/Apple%20Logo%20on%20Store%20Front.jpg)

Apple (AAPL) reported yesterday that it produced solid fiscal Q4 earnings for the quarter ending Sept. 24. As it stands AAPL stock is cheap at just 21x forward earnings, with a 23% free cash flow (FCF) margin and a 4.6% FCF yield.

As a result, investors are pushing Apple stock higher given how powerful its results were and how strong its FCF was during the quarter. For example, it produced $24.1 billion in operating cash flow for the quarter and after capex spending, FCF was $20.8 billion. That represents 23% of its total $90.1 billion in revenue for the quarter.

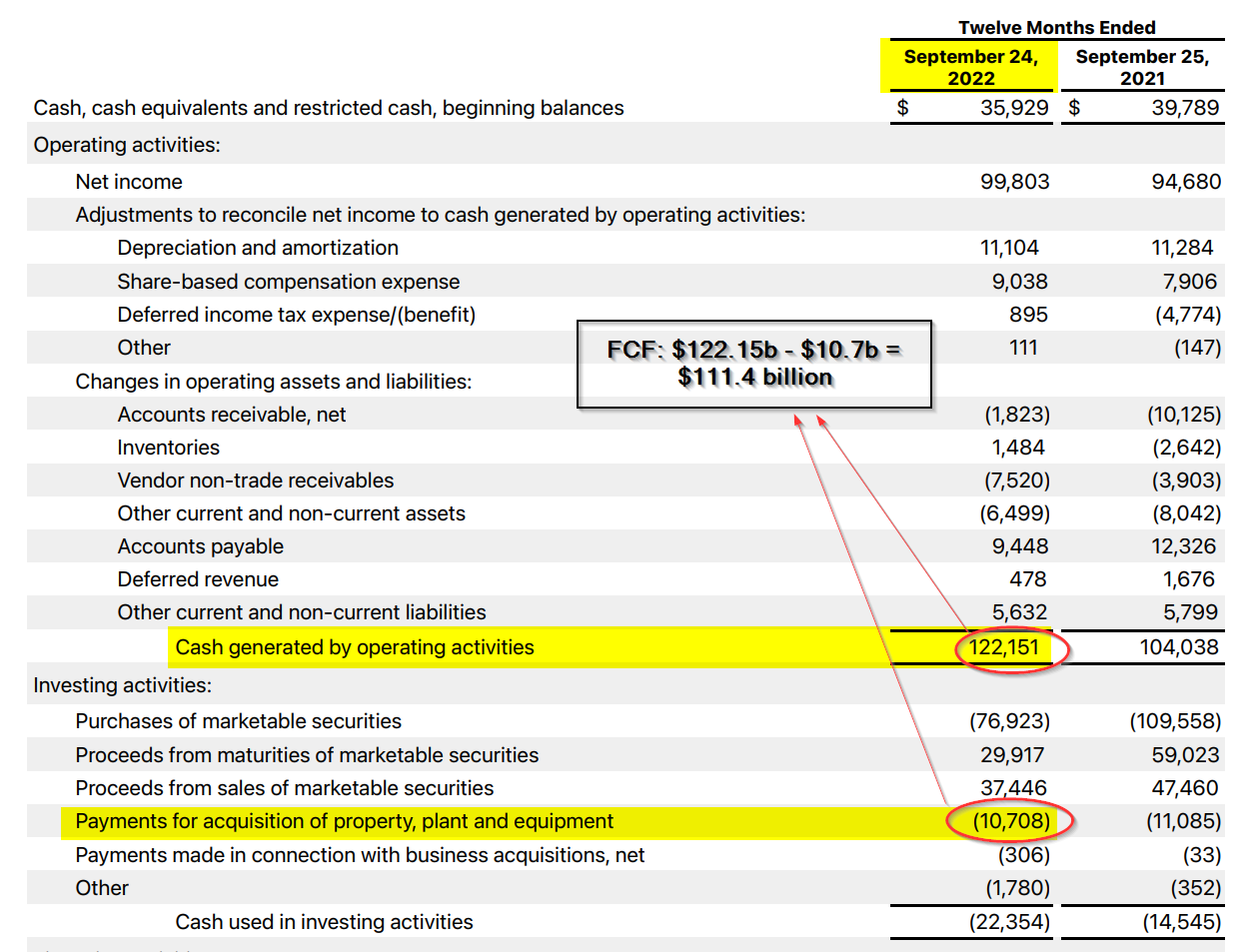

Free Cash Flow

For the past fiscal year ending Sept. 24, Apple's operating cash flow was $122.5 billion and FCF was $111.4 billion. That can be seen on page 3 of the company's financial results in the cash flow statement. That FCF represents 28.3% of its $394.3 billion in full-year revenue.

That also means that the $111.4 billion in FCF represents 4.6% of its $2,400 billion market capitalization. That is very cheap indeed.

Forecasts Make AAPL Stock Look Cheap

As revenue rose 8% during the quarter and FCF was strong, analysts are very positive on fundamentals going forward. For example, the average analyst revenue forecast for FY 2023 is for $428.9 billion, or 8.6% higher.

That means that assuming a 28% margin, FCF could hit $120 billion. Even if the margin falls to 25%, assuming a recession, FCF would still be well over $100 billion at $107 billion.

Moreover, analysts forecast $6.76 in earnings per share (EPS), up from $6.11 EPS for the FY ending Sept. 24. That puts AAPL stock, at $153.76 today (Oct. 28), at just 22.7x earnings.

Where This Leaves Investors in Apple Stock

So far this year, AAPL stock is still down almost 15% YTD. Assuming the stock moves higher with these results, there is a good chance it could end the year with a positive return.

Here is one reason why. Typically, companies with this high FCF margin will have at least a 3% to 4% FCF yield. Today's its FCF yield is 4.6% based on historical results (see above).

So, for example, if we estimate next year's FCF hits $107 billion and then divide that result by 3.5%, the market cap should be $3.057 trillion. That is 27.4% higher than today's market cap.

This means that AAPL stock could be worth close to $200 (i.e., 1.234 x $153.76 = $195.81 per share). That will put the stock in positive territory for the year.

As a result, investors are looking at AAPL stock as a bargain investment now.

More Stock Market News from Barchart

- Markets Today: Stocks Rally Despite Amazon’s Plunge

- 10 Stocks With Low Implied Volatility Percentile

- Pre-Market Brief: Stocks Plunge As Mixed Earnings Weigh On Sentiment

- Stocks Succumb to Meta’s Plunge

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)