/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

In October 2025, Goldman Sachs estimated that global AI infrastructure investments could reach $3 to $4 trillion by 2030. Nvidia (NVDA) seems well positioned to benefit from the big market potential, and it’s not surprising that NVDA stock has already created immense value.

Investors, however, had a phase of anxiety in January 2025 when Nvidia stock plunged by 17%, which translated into a $600 billion loss in market capitalization. This panic was triggered by the launch of DeepSeek, which challenged the dominance of the U.S. in the world of AI. However, the nervousness was short-lived, and U.S. tech stocks have continued to create value after that temporary blip.

With DeepSeek expected to launch its next-generation AI model, V4, is a repeat of Jan. 2025 likely?

It’s worth noting that DeepSeek’s V3.2 model was released in December 2025. While it outperformed OpenAI’s GPT-5 and Google’s Gemini 3.0 Pro on “certain benchmarks,” the markets were not unnerved. Of course, V4 will have strong coding capabilities, but it’s unlikely to create jitters. Specific to Nvidia, even extreme efficiency of V4 is unlikely to impact the demand for GPUs.

About Nvidia Stock

Nvidia, headquartered in Santa Clara, defines itself as a global leader in GPU-accelerated computing. The company’s products and platforms are specialized for industries that include gaming, professional visualization, data centers, automotive, and healthcare, among others.

With AI being a multi-year growth driver, Nvidia commands a market valuation of $4.9 trillion. For Q3 2026, Nvidia reported revenue growth of 62% on a year-on-year (YoY) basis to $57 billion. For the same period, the company’s operating income was robust at $36 billion.

Backed by industry tailwinds, healthy growth, and swelling cash flows, NVDA stock has trended higher by about 12% in the past six months.

Ample Growth Opportunities

In a recent report, BNP Paribas identified “robotics as a key emerging market in the tech sector.” Further, BNP believes that robotics is “on the cusp of adoption,” and these emerging markets within the tech sector will continue to benefit Nvidia. Furthermore, BNP opines that Nvidia is a “clear winner in the AI era.”

While data centers remain a key growth driver, Nvidia is spreading its wings. Thermo Fisher Scientific (TMO) has collaborated with Nvidia for the use of AI to improve lab workflows. Similarly, Eli Lilly (LLY) is partnering for the launch of an AI co-innovation lab for drug discovery.

In the data center segment, Nvidia reported YoY growth of 66% to $51.2 billion. A key highlight during the quarter was the partnership with OpenAI. As a part of the collaboration, Nvidia and OpenAI will be building at least 10 GW of infrastructure to be operated by the latter. This would imply demand for “millions of GPUs.”

It’s worth noting that for the first nine months of 2025, Nvidia reported operating cash flow of $66.5 billion. Robust cash flows provide flexibility for continued investment in R&D. As the AI ecosystem expands, there will be new opportunities for growth.

What Analysts Say About NVDA Stock

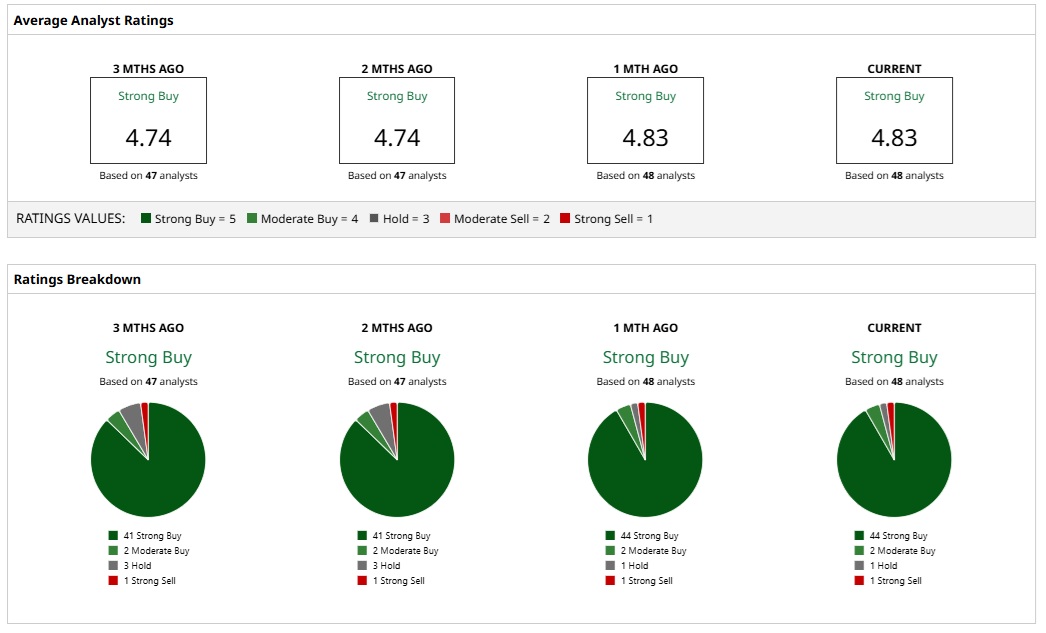

Based on the ratings of 48 analysts, NVDA stock is a consensus “Strong Buy.” An overwhelming majority of 44 analysts assign a “Strong Buy” rating to NVDA. Further, two and one analyst have assigned a “Moderate Buy” and “Hold” rating, respectively. One analyst, however, believes that NVDA stock is a “Strong Sell.”

Based on these ratings, analysts have a mean price target of $256 currently, which would imply an upside potential of 38%. Further, with the most bullish price target of $352, the upside potential for NVDA stock is 90%.

From a valuation perspective, NVDA stock trades at a forward price-earnings ratio of 41.74. Valuations remain attractive considering the fact that analysts expect earnings growth for FY26 and FY27 at 51.2% and 56.7%, respectively. The price-earnings-to-growth ratio is therefore less than one and indicates potential for stock upside.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)