/Amazon%20Delivery%20Truck.jpg)

Institutional investors have been shorting Amazon on out-of-the-money (OTM) puts in unusual options activity. That means they are very bullish on the stock and feel the decline in the past month has been overdone.

AMZN stock has fallen over 2% in the past month and almost 6.8% in the last week. Investors seem to be negative about shopping during the Christmas season, even though the economy is still not in a deep recession. In fact, year-to-date, AMZN stock is off over 48%.

That is making some institutional investors take a contrarian stance in the stock. For example, even though analysts expect to see negative earnings this year, they are still projecting a positive profit on a earnings per share (EPS) basis for Q4. In addition, for next year, they forecast $1.74 EPS, putting the stock, at $88.22 on Dec. 7, on a forward P/E multiple of 50.7x. More importantly, it will mean that the company will return to generating positive free cash flow.

As a result, assuming the stock's selloff has been overdone, one of the quickest ways to take advantage of this is to short OTM puts.

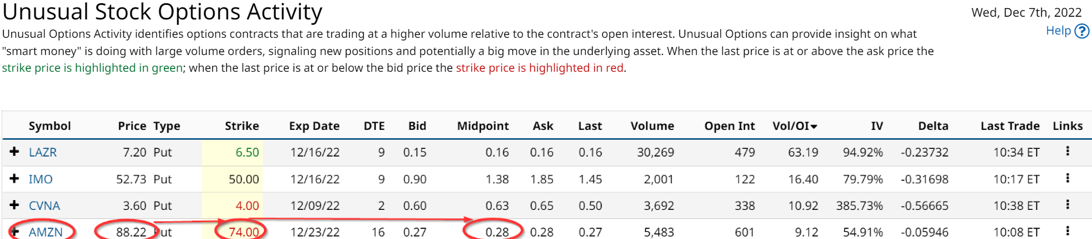

For example, the Barchart Unusual Stock Options Activity report on Dec. 7 shows that the Dec. 23 put options at a $74 strike price have been heavily shorted. The midprice received seems to be about 28 cents.

That works out to an immediate yield of 0.378% in just two weeks. So, on an annualized basis that translates into a 9.837% annualized return (i.e., 0.003783 x 26 weeks= 9.837%). For example, by putting up $7400 per put contract, the investor receives $28 per contract shorted.

The chart above shows that there were 5,483 put contracts sold. This means that the investor received $153,524 for put options that expire in two weeks. The investor now has the risk that his puts could be exercised and he would have to spend $38.929 million (i.e., $74 x 100 x 5,483 contracts). But how likely is that to happen?

For one, the stock would have to fall from $88.22 today to $74.00 by Dec. 23, a tumble of over 16.1%. That probability is probably very low, given that there is not likely to be any major negative news between now and that date, at least in terms of company news. This does not rule out an exogenous event.

And that may not be the end of the world anyway for the investor. He could immediately turn around and sell covered calls if the puts were exercised and he is forced to buy the shares at $74.00. The investor also could buy back the short puts closer to expiration, especially if there is a profit which is highly likely, just to lower that exercise risk. In addition, the investor could also buy puts at a lower strike price to lay off some of the downside risks of large unrealized losses.

The bottom line here is that short puts at huge discounts to today's price look like a good income play for value investors in AMZN stock.

More Stock Market News from Barchart

- Shopify Hopes to Recover E-Commerce Dominance

- Stocks Under Pressure as Weak Chinese Trade News Sparks Global Growth Concerns

- Markets Today: Stocks Mixed On Negative Chinese Trade News

- Dave & Buster’s (PLAY) May Offer Upside for the Daring Contrarian

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)