/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

On Dec. 19, Barchart’s Top Trade Alerts screener notified readers about a potential buying opportunity in Nvidia (NVDA). So far, the signal has proven prescient. On the close of that session, NVDA stock sat a penny short of $181. On Dec. 26, the security reached $190.53. And while subsequent trades have seen a slight cooling off, overall sentiment appears robust as major tech enterprises have started to shake off bubble fears impacting artificial intelligence.

Having said that, few things tend to be as unhelpful to readers of financial publications than stories about what could have been. Fortunately, NVDA stock is not one of those examples. Quantitatively, there’s reason to believe that the semiconductor giant is basically a time-capsule opportunity.

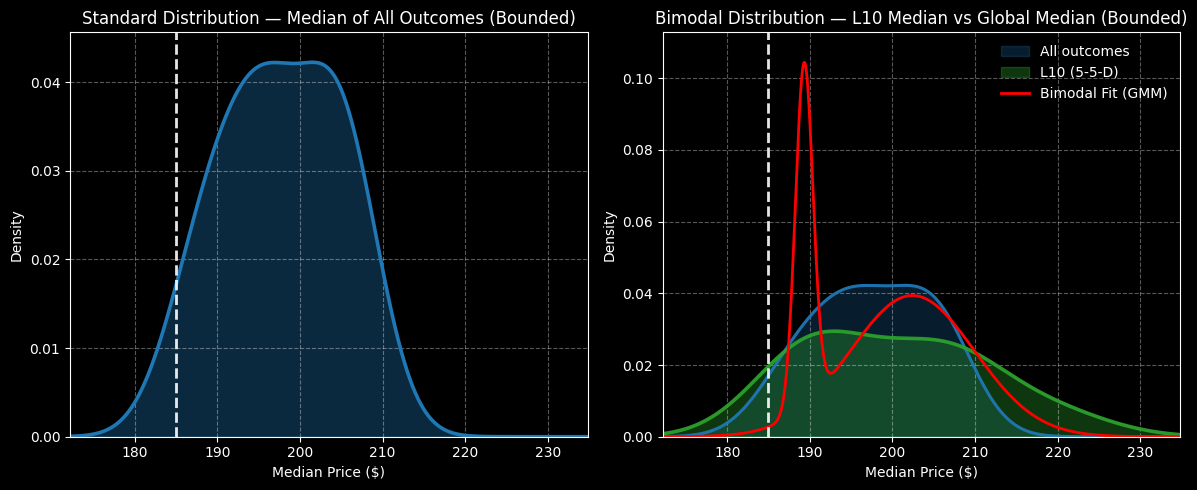

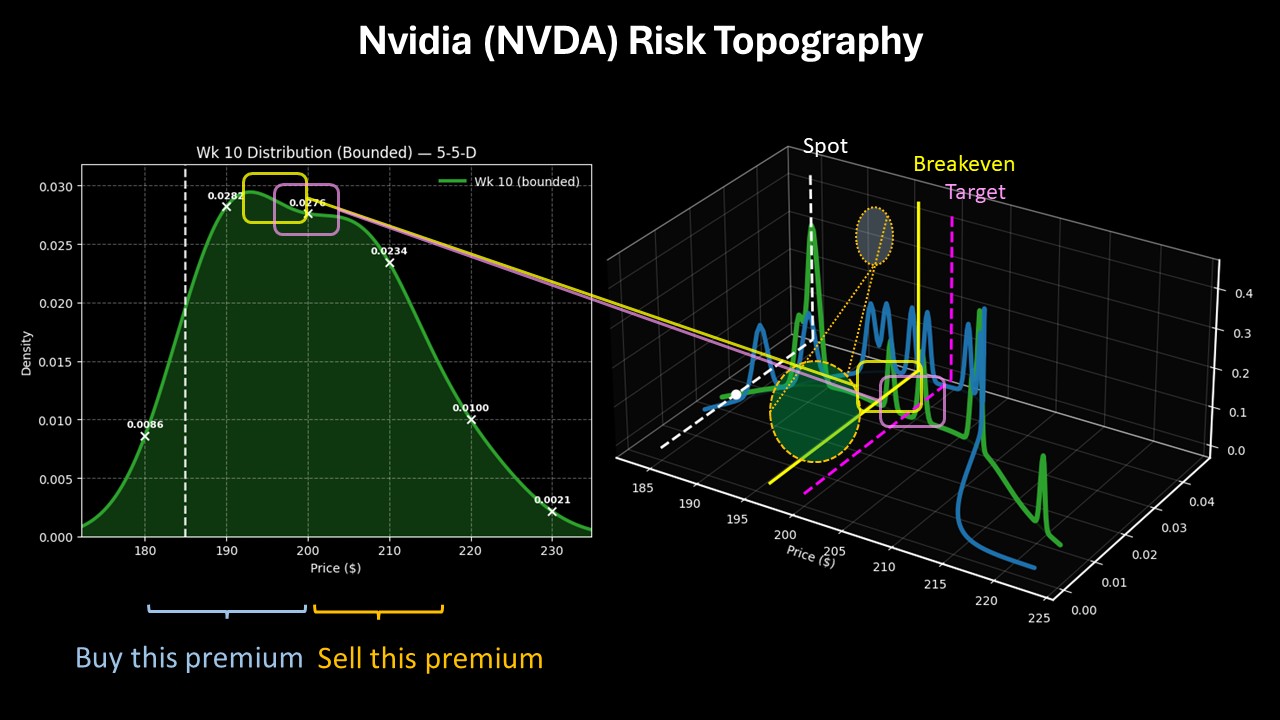

Not to toot my own horn but a few days before the Top Trade Alerts, I stated that NVDA stock was trading at a quantitative discount. At the time, NVDA had only printed three up weeks over the course of the last 10 weeks. Under the common interpretive lens, such a framework was risky for bullish investors because it appeared that the bears had full control.

However, where I diverged from standard Wall Street methodologies was that I felt that the Gaussian worldview — of which the Black-Scholes model is a part — was the suboptimal frame for NVDA stock at that particular time. Instead, I interpreted NVDA’s sentiment structure from a Markovian lens and calculated risk as a Markov property.

What exactly does that mean in English? In the Gaussian/Black-Scholes world, risk is calculated monotonically; specifically, as a function of the target stock price’s distance to the spot price (while accounting for time to expiration). In football terms, this is like saying a 50-yard field goal attempt is more difficult than a 30-yarder.

Sometimes, though, outside factors like inclement weather can make a 30-yard attempt incredibly difficult, while a 50-yard attempt, under the right circumstances, could be the higher-probability event. A Markovian framework would price risk non-monotonically, allowing room for probability by structure as opposed to mere numerical ascendancy.

Treat NVDA Stock Like an Insurance Agent

Insurance companies are by default “discriminatory” institutions. Obviously, that term carries heavy implications. However, insurance companies must price various risk profiles differently. If they were purely democratic and equitable, the industry would collapse — and right quick.

What does that have to do with NVDA stock? When we price a highly kinetic tech play like Nvidia under the same mathematical framework as, say, a railroad company, we should expect some distortions. In other words, Black-Scholes or any number of Gaussian frameworks may not be the most optimal way to forecast projected movements.

