Even the most aggressive bull markets do not move in straight lines. Bull market selloffs and corrections can be brutal, shaking the confidence of even the most committed investors and traders. In Q3, crude oil, oil products, refining spreads, ethanol, and coal prices fell, with most posting double-digit percentage losses. Natural gas posted a significant gain in highly volatile trading conditions.

However, even after a bearish third quarter in crude oil and other fossil fuels, since the end of 2021, all energy commodities have posted substantial gains.

US energy policy under the Biden administration, the war in Ukraine, and OPEC’s control of oil pricing add up to a bullish picture for fossil fuels going into Q4 and beyond. While the world is embracing alternative and renewable energy sources, hydrocarbons continue to provide most of the power. The oil, gas, coal, and biofuel prospects remain bullish but expect lots of hair-raising volatility in the energy sector over the coming months and years.

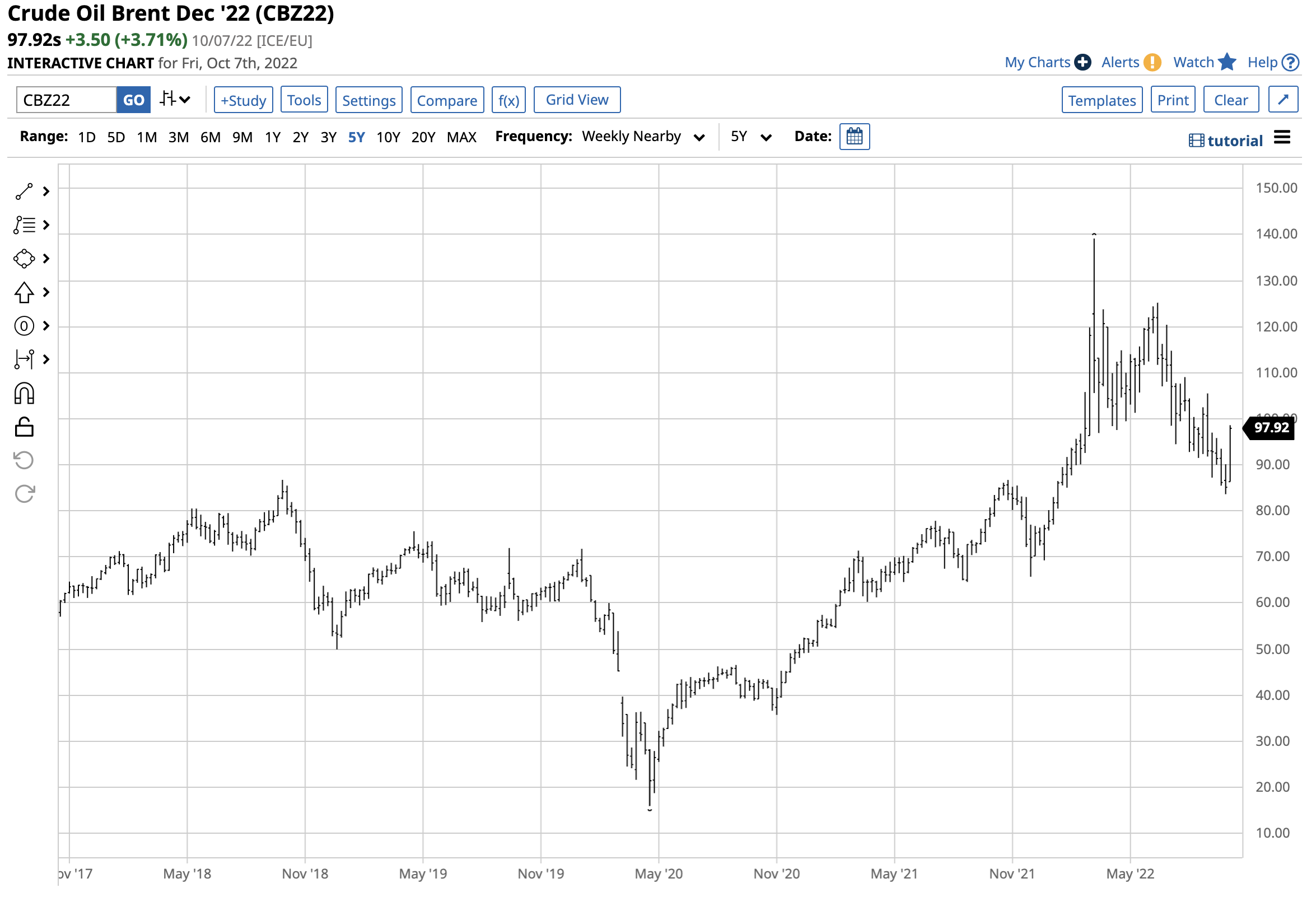

Crude oil drops by over 20% in Q3

The two crude oil benchmarks traded on the CME’s NYMEX division and the Intercontinental Exchange corrected lower in Q3.

Nearby NYMEX WTI crude oil futures, the benchmark for North American petroleum, fell 24.84% in Q3 but were still 5.69% higher over the first nine months of 2021. In 2021, NYMEX crude oil gained a whopping 55.01%. After reaching a peak of $130.50 in March 2022, the highest price since 2008, the contract settled at $79.49 per barrel on September 30. On October 7, the price rebounded to the $92.64 level.

While the WTI contract is the benchmark for about one-third of the world’s oil production, the Brent contract reflects the other two-thirds. Brent crude oil is the benchmark for petroleum produced in Europe, North Africa, Russia, and the oil-rich Middle East.

Nearby Brent crude oil futures on the Intercontinental Exchange slightly outperformed the NYMEX futures with a 21.90% loss in Q3 but was still 9.52% higher than the price at the end of 2021. Brent futures moved 50.02% higher in 2021. Brent futures reached a $139.13 per barrel high in March 2022, the highest price level since 2008, when Russia invaded Ukraine. Nearby Brent futures settled at $85.14 per barrel on September 30 and were near the $98 level on October 7.

