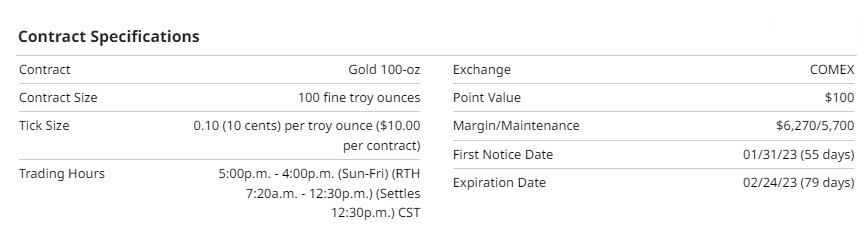

Specifications and statistics

In a recent article, "Will Santa Deliver a Gold Bull Market," I discussed waiting for this time of year for a consistently strong seasonal pattern in the gold market.

For centuries, many have sought gold for investment and industrial reasons. Demand for gold is global, with India being the most significant consumer accounting for approximately 24% of the demand. Known for large gold purchases during their wedding season, India can significantly impact gold prices. Throughout the year, other various fundamental factors influence gold prices.

Central banks worldwide hold gold and paper assets to help diversify their currency. During geopolitical issues, much like the Russia-Ukraine war, they tend to accumulate more gold for safety.

The US Dollar and interest rates also act as fundamental drivers of gold prices. The US Dollar is typically inversely correlated with gold. Depending on the world crisis causing a flight to quality, the US Dollar or gold can act as a haven.

Gold does not pay interest or dividends and is purely a capital appreciation asset. High-interest rates are competition for gold investment dollars. As rates go higher, investors can seek the safety of an interest-bearing investment.

Gold has always been in high demand for jewelry and ornamental decorations. Around the holidays' demand for gold can increase, causing prices to go higher as consumers purchase gifts made from gold.

Another large demand area is Exchange Traded Funds (ETF). State Streets SPDR Gold Trust (GLD) owns physical gold for all the shares they issue. Their securities filings show they hold approximately 1,000 plus tonnes of physical gold.

Recent performance

Gold prices have increased by 3.45% during the past three months from the October lows after forming a triple-bottom reversal pattern. Due to the exuberant US Dollar this year, the year-to-date results are meager -2.41%. Even with inflation at 40-year highs, gold could not make a new all-time high, leading some to believe that gold may have lost its inflation hedge.

Fundamentals that may impact market behavior

The Chinese New Year is an annual fundamental event affecting the gold market. The demand for gifts and wealth concerns during this festival has caused a seasonal pattern of higher prices. This year the Chinese New Year will be celebrated from January 22 to February 01.

Some say that the Chinese feel gold brings them good luck, fortune, wealth, and prosperity. For a couple of years, the Chinese government has enforced some of the strictest pandemic lockdowns in the world. Recently the Chinese government has announced a more lenient stance on these restrictions. Citizens have yet to have a chance to live as they had in the past. What better way to celebrate their new freedom than the Chinese New Year?

Here in the US, our government had also put its citizens in the same scenario using lockdowns. When people are forced into confinement for long periods, they react aggressively when finally released from imprisonment. For US citizens, when the lockdowns ended was a spending spree for travel and materialistic items, leading to a robust economy and the highest inflation in 40 years.

The Chinese government will most likely appease its citizens with the relaxed pandemic conditions until after their holiday. At which point, who knows what will happen? But, in the interim, the solid seasonal gold price appreciation will be accelerated by the Chinese citizens' pent-up demand.

