Exxon Mobil (XOM) will report on Jan. 31 (before the market opens) its Q4 and 2022 full-year earnings. However, its option premiums now show much higher prices on the put side compared to calls. This skewness on the put side displays investors' fears about the upcoming earnings. However, it also provides a good income play for investors willing to short them now.

For example, look at the option chain for the period ending Feb. 17, 2023. If we pick a strike price between 5% and 6% away from today's price, we can compare the premium as well as the implied yield.

On Jan. 23, XOM stock opened at $112.76. The call option premium for the $119 strike price closed yesterday at 95 cents. That implies a covered call yield of 0.91% and the stock price was 5.5% from the $119 strike price.

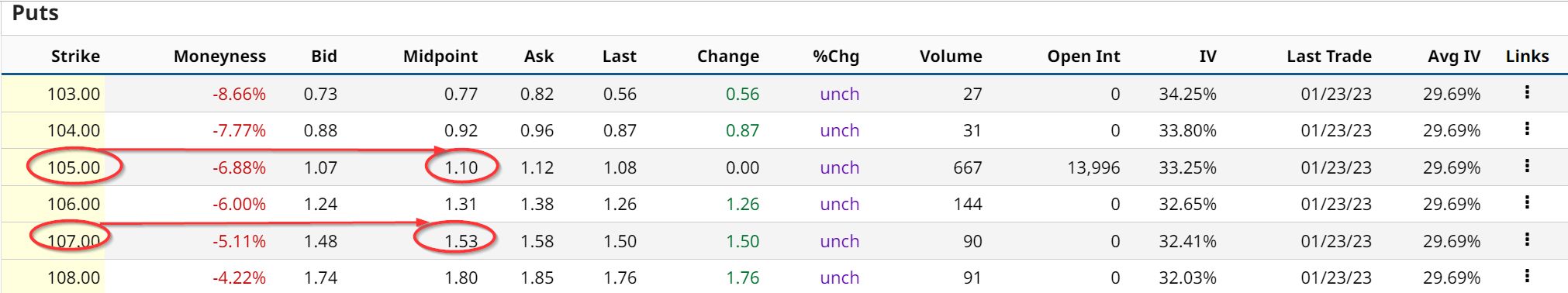

By contrast, the $107 strike price puts closed at $1.53, where the stock is 5.1% away from the put price. That provides a yield of 1.356% compared to the spot price of $112.76. Moreover, compared to the $107 strike price, the $1.53 put premium provides an excellent yield of 1.43%. It also lowers the short put investors' breakeven price to $105.47 per share (i.e., $107-$1.53).

Some more conservative investors may want to short the $105.00 strike price, which is further away from the Jan. 23 price. It provides only a slightly lower yield of 1.04% (i.e., $1.10/$105).

Opening on Jan. 24, 2023 - Use a Jade Lizard Strategy

However, the stock opened up down $2.01 on Jan. 24, before the option prices started trading. This seems to validate the investor's fears about a potential drop in XOM stock. That provides conviction to the high put prices.

I pointed out in my previous article on Jan. 8 on Exxon that its 5-year plan highlights its new buyback plan. It expects to repurchase about $15 billion annually. That is extremely important for short-put investors, as it means that any material weakness in the stock price will likely attract buying by Exxon itself.

As a result, even though the stock opened up down on Jan. 24, the short put premiums and yields are still very high and haven't moved much. That is attracting short-put investors. For example, you can see in the option chain above the $105 strike price volume has skyrocketed to 13,996 contracts as of Jan. 24.

Investors may want to consider putting on both a short put and call trade. However, that will involve a double whammy in terms of cash and margin that is required. One way around this is to put on a Jade Lizard strategy, as I have explained in other articles.

That means buying a long call for the same expiration period at just a $1.00 or $2.00 higher out-of-the-money strike price from the short call. For example, the $121 call will cost 57 cents, but the 95 cents income from the short $119 call covers this. The net credit is $0.38. Now the investor doesn't have to buy 100 shares of XOM, which lowers the margin requirement.

As a result, combined with the $1.53 from the $107 short put, the total income is $1.91. That represents a whopping 1.785% yield on the $107 put strike price, or 21.4% annually. Moreover, the $1.91 income more or less covers the $2.00 width of the call spread ($121-$119 strike prices). This alleviates any major risk on the upside should the stock rise over $1.19 by the close.

More Stock Market News from Barchart

- Markets Today: Stock Indexes Slip on Negative Corporate News

- Naked Put Screener Results For January 24th

- Pre-Market Brief: Stocks Mixed As Focus Shifts to Big Tech Earnings

- Strength in Tech Stocks Leads the Overall Market Higher

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)