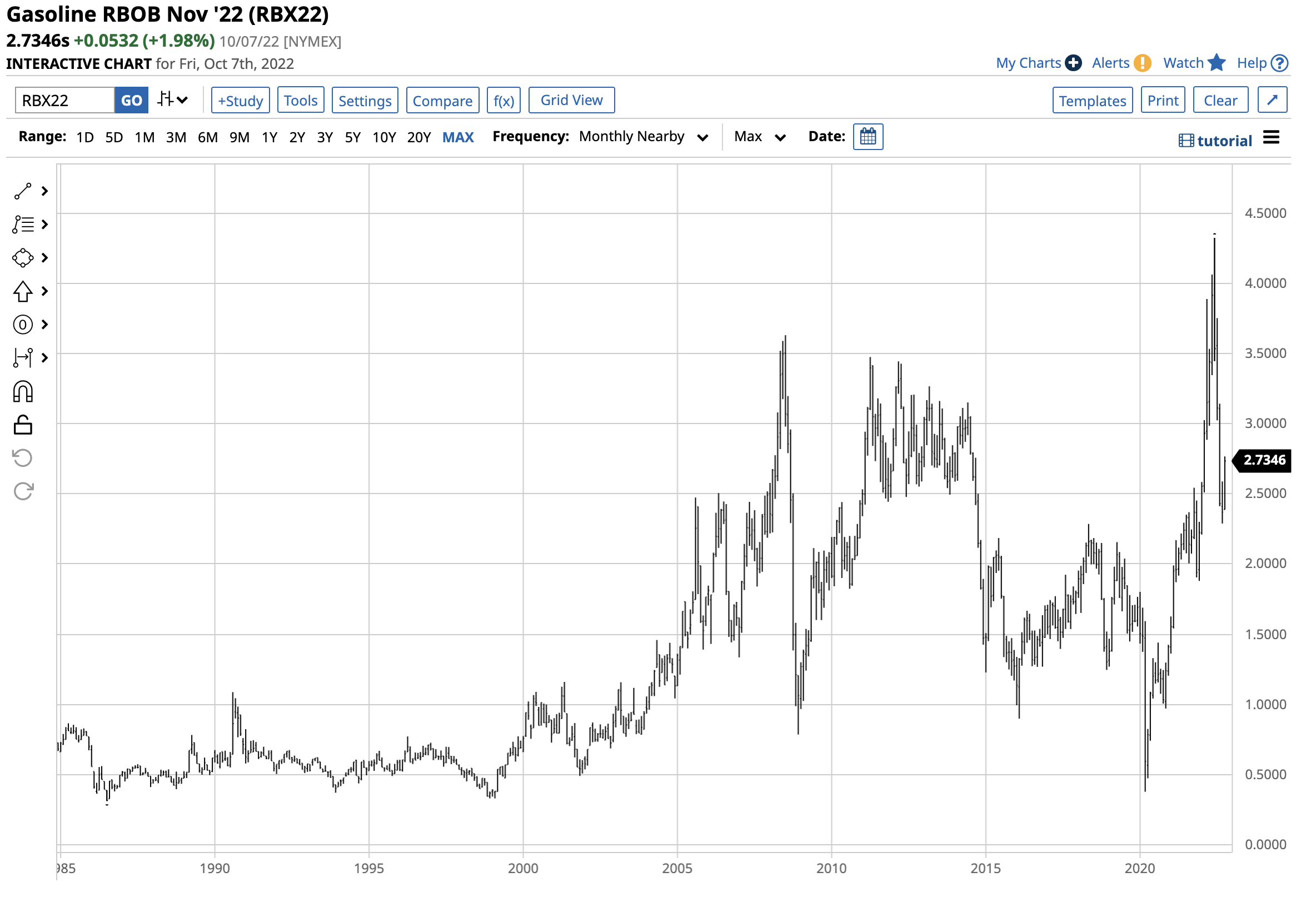

Oil product prices plunge over the three months

Refiners process crude oil into products: gasoline and distillates. While crude oil futures stopped short of record highs in March 2022, product prices rose to all-time peaks this year.

Gasoline requires lighter and sweeter crude oil with lower sulfur content, while distillate processing favors petroleums with higher sulfur content. Therefore, WTI is the preferred petroleum for gasoline and Brent for distillates. Gasoline trades on the CME’s NYMEX division.

The chart illustrates gasoline’s ascent to a record $4.3260 per gallon wholesale high in June 2022. In Q3, gasoline futures declined 32.99% as crude oil fell and the peak driving demand season ended after the summer. Over the first nine months of 2022, gasoline futures moved 6.53%, closing at the $2.3698 per gallon level on September 30. Gasoline futures rebounded to $2.7436 on October 7. In 2021, gasoline futures rose 57.76%.

