The energy sector fell 4.62% in Q4 but was 15.47% higher in 2022. In my Q3 energy report on Barchart, I wrote, “I am bullish on the prospect for crude oil in Q4 and beyond.” Regarding natural gas, my forecast was, “I expect wild price swings and a continuation of explosive and implosive behavior with natural gas futures at the $7 per MMBtu level on October 7.”

Crude oil, oil product, and crack spreads moved higher in Q4. Meanwhile, natural gas dropped like a stone, and while my “bias was to the upside” trend following saved lots of money as the volatile energy commodity fell steadily throughout 2022’s final quarter. However, natural gas posted a nearly 20% gain from the end of 2021 to the end of 2022.

The war in Ukraine and U.S. energy policy continued to cause lots of price action in the energy arena, which should continue in 2023.

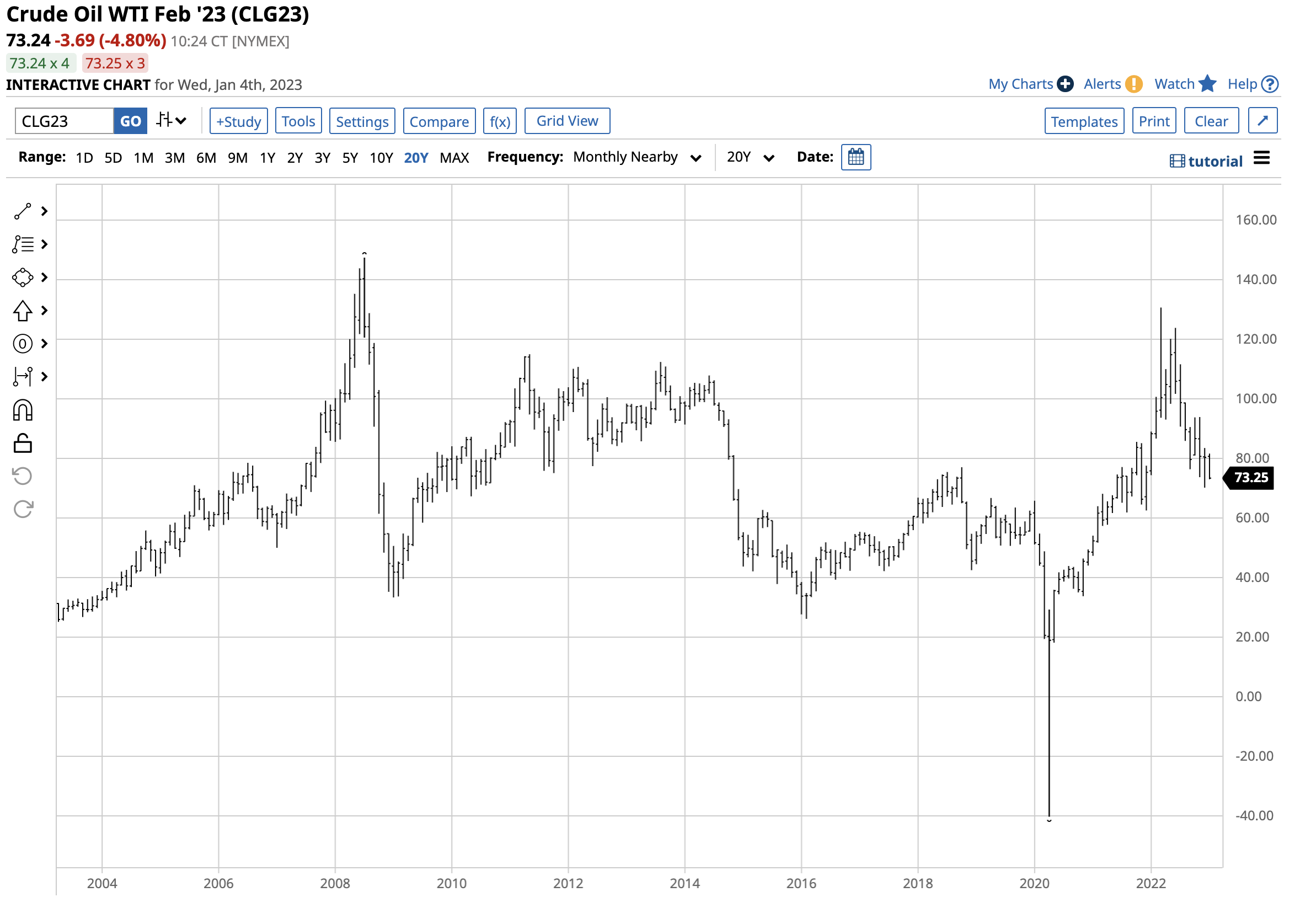

Crude oil edged higher in Q4 and posted gains in 2022

After falling by over 20% in Q3, WTI and Brent crude oil futures recovered and edged higher in Q4 after making lower lows, with the nearby NYMEX futures falling to just above the $70 per barrel level.