Therefore, my solution is to identify how the market is pricing risk under the standard Black-Scholes formulation — and then see if there are any variances when NVDA stock is viewed through a Markovian lens. Essentially, that’s the basis for structural arbitrage. And it’s the same philosophy that insurance agents use.

Let’s be real: a bad driver is never going to get a good (i.e. low) premium for auto insurance. So, NVDA stock shouldn’t be priced as an average driver. It’s an excellent driver with an excellent safety history. We should price its risk accordingly but Wall Street is not doing so. That’s the opportunity.

In fact, if you look at Barchart’s options flow screener, net flows of big block transactions are net positive. So, whether you believe in technical alerts, quantitative structures or option flows, the winds are blowing in a northward direction.

Now, at this moment, the quant structure of NVDA stock is positioned as a 5-5-D sequence. In the trailing 10 weeks, the number of up weeks and down weeks are evenly split but with a downward slope. That makes the structure contrarian, as over the next 10 weeks, NVDA stock would be expected to range between $170 and $240 (assuming a spot price of $184.94).

Critically, probability density should peak between $190 and $200, with probability decay projected to accelerate from beyond $210. Therefore, $200 statistically represents a compelling target for the Feb. 20 options chain.

Extreme Fear Makes Nvidia Even More Compelling

Under the Black-Scholes framework, NVDA stock reaching $200 on Feb. 20 represents a low probability of around 24.34%. However, that generally means that the reward for hitting the target could be substantial — and that’s exactly what’s going on here.

I’m really liking the 195/200 bull call spread expiring Feb. 20. For putting $150 at risk, there’s a chance for speculators to earn $350 in profit should NVDA stock rise through the second-leg strike at expiration. That comes out to a maximum payout of over 233%.

Part of the reason why the payout is so big for what I perceive to be a structurally modest risk is the lingering fear of the AI bubble. It’s possible that spending in machine learning is getting ahead of itself and that could lead to a serious deterioration of NVDA stock and similar assets. However, I’m not seeing much evidence of this worst-case scenario and therefore, I stand on the bullish camp at this juncture.

What’s more, the underlying sentiment regime of the 5-5-D sequence points to $200 being a realistic target. Under the same breath, I don’t want to outright ignore that Black-Scholes treats $200 as a low-probability event.

Here’s the bottom line. Either Gauss or Markov is going to come up with the more salient framework for NVDA stock at this hour. In this ideological battle, I’m going with Markov because his framework accommodates the non-parametric realities of highly kinetic tech plays.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)