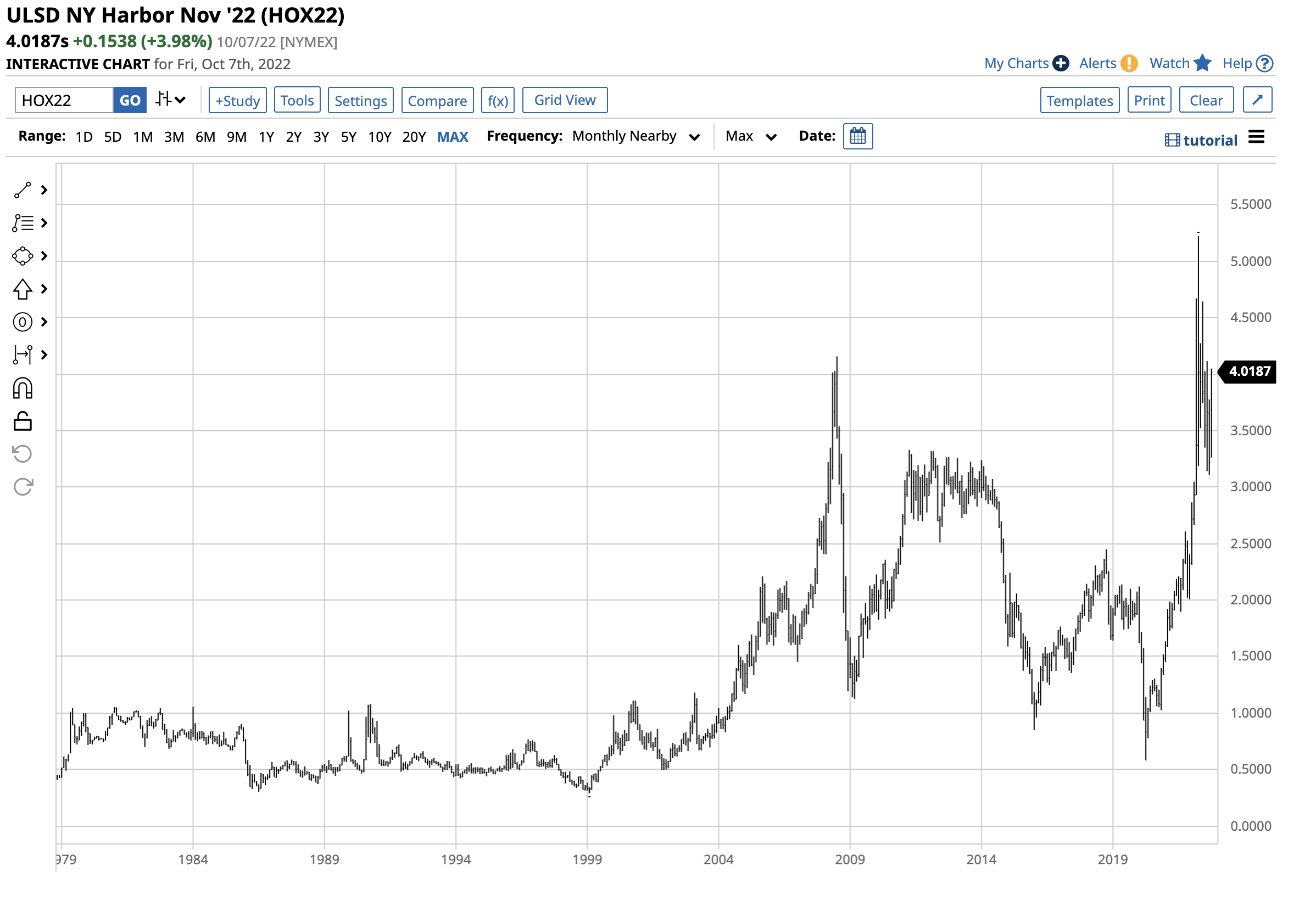

Heating oil trades on the CME’s NYMEX division and is a proxy for other distillates, including jet and diesel fuels. While gasoline is a seasonal fuel that tends to rally during the peak driving season, heating oil is a more year-round fuel.

The chart shows the record peak at $5.2217 per gallon wholesale in the heating oil futures market in April 2022. Since Brent is the petroleum for distillate processing, Russia and OPEC’s dominance in the Brent market caused it to soar because of the war in Ukraine. In Q3, heating oil futures outperformed gasoline, WTI, and Brent futures, posting a 15.90% loss. Over the first nine months of 2022, heating oil futures moved 38.55% higher. In 2021, the distillate fuel gained 56.69%. Nearby heating oil futures settled at $3.2216 on September 30 and were higher above the $4 per gallon wholesale level on October 7.

Crack spreads reflect the margin for processing a barrel of crude oil into products. The gasoline crack spreads fell 54.06% in Q3 but were 10.27% higher than at the end of 2021 on September 30. Distillate refining spreads edged only 0.09% lower in Q3 and was 147.96% higher over the first nine months of 2022. Gasoline cracks reflected the seasonal demand factors at the end of Q3, while distillate cracks reflected the strength of Brent crude oil because of concerns over Russian and OPEC supplies. Gasoline and distillate cracks moved higher at the start of the fourth quarter.

Natural gas rallies- Not a commodity for the faint of heart

Natural gas is a wild commodity. In June 2020, as the pandemic gripped markets across all asset classes, NYMEX natural gas futures fell to a twenty-five-year low of $1.44 per MMBtu. The US and Russia are the world’s leading natural gas suppliers, with Western Europe depending on Russian supplies. In 2022, natural gas futures exploded to the highest price since 2008.

The chart illustrates the ascent of natural gas prices that reached $10.028 per MMBtu in August 2022. While the price closed Q3 at the $6.826 per MMBtu level, natural gas futures posted a 25.85% gain in Q3 and were 83% higher over the first three quarters of 2022. In 2021, nearby natural gas futures rose 46.91%.