The chart highlights nearby NYMEX crude oil futures rose 0.97% in Q4 in a volatile quarter, taking the price to a $70.08 low in December. Crude oil recovered to close at the $80.26 per barrel level as the U.S. declared it would replace Strategic Petroleum Reserve sales around the $70 level. Moreover, OPEC kept production cuts in place, citing economic weakness in China and the increasing potential for a U.S. recession that will weigh on 2023 energy demand. While NYMEX crude oil posted a marginal gain in Q4, the energy commodity was 6.71% higher in 2022.

The chart illustrates the price action in Brent crude oil futures. Brent was 0.80% higher in Q4, and while it slightly underperformed WTI in 2022’s final quarter, it outperformed in 2022, rising 10.39% for the year that ended on December 30, 2022. OPEC and Russia pushed Brent higher as it is the crude oil that reflects supplies from Europe, Africa, and the Middle East. Nearby Brent futures closed at $85.82 per barrel on December 30, after falling to $75.11 in December and recovering. Crude oil prices were declining in early January.

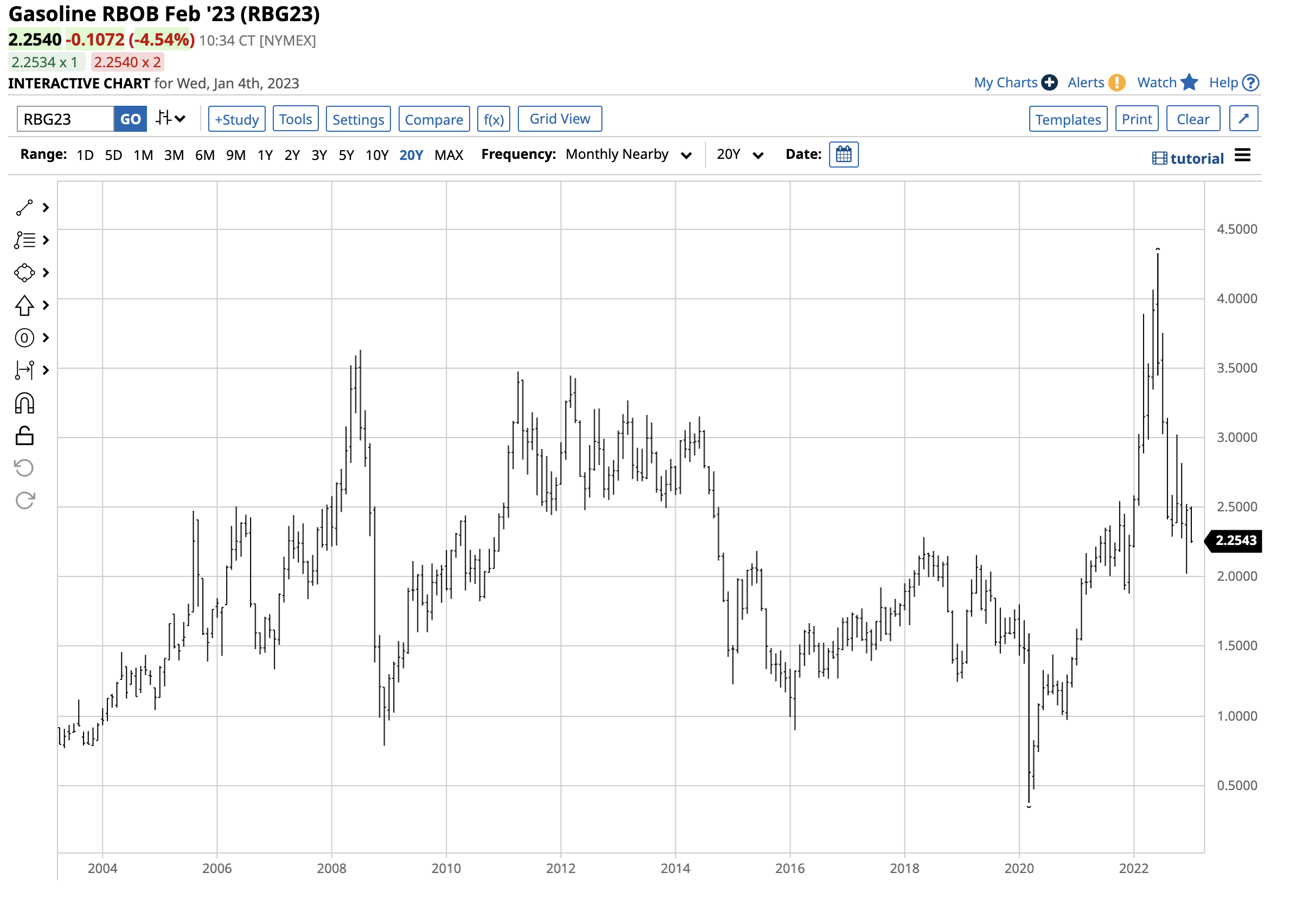

Oil products and crack spreads moved to the upside

Oil product prices outperformed crude oil in Q4, pushing refining spreads higher for the quarter. Oil products and crack spreads also outperformed raw petroleum in 2022. While crude oil remained below the 2008 highs at the March peak at over $130 per barrel, gasoline, heating oil, gasoline cracks, and distillate processing spreads rose to new record highs in 2022.

The chart of NYMEX gasoline futures shows a 4.58% gain in Q4, closing at $2.4783 per gallon wholesale. Gasoline futures moved 11.40% higher in 2022 and traded to an all-time $4.3260 per gallon high in June 2022 before correcting. June is the beginning of the peak driving season.

Meanwhile, gasoline crack spreads were at the $23.60 per barrel level on December 30, 2022, 17.58% higher in Q4 and 29.67% above the 2021 closing level.

The chart of NYMEX heating oil futures highlights the 2.28% gain in Q4, closing 2021 at the $3.2950 per gallon level. Heating oil futures moved 41.7% higher in 2022, peaking at a record $5.2217 per gallon wholesale level in April 2022.

Heating oil futures are a proxy for other distillate products, including diesel and jet fuels. The distillate crack spread moved 3.68% higher in Q4 but was a whopping 157.09% above the 2021 close on December 30, 2022, at the $58 per barrel level. Oil products and crack spreads moved lower with crude oil in the early days of January 2023.

