On Dec. 8, Exxon Mobil Corp (XOM) detailed its 5-year plan and said it expects higher cash flow and capex spending. It also announced a significant increase in its stock buybacks. This is on top of a recent dividend hike. These activities make XOM stock much more attractive to value investors. In addition, short put and call plays can provide extra income opportunities.

The oil and gas giant said that it will maintain its capex spending at $20 billion to $25 billion over the next five years, but its earnings and cash flow double by 2027 compared to 2027.

Buybacks and Dividends are Significantly Higher

Moreover, Exxon said its share repurchase plan will rise significantly. It was recently hiked to $30 billion by the end of 2023, or about $15 billion annually as explained in my last article on Exxon. But now it will rise by 67% to $50 billion by the end of 2024. That increases the average amount to $25 billion over the next two years.

So, compared to its present market capitalization of $455 billion, this means that the buybacks represent 5.45% of its stock value. That is the same thing as a 5.45% buyback yield. This is much higher than its average of just 0.59% over the past 5 years, and even just 2.34% in the last 12 months, according to Morningstar.

In addition, since Exxon raised the quarterly dividend to 91 cents in October, the annualized dividend yield is now 3.29% (i.e., $3.64 annual dividend/$110.53 price as of Jan. 6). This is roughly similar to its 3.21% yield over the last year, but below the average 5.36% yield in the last 5 years. Much of the reason for the lower yield has to do with the fact that XOM stock rose 80% in the last year.

Exxon did not say what it will do with the dividend over the next 5 years. But investors can probably continue to expect annual increases as the company has done so for the past 40 years. Moreover, Exxon said that it spent $15 billion in buybacks in 2022 and the same amount in dividend payments. This implies that as the share buybacks rise by 67%, the dividend might also rise by this amount, although that is not guaranteed and the company did not indicate this would happen.

Shorting Calls and Puts for Extra Income

In our article on Dec. 5, 2022, we wrote that the Dec. 30 covered calls and short puts looked attractive to short. At the time XOM stock was $109.91and the $119.00 strike price calls sold for 64 cents, providing a 0.58% immediate yield or 7.0% annually. Those expired out-of-the-money since XOM stock did not rise to $119.00 by Dec. 30, so the covered call investor made a clean yield with exercise.

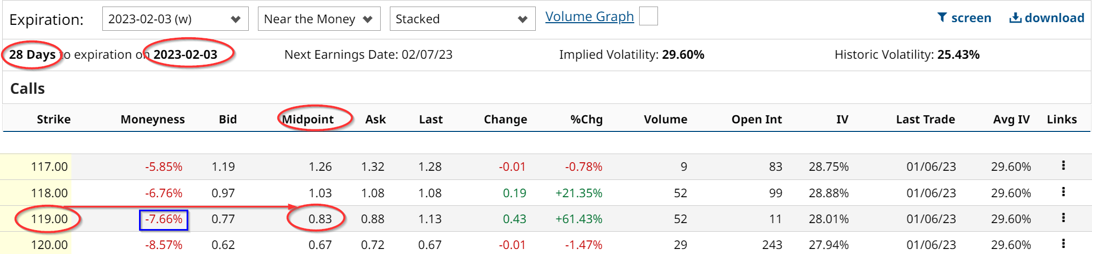

Today, the $119.00 strike price calls for Feb. 3, 28 days from now, trade for 84 cents. Since XOM stock is at $110.53, this $119.00 strike price is still 7.66% over the price today.

This gives the covered call investor an immediate yield of 0.76%, or 9.11% on an annualized basis, based on the price as of Friday, Jan. 6, 2023, of $110.53.

Moreover, investors can also short out-of-the-money puts, as I discussed last month when the $100 strike price puts for Dec. 30 traded for 68 cents. Those puts also expired worthless, giving the short put investor a monthly income yield of 068% or 8.16% annualized.

Today, the $101 strike price puts trade for 82 cents for puts expiring Feb. 3, providing for an immediate yield of 0.81% or 9.7% if it can be repeated each month.

This shows that investors can expect to make good money with XOM stock, from its dividends, and buybacks, and also shorting out-of-the-money calls and puts.

More Stock Market News from Barchart

- Meta Platforms Short Strangle Could Net $260 In 3 Weeks

- Stocks Surge as Bond Yields Tumble on Weak U.S. Reports

- China’s BYD is Surpassing Tesla in China

- Stocks Rally as Bond Yields Plunge on U.S. Reports

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)