/Apple%20Logo%20on%20Store%20Front.jpg)

Apple, Inc. (AAPL) stock is off its peak from mid-November when it was at $151.68 and is now at $146.63 as of Dec. 5. As a result, its put option premiums are at high levels as many assume AAPL stock will crater. This makes these puts attractive to value investors who short cash-secured puts as an income play.

When the company revealed solid fiscal Q4 earnings results for the quarter ending Sept. 24, many investors were impressed with its huge free cash flow (FCF). I wrote about this on Oct. 28 and showed that Apple generated 28.3% of its revenue as FCF. Given that its FCF was $111.4 billion. This represents almost 4.8% of its $2.35 trillion market value.

If these high margins keep up in 2023, AAPL stock is likely to continue moving higher, given how cheap it is now. For example, analysts project that revenue will rise to $406.87 billion for the year ending Sept. 2023, up 3.2% from $394.3 billion in the year to Sept. 2022. That could rise to over $115 billion in 2023.

So, if the FCF yield improves to 4.0%, the stock could end up with a market cap of $2.878 trillion. That represents a potential gain of 22.5% and could mean AAPL stock could end up at $179.62, up 22.5% from $146.63 today. We can use that to help set a target price with put options.

Gaining Income Shorting Out-of-the-Money Cash-Secured AAPL Puts

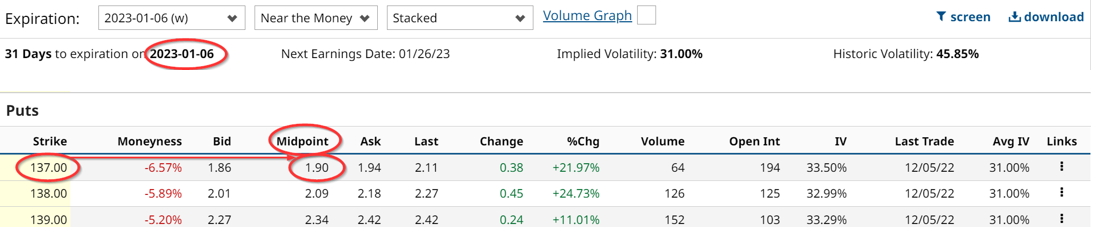

Right now AAPL put options have high premium prices. For example, the Jan. 6, 2023, put options, one month out, have put option prices of $1.90 per contract at the $137.00 strike price. That price is 6.57% below today's price.

This means that if an investor puts up $13,700 in cash or margin with his brokerage firm, and then shorts the $137.00 puts for Jan. 6, he will immediately receive $190 in his account. That represents an ample 1.39% monthly yield or an annualized yield of 16.68%.

This means that if the stock falls to $137.00 by Jan. 6, the investor's cash collateral will be exercised and the investor will purchase AAPL stock upon expiration at the $137.00 stock price. That is 6.57% below today's price.

In fact, other sites show that the $132 strike price has premiums trading between $1.08 and $1.13 per put option contract, or $1.11 in the midprice. That strike price is 10% below today's $146.66 stock price, but still represents a 0.84% monthly yield. The annualized rate is still attractive at 10% if the monthly cash-secured short put rate can be duplicated monthly over the next year.

That is a very attractive annual return, especially since AAPL stock pays dividends at a much lower dividend yield of just 0.63% annually. As a result, value investors are shorting deep out-of-the-money (OTM) puts in order to both be able to buy the stock cheaper, if exercised, and also get paid a nice yield.

More Stock Market News from Barchart

- 2 Bear Call Spread Trade Ideas For This Tuesday

- Pre-Market Brief: Stocks Mixed As Resurgent Fed Fears Weigh On Sentiment, China Reopening Hopes

- Stocks Tumble as Strong U.S. Economic News Fuels Hawkish Fed

- Analysts are Positive on Activision Blizzard Even if Microsoft’s Acquisition Fails

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)