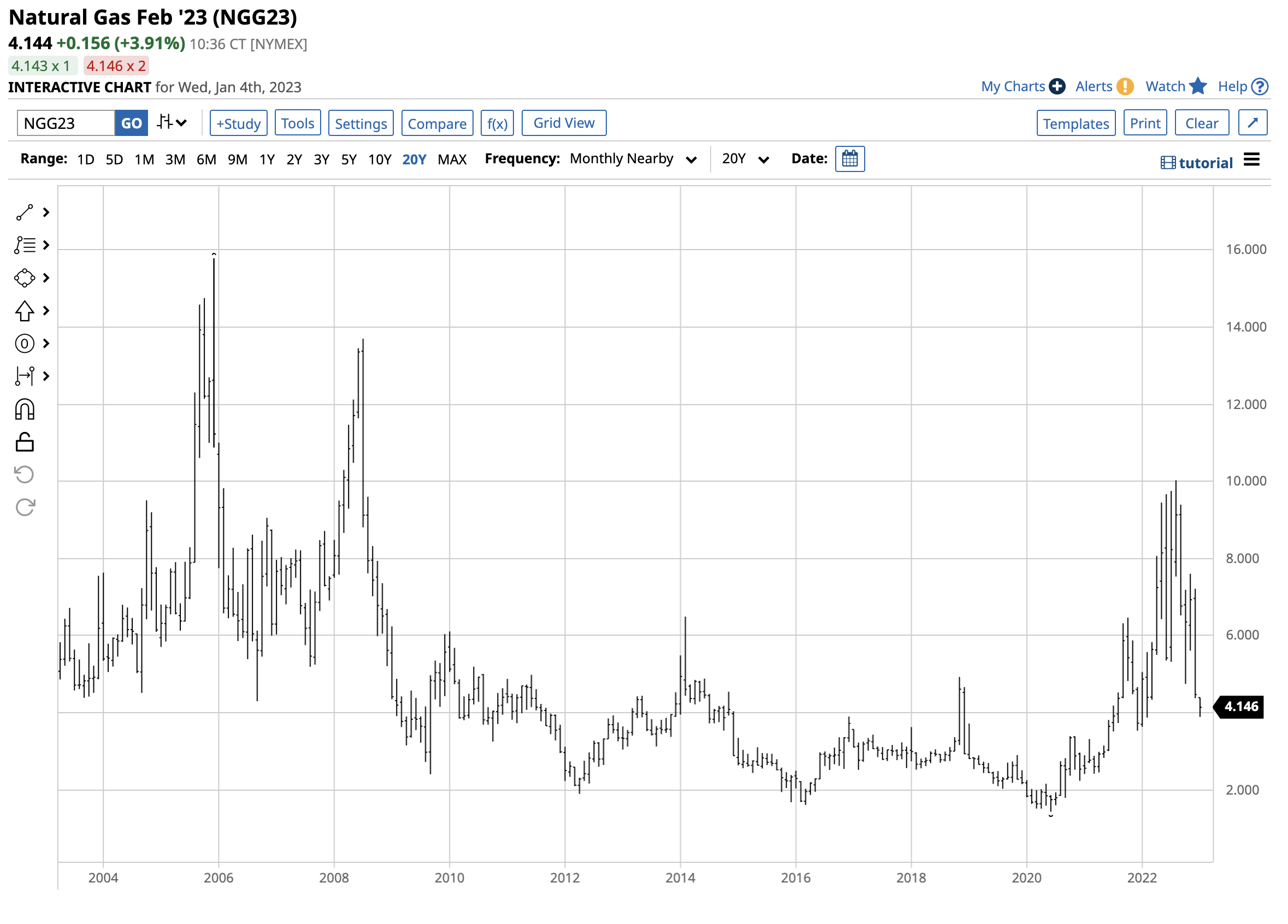

Natural gas- A volatile beast

Natural gas traded in a $6.39 per MMBtu range in 2022, with a low in early January and a high in August. Natural gas reached a high of $10.028 per MMBtu, the highest price since 2008, before turning lower and more than halving in value by the end of the year.

The chart shows the explosive and implosive price action in U.S. natural gas in 2022. While natural gas futures fell 34.44% in Q4, they were still 19.97% higher in 2022, closing at $4.4750 per MMBtu on December 30, 2022.

While U.S. natural gas prices fell, European prices for delivery in the U.K. and the Netherlands stood at multi-year highs at the end of 2022 after reaching record peaks and correcting. Natural gas was continuing to decline in early January.

Ethanol and coal fall in Q4 but rise in 2022

Ethanol, the biofuel that processors blend with gasoline because of a mandate from the U.S. government, fell 1.89% in Q4 but was 2.64% higher in 2022. Nearby Chicago Ethanol swaps were at the $2.33 per gallon wholesale level on December 30, 2022. Corn is the primary ingredient in U.S. ethanol as the U.S. is the world’s leading producer and exporter of coarse grain. Corn prices rose 0.15% in Q4 and were 14.37% higher in 2022. Higher corn and gasoline prices supported ethanol in 2022.

While natural gas was highly volatile in Q4 and 2022, coal prices experienced even more price variance. Coal for delivery in Rotterdam, the Netherlands, was the worst-performing commodity in Q4 falling 39.62%, but it was the best performer in 2022, rising 62.27% from the 2021 closing level.

The chart illustrates the rise to the 465 level in March 2022. At $190.50 at the end of 2022, Rotterdam coal was at the highest pre-2021 level since 2008. Coal production has declined over the past years as environmentalists, and zero carbon pledges have weighed on mining activities. However, the increase in oil and gas prices in 2022 pushed coal to record levels as the demand from China, India, and other countries rose, and supplies struggled to keep pace with the requirements.