Meanwhile, in 2022, the US natural gas futures market’s price range was $6.39 per MMBtu, over four times the price at the 2020 $1.44 low. Natural gas volatility makes the energy commodity a very treacherous market for traders and investors. However, it attracts market participants seeking price action and substantial moves.

Meanwhile, price swings in the European natural gas futures arenas were even wilder than in the US market. The UK futures contract explosively reached a record peak in March 2022, while the Dutch futures contract followed the same path.

On October 7, nearby NYMEX natural gas futures were around the $6.75 per MMBtu level.

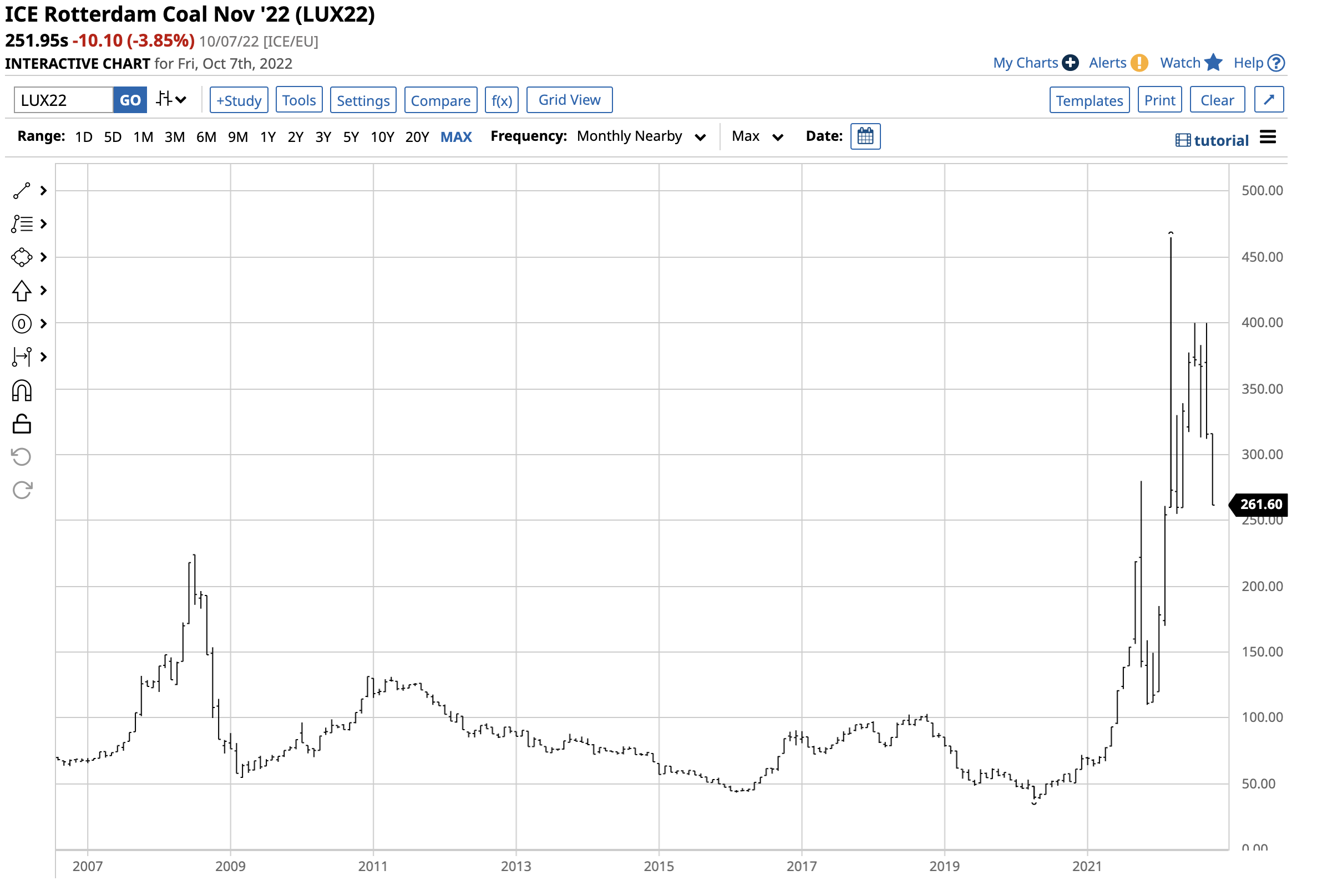

Coal and ethanol declined in Q3 but were higher since the end of last year

Coal, another fossil fuel, corrected 14.73% lower in Q3, with the futures contract for delivery in Rotterdam, the Netherlands closing at $315.50 per ton on September 30, 2022. Over the first nine months of 2022, Rotterdam coal futures rose by 168.74% after a 46.31% loss in 2021.

