 trillion cubic feet, natural gas inventories were 9.4% above last year’s level and 6.7% over the five-year average at the end of January. In March 2022, U.S. natural gas stockpiles fell top 1.382 trillion cubic feet at the end of the peak withdrawal season. At over 2.5 tcf on January 27, stocks are unlikely to fall near that level when natural gas begins flowing back into storage during the injection season from late March through November 2023.

Stockpiles have become a fundamental bearish factor for the U.S. natural gas market.

Be careful with the ETF and ETN products- A decline into negative territory could cause havoc

The three most liquid products providing market participants with exposure to the natural gas market are:

- The United States Natural Gas Fund (UNG)- At $8.55 per share on February 7, UNG had $670.956 million in assets under management. UNG trades an average of over 21.6 million shares daily and charges a 1.11% management fee. UNG tracks nearby NYMEX natural gas futures prices and rolls to the next active month contract two weeks before expiration. Rolling natural gas futures from one month to the next is a significant risk that caused distortions in the UNG product.

- The ProShares Ultra Bloomberg Natural Gas product (BOIL)- At $6.37 per share on February 7, BOIL had $670.785 million in assets under management. BOIL trades an average of over 43.1 million shares daily and charges a 0.95% management fee. BOIL is a bullish product that seeks to deliver twice the percentage performance of nearby natural gas prices on the upside. The leverage causes BOIL to suffer from time decay with reverse splits. BOIL is only appropriate for short-term risk positions.

- The ProShares Ultrashort Bloomberg Natural Gas product (KOLD)- At $61.44 per share on February 7, KOLD had $145.584 million in assets under management. KOLD trades an average of over 3.64 million shares daily and charges a 0.95% management fee. KOLD is a bearish product that seeks to deliver twice the percentage performance of nearby natural gas prices on the downside. The leverage causes KOLD to suffer from time decay with reverse splits. KOLD is only appropriate for short-term risk positions.

While UNG, BOIL, and KOLD have performed in the past, the products may run into problems if natural gas prices fall below zero on nearby contracts and the next active month. Prices below zero could wreak havoc in the natural gas ETF and ETN arena.

The trend is always your friend in any market, and natural gas is no exception. While the odds favor a recovery, the trend remains bearish in February 2023 even though prices are less than one-quarter the level as in August 2022. Natural gas is not for the faint of heart and requires a plan, careful attention to risk-reward dynamics, and the discipline to stick to that program.

More Energy News from Barchart

- Nat-Gas Consolidate Above a 2-Year Low

- Crude Recovers After Saudi Arabia Raises Crude Prices for March Delivery

- Crude Slides on Concern About Chinese Energy Demand

- Friday's Last Call: Crude Oil's Hard Fall

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)