/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)

Investors have had little reason to look away from Western Digital (WDC) in recent times. The company has staged an impressive rally to fresh 52-week highs as investors continue to feel positive about spending on infrastructure for artificial intelligence. In this context, the announcement of an Innovation Day event on Feb. 3 appears to be a calculated move.

This is especially true in a market where investors are increasingly distinguishing between cyclical upswings and structural winners. Storage spending related to artificial intelligence workloads, hyperscale data centers, and cloud infrastructure has been far more robust compared to earlier spending cycles related to PC infrastructure. In that sense, Western Digital is using its Innovation Day event to prove that its technology portfolio is squarely in line with these structural winners.

About Western Digital Stock

Western Digital is a leading company in designing and developing data storage solutions. It offers high-capacity hard disk drives and flash storage solutions for enterprise, cloud, and consumer storage applications. The company is based in San Jose, California. Today, its market capitalization stands at around $96 billion. This is a significant jump from what it had been in the past year.

In terms of price performance, WDC stock has been one of the top performers in the market. In recent times, the stock has been trading at $279. This is following an intraday high of $285.25. It has since seen some volatility today, but this has still been a significant recovery from what the stock had been through in the past year. In terms of price movement over the last 52 weeks, it has moved from around $30 to its current levels of about $250. This is a significant improvement over the S&P 500 ($SPX).

Valuation has grown along with this run. Western Digital now has a forward price-to-earnings ratio of 47x and a price-to-sales ratio of approximately 10x. These are not numbers that indicate a near-term upcycle; rather, they show that Wall Street believes this profitability will continue. These numbers make sense when you look at Western Digital’s profitability metrics, such as a return on equity that is near 31% and operating margins that are growing rapidly.

The stock may not be considered cheap anymore, but Wall Street is more than willing to pay a premium for a stock that is improving its fundamentals and has a high cash flow.

Western Digital Beats on Earnings

Western Digital’s latest earnings report may be a big reason why Wall Street is so confident. In its fiscal Q1 2026 report, Western Digital reported $2.82 billion in revenue, a 27% increase from last year. Its diluted earnings per share came in at $3.07, a gain of over 1,000%. Its non-GAAP earnings per share also came in at $1.78, a gain of over 1,000% from last year. The gross margin also saw a significant increase. The GAAP gross margin was 43.5%, an increase of more than 700 basis points. The operating income also more than doubled from last year. The free cash flow also came in at approximately $599 million. The outlook also indicates that this is a long-term trend. The company is guiding fiscal Q2 2026 revenue to be $2.9 billion at the midpoint, representing 20% year-over-year (YoY) growth. The company also expects its non-GAAP EPS to come in at $1.88. The company also cited continued strength in its data center business and adoption of high-capacity drives. The company also increased its quarterly dividend by 25% to $0.125. This is a big vote of confidence from its board and may be a good sign for its future.

While Innovation Day is not an earnings event, it could be important for the next leg in the stock. As a reminder, the Feb. 3 event is designed to highlight the innovations that Western Digital is working on to support customers in an AI-driven data economy. This is important for investors because it shifts the focus away from the cyclical recovery in storage and towards the secular theme of exposure to AI infrastructure.

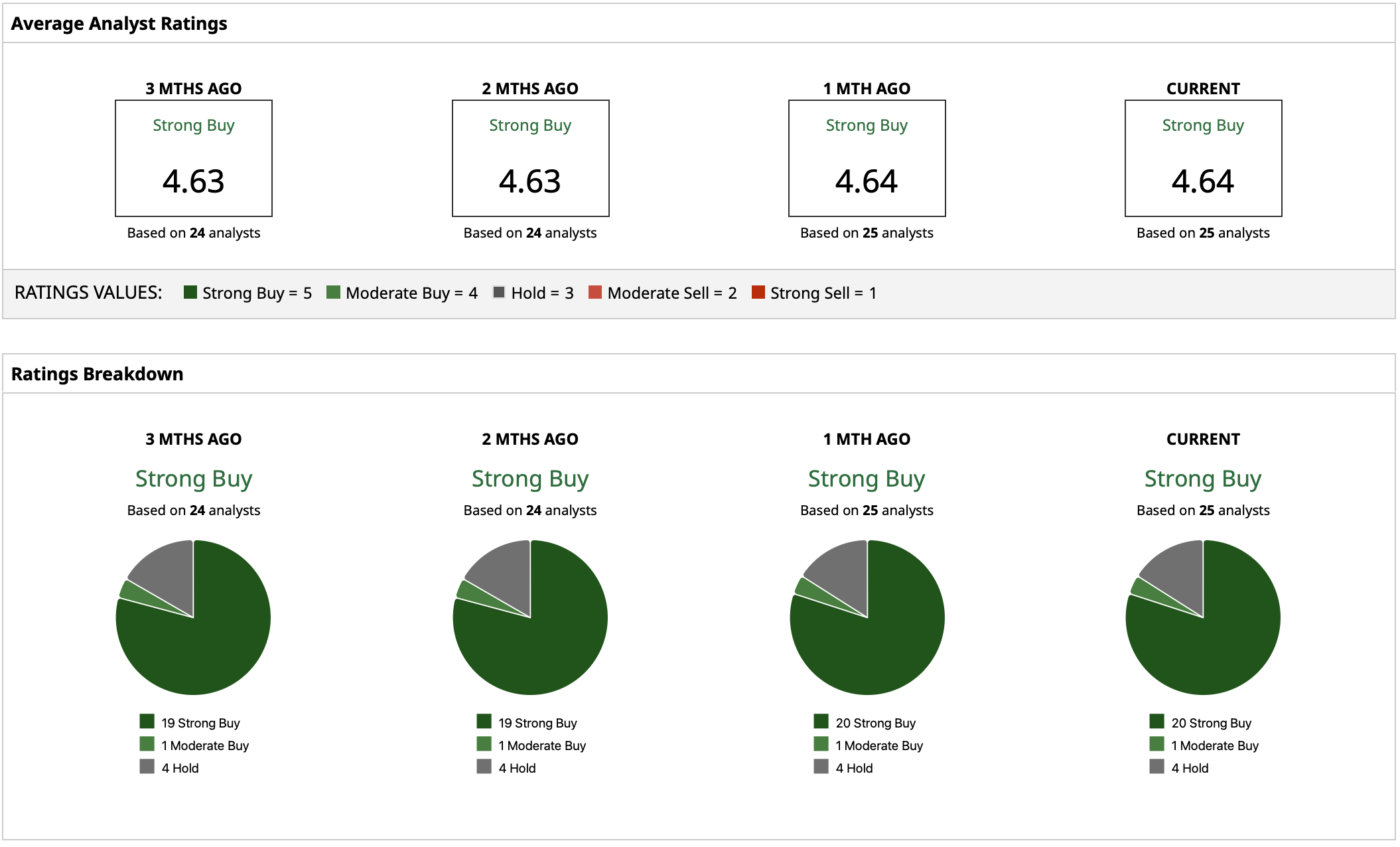

What Do Analysts Expect for WDC Stock?

Wall Street’s consensus for Western Digital stock is bullish, with a “Strong Buy” rating consensus and a mean price target of around $224.54. This would represent a decline in the current stock price, and the high price target on the Street is around $300. That gap between market price and average target highlights why Innovation Day matters. Analyst models often lag narrative inflection points, especially when a company transitions from a cyclical recovery to a structural growth story. Feb. 3 may not change near-term numbers, but it could influence how analysts frame Western Digital’s longer-term role in the AI data center stack.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)