EQT Corp. (EQT) stock, the natural gas production firm, has a low multiple and a 1.58% yield. But its relatively high implied volatility (IV) attracts investors since this is ideal for a jade lizard options strategy. We have discussed this options strategy in a previous article on Spotify (SPOT) last month.

The main reason why a Jade Lizard strategy works out well for EQT stock is its relatively high IV stats. That more than makes up for its lower-than-average dividend yield compared to other energy stocks.

For example, look at the Barchart “Options Overview” section for EQT stock, just below the Fundamentals section. It shows that the Implied Volatility (IV) is now 49.9%. Moreover, it is in the top 1% of the highest IV stats for all stocks that Barchart analyzes.

Compare this to Chevron Corp (CVX). Even though its dividend yield is higher at 3.20%, the Barchart Options Overview section shows that its options have a lower 27.11% IV and are ranked in the top 4%. Also, Exxon Mobil (XOM) stock has a 3.22% dividend yield, but its IV is lower at 27.95%.

So, even if you don't completely understand the Implied Volatility concept, you can inherently see that EQT options' higher IV will likely lead to much higher premiums.

High IV is Good for Shorting OTM Calls and Puts

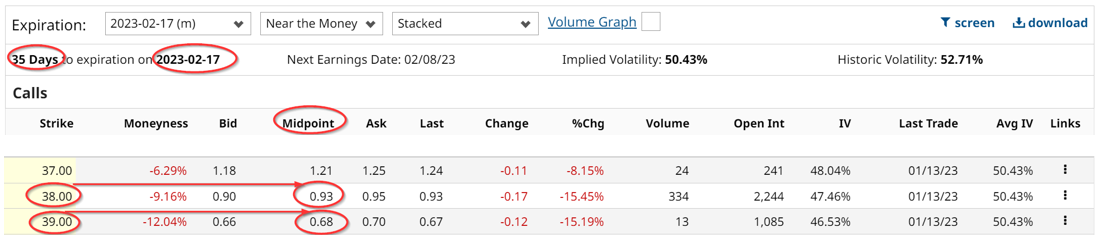

For example, look at the EQT call options for Feb. 17, 2023, which is 35 days from today. The $38.00 strike price, which is 9.16% higher than the price on Friday, Jan. 13, 2023, of $34.81, is at 93 cents in the midprice.

That means the covered call option investor can make an immediate yield of 2.67% (i.e., $0.93/$34.81). This is very attractive since it means the investor could potentially make an annualized income of 32%, assuming it can be repeated for 12 months. In fact, even if the high IV lasts for only 3 months, the investor can make 8.0% (i.e., 2.67% x 3). This enhances the investor's otherwise relatively lower dividend yield. Moreover if EQT stock rises to $38,00 the investor will also make a gain of 9.16%.

However, given EQT's high implied volatility, it is very possible it could rise more than 9.16% well above $38.00. That is a situation where the investor has to put up a large amount of money in a covered call, only to see the stock rise significantly over the strike price. As a result, the covered call investor may want to short the $39.00 strike price for 68 cents. This still provides an ample yield of 1.95%. But again the investor has to put up $3,481 in capital to buy the 100 shares.

Jade Lizard Strategy Eliminates Upside Risk and Provides Income

One way around this is to do a Jade Lizard strategy. Here the investor shorts the $38.00 call price and simultaneously buys the $39.00 call price. This call spread provides an upside if the stock rises over $39.00 with the same expiration period. The spread results in a net income of 25 cents (i.e., a short call brings in $0.93 but the long call costs $0.68).

But this still leaves a $1.00 potential risk between $38.00 and $39.00 If the stock closes at $39.00 the investor will lose $1.00, so the net income will be -$0.75 (i.e., $1.00 less the $0.25 call spread income).

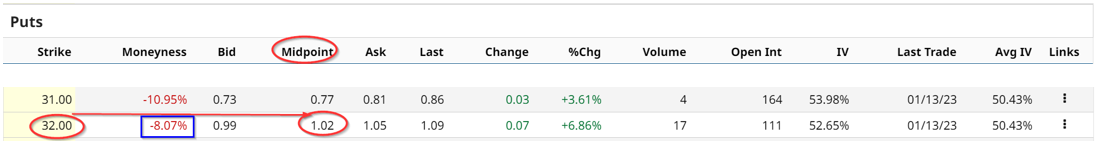

The Jade Lizard strategy says that to take care of this upside risk, the investor shorts a relatively near-term out-of-the-money put option. For example, the $32.00 put option trades for $1.02 for Feb. 17.

Therefore, by simultaneously shorting the $32.00 put, and receiving $1.02, along with the call spread, the net premium received is $1.27 (i.e., $1.02 put income plus the $0.25 call spread income). This is 27 cents more than the $1.00 risk between $38.00 and $39.00 which is not covered by the call spread income.

In addition, the short put strike price allows the investor to make money since it assumes that the stock will not fall by over 8.07% to $32.00. But even if it does, the investor buys the stock at $32.00 and can turn around and short-covered calls from that point on.

Note that this Jade Lizard strategy provides a net income yield to the investor and has no upside risk since the upside over $38.00 is completely covered by the income received. It can be done on a fully covered call basis, or else without having to buy the underlying 100 shares for the call spread, depending on the investor's cash and margin available in the account.

The bottom line is that EQT stock has a high implied volatility, making it ideal for covered calls, short puts, and a Jade Lizard options income strategy.

More Stock Market News from Barchart

- Stocks End Higher as Bank Stocks Recover Early Losses

- Tepid Demand Threatens Chip Stock Rally

- Stocks Fluctuate as We Head Into a 3-Day Weekend

- Should Retail Investors Buy the Explosive Options Movement in Arrival (ARVL)?

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)