ExxonMobil Corp (XOM) produced blowout earnings and free cash flow for Q3 as reported on Friday, Oct. 28. As a result, it raised the quarterly dividend and bought back large numbers of its shares. All of these factors are pushing XOM stock price higher, closing up 2.93% on Friday at $110.70. Moreover, investors might expect XOM stock to move higher base on its high total yield (i.e., dividends and buybacks).

Exxon raised its quarterly dividend to 91 cents per share, up 3 cents from 88 cents over the last four quarters. That gives it an annualized rate of $3.64 and gives XOM stock a 3.29% dividend yield.

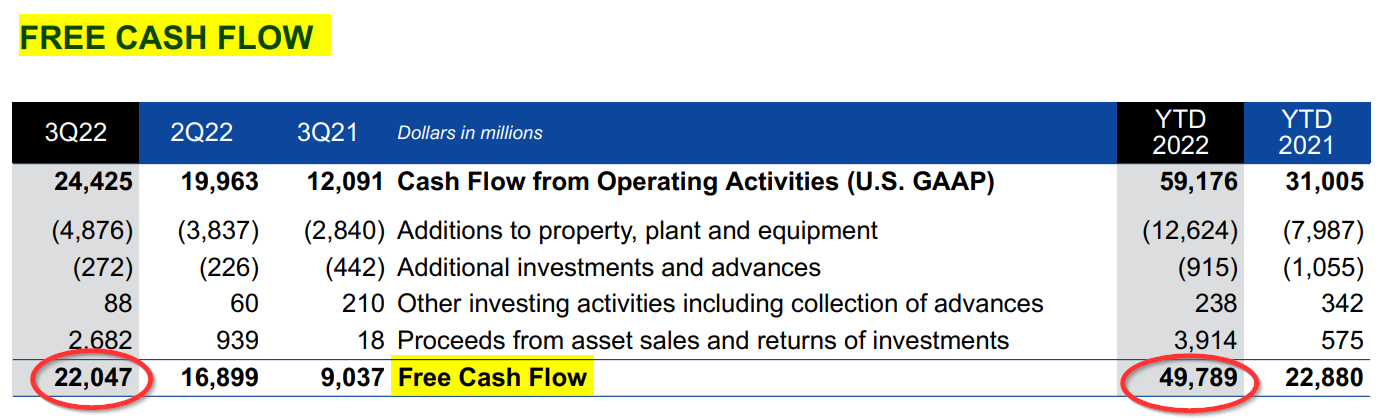

Massive Free Cash Flow

This was a result of the massive $22 billion in free cash flow (FCF) it produced during the quarter. That means Exxon has produced almost $50 billion in FCF YTD. It also represents $88 billion on an annualized basis.

As a result, this works out to 19.3% of its $455.86 billion market cap - a 19.3% FCF yield (i.e., $88b/$456b). To say the least, this is incredibly high, as most profitable companies have a 3% to 5% FCF yield.

Huge BuyBacks and Dividend Growth

As a direct result of this, Exxon bought back $4.5 billion of its stock during the quarter, and this brings its YTD repurchases up to $10.5 billion. Exxon reiterated its plan to repurchase its shares up to $30 billion by the end of 2023.

Let's think about this for a minute. If the company can buy back another $19.5 billion in the next year and a quarter, its annualized buyback rate is $15.6 billion annually. And if it keeps doing $4.5 billion per quarter, that works out to an annual rate of $18 billion. So, on average this works out to $16.8 billion annually.

That works out to a buyback yield of 3.68%, as $16.8 billion in share repurchases compared to its $456 billion market value is 3.68%. That means in the next three years, its share count could fall by 10%, and this effectively raises its earnings per share by that amount.

It also means that the dividend per share could rise by 10% over the next three years as well, at the same dividend cost to the company. If Exxon spends more on the dividend, the dividend growth could be even greater than 10% over the next three years.

Where This Leaves Investors in XOM Stock

So far this year XOM stock is up over 74%, including over 27% in the last month. But this massive cash flow, due to higher oil and gas prices, and higher refinery margins could move up even more once the world recovers from recession.

In addition, the stock now has a total yield, including dividend and buyback yields of about 7.0%. This is because the dividend yield of 3.29% added to the 3.68% buyback yield works out to 6.97% (i.e., $7.72 per share)

That is a high total yield and should help push XOM stock even higher. For example, at a 5.0% total yield, XOM stock could rise to $154.40 per share (i.e., $7.72/.05). That represents a potential upside of 39.5% for XOM stock from here.

More Stock Market News from Barchart

- Elon Musk’s Twitter Troubles and 4 Other Themes to Watch This Week

- Stocks Rally Sharply as Tech Stocks Rebound

- Will Next Week’s Expected +75 bp FOMC Rate Hike Be the Last?

- Stocks Boosted by Apple and U.S. Economic Reports

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)