Technicals driving futures prices

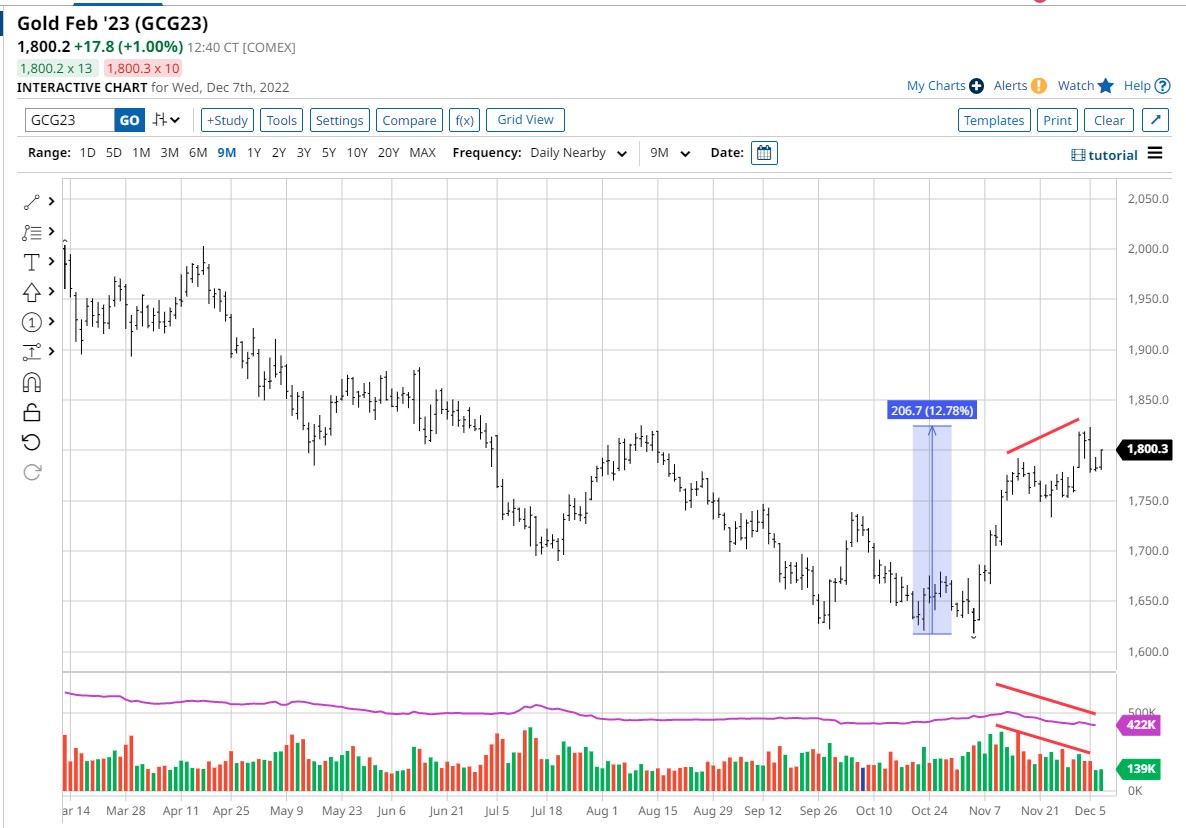

The daily chart shows the solid price move off the triple bottom October lows. Price rallied approximately 13% off the lows. While the price action shows a strong movement, the internals appears weak. Notice the price-making new highs for the move marked by the ascending red line. Then notice under the price that the volume and open interest have declined after the initial high in mid-November. The weakness shows that traders and investors may want to wait for a price correction before buying gold.

Seasonal pattern

Moore Research Center, Inc (MRCI) has found that December usually has a bottom in the gold market and rallies until after the Chinese New Year ends in February. The seasonal pattern does not factor in the celebration of freedom the Chinese will celebrate during their New Year. A seasonal pattern with a 30-plus-year track record and the joyous celebration of freedom should catalyze a decent price appreciation.

MRCI has also found that when seasonal lows form earlier than expected, as gold did in October instead of December, the price has a high probability of advancing for a more extended period than usual.

The Commitment of Traders (COT) Report

The COT report did not show strong participation from managed money in this recent rally. Possibly due to the time of year, the rally occurred when large traders usually closed their trading books for the year. Regardless, the rally looked weak when the COT was combined with the volume and open interest decline. Don't get me wrong, I'm bullish on gold, but this market tends to punish traders who chase it.

Related ETFs and micro futures contracts to participate

If the seasonal pattern is expected to last multiple months, consider using the exchange-traded fund (ETF) for gold (GLD). Both GLD and GC have options available to trade. The first choice would be trading the standard gold contract (GC), but if that is too expensive, consider the micro-gold contract (GR). Another ETF (GLDM) reduces capital requirements but tracks the GLD closely.

Summary

The fundamentals for gold look bullish for the intermediate term, but we must respect the weak technicals after this 13% rally in the near term. Watching for the open interest to begin increasing again would be bullish if, after a price decline, the trend turns up again. Lower prices would offer a better value trade.

Strong market moves need a catalyst, and it appears that could be Chinese citizens coming out of lockdown. Combine this catalyst with a consistently bullish seasonal pattern, and we could have a nice run in gold prices, which will also affect silver prices.

More Stock Market News from Barchart

- Stocks Weighed Down by Global Economic Concerns

- GameStop’s Latest Job Cuts Shows the Emperor Has No Clothes

- Unusual Activity in Amazon Put Options Show They Are Bullish on AMZN Stock

- Shopify Hopes to Recover E-Commerce Dominance

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)