The outlook for energy in 2023

As the energy sector heads into 2023, expect wide price variance to continue. The following factors support energy prices over the coming months:

- The war in Ukraine continues to turbocharge traditional energy prices as Russia uses oil and gas as an economic weapon against “unfriendly” countries supporting Ukraine.

- The West has put a cap on Russian oil prices, and Russia retaliated with a ban on oil shipments to countries capping prices.

- The U.S. energy policy supports alternative and renewable fuels and inhibits fossil fuel production, handing oil’s pricing power to OPEC and the cartel’s most influential non-member Russia.

- The U.S. is seeking to replace SPR sales at the $70 per barrel level, which could put a floor under oil’s price with the SPR at the lowest level since December 1983.

- While many countries are addressing climate change with a greener path to energy production and consumption, fossil fuels, including oil, gas, and coal, remain the commodities that power the world.

- Higher grain and oilseed prices support higher biofuel prices as corn and sugar are ethanol inputs, and soybean oil is the ingredient in biodiesel.

Expect lots of volatility in the oil, gas, coal, and biofuel markets over the coming weeks and months, and you will not be disappointed. The first move in 2023 was to the downside.

More Energy News from Barchart

- Nat-Gas Prices Plunge on Warm Temps in the Northern Hemisphere

- Crude Tumbles as the Dollar Rallies and Stocks Decline

- Crude Tumbles on Dollar Strength while Nat-Gas Plunges on Warm Temps

- 3 Factors to Watch as Investors Gauge the Cryptocurrency Market in 2023

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)