Exxon Mobil Corp (XOM) recently raised its dividend and is buying back large amounts of shares. Along oil price rises, doing covered calls and short puts to earn income in XOM stock is very attractive to value investors.

As I wrote on Oct. 30, Exxon produced stellar results for Q3, based on its powerful free cash flow (FCF). It generated $22 billion in FCF during the quarter and over $50 billion YTD. That puts it on an annualized 19.3% FCF yield of about 19.3%.

As a result, the company is buying back large amounts of its shares. The company plans on buying back $30 billion of its shares by the end of 2023. I estimate that its buybacks now are about $15 to $17 billion annually compared to its $452 billion market capitalization, or a buyback yield of 3.3% to 3.76%.

That is on top of its ongoing dividend yield of 3.31%, giving shareholders a total yield of about 7.0%. That makes the stock very attractive going forward.

Playing Covered Calls and Short Puts For Income

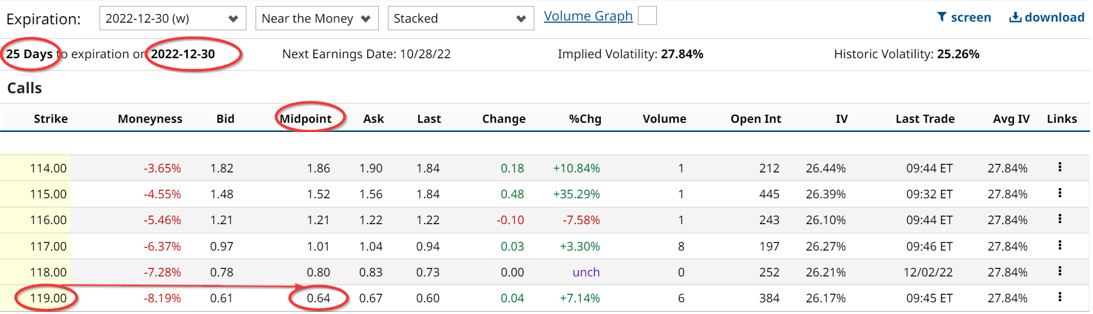

Right now some investors are playing out-of-the-money (OTM) covered calls and OTM short puts to generate extra income. For example, the Dec. 30, 2022, $119.00 strike price calls have a premium of 64 cents at the midpoint.

This means that an investor who pays $109.91 for 100 shares, or $10,991 they will immediately receive $64 by shorting the $119.00 strike price. This works out to an immediate return of 0.58%, or 7.0% on an annualized basis. Moreover, even if the stock rises by over 8.27% to $119.00 by Dec. 30, the investor keeps the capital gain. If the stock rises to below $119.00, the investor also keeps the unrealized gain. That means the potential upside is almost 9.0% (i.e., 8.27%+0.58% = 8.85%).

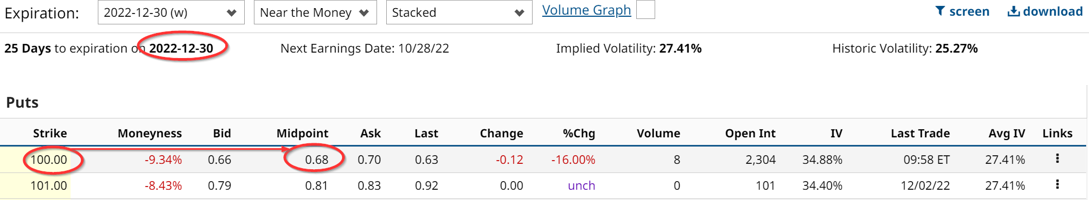

In addition, some investors are shorting OTM put options as well. For example, the $100.00 strike price for Dec. 30, trades for 68 cents.

This means that an investor who puts up $10,000 in cash or margin with his brokerage firm (i.e., $100 x 100 shares), will immediately receive $68 by shorting the $100 strike price puts. That works out to a 0.68% return and annualized 8.16% rate.

However, in this situation, the investor cannot make a capital gain as the covered call investor can make. As a result, sometimes investors will do both OTM-covered calls and OTM short puts to maximize their income. This involved putting up twice as much capital, $10,000 in the short put leg and $10,991 in the covered call ($20,991 total), in order to make $68 plus $64, or $132. That works out to a return of 0.6288% or 7.54% annually.

Keep in mind as well this is in addition to the ongoing benefits of owning XOM stock, which has a 7.0% total yield. As a result, the investor can almost double their implied total return using these short put income plays.

More Stock Market News from Barchart

- Markets Today: Stock Indexes Slip as Bond Yields Rise

- Option Volatility And Earnings Report For December 5 - 9

- Pre-Market Brief: Stocks Mixed As Labor Market Strength Weigh On Sentiment

- PPI, PMI and other Key Themes To Watch This Week

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)