The chart shows Rotterdam coal spiked to a $465 per ton record high in March 2022.

Bullish price action in fossil fuels lifted ethanol and other biofuel prices in 2022. In Q3, nearby ethanol futures declined 7.59% but were 4.63% higher over the first three quarters of 2022. In 2021, ethanol futures rose 58.41%. Since corn is the primary ingredient in US ethanol, the price of the biofuel tends to move higher and lower with corn futures prices. In Q3, corn futures fell 8.91% but were 14.2% higher since the end of 2021; last year, corn rose 22.7%. Ethanol prices are a function of corn and gasoline prices.

The chart shows that Chicago ethanol swaps rose to a record high of $3.45 per gallon wholesale in November 2021. Ethanol was still at a multi-year high at the $2.3750 per gallon level on September 30.

The prospects for Q4 and beyond

Despite the decline in oil prices in Q3, I am bullish for Q4 and beyond for the following reasons:

- US energy policy does not support increased production.

- The US has depleted its Strategic Petroleum Reserve to 416.4 million barrels to combat rising oil prices. The SPR level at the end of Q3 was the lowest since the early 1980s.

- Russia is using oil and gas as a weapon against “unfriendly” countries supporting Ukraine, and Russia is a powerful force within OPEC, the international oil cartel.

- While the US has been after OPEC to increase output, the cartel cut production by two million barrels per day at the biannual meeting in early October 2022.

- Chinese petroleum demand will increase as the world’s most populous country emerges from COVID-19 lockdown protocols.

- The overall trend since April 2020 is higher, and crude oil remains at a multi-year high above the $80 per barrel level.

- The potential for a spike to a new all-time high above the 2008 peak in WTI and Brent futures remains a real and present danger.

For these reasons and more, I am bullish on the prospects for crude oil in Q4 and beyond.

Natural gas is a highly volatile commodity. I expect wild price swings and a continuation of explosive and implosive behavior with US natural gas futures at the $7 per MMBtu level on October 7. My bias is to the upside because:

- As of the week ending on September 30, US inventories are 5% below last year’s level and 7.8% under the five-year average at the end of Q3.

- Europe depends on Russian natural gas, increasing the potential for higher prices and shortages during the peak winter heating season.

- In the US, natural gas tends to peak during the winter, which is the withdrawal season when natural gas inventories decline. The withdrawal season will start in November 2022 and run through March 2023.

- European gas prices remain at multi-year highs, increasing the demand for US LNG exports.

Natural gas should continue to experience price explosions and implosions, offering lots of trading opportunities for nimble traders with their fingers on the market’s pulse. Substantial moves provide the opportunity for significant profits when trends change.

Coal and ethanol prices should follow the other fossil fuel markets. Ethanol will be highly sensitive to corn prices. Since Russia and Ukraine are leading corn producers and exporters, the coarse grain’s price should remain elevated.

Bull markets tend to experience significant corrections, as we have seen in Q3. However, the fundamental supply and demand equations and the geopolitical landscape support higher energy prices over the coming months and into 2023. The only factor that could change the current fundamentals would be the end of the war in Ukraine and a peaceful settlement or a return to a drill-baby-drill US energy policy. In October 2022, the battle continues to rage, and the US is focused on a greener path for energy production, making the upside more likely regarding prices.

More Energy News from Barchart

- Crude Prices Soar on Global Supply Fears

- Nat-Gas Prices Fall as U.S. Inventories Recover

- Crude Pushes Higher on the Outlook for Tighter Global Supplies

- Crude Closes Moderately Higher on Global Supply Concerns

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)