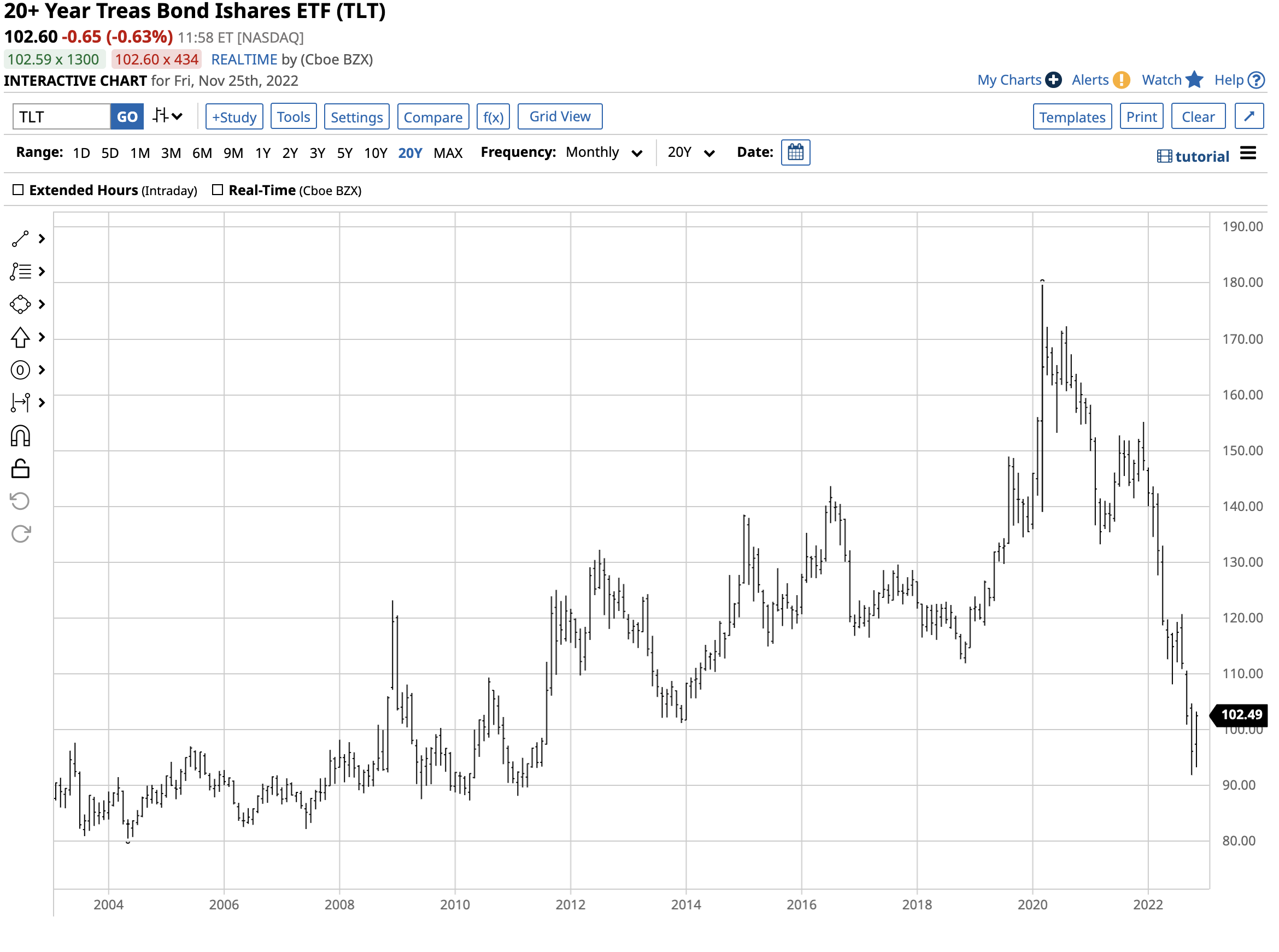

In March 2022, the short-term Fed Funds Rate sat between zero and twenty-five basis points. On November 23, 2022, the rate controlled by the US central bank was between 3.75% and 4.00%, a dramatic rise. In late 2021, a thirty-year conventional rate mortgage was below 3%. In November 2022, homebuyers or those refinancing existing mortgages face rates north of 7%. On a $400,000 conventional thirty-year fixed-rate loan, the difference in monthly payments is over $1,300 per month, precluding many from buying homes or refinancing or withdrawing equity from existing homes. While the Fed has pushed short-term rates substantially higher, quantitative tightening to reduce the central bank’s swollen balance sheet has caused rates to rise further out along the yield curve, with significant ramifications for markets across all asset classes. The iShares 20+ Year Treasury Bond ETF (TLT) moves higher when interest rates drop and lower when they increase.

The long bond futures drop to the lowest level since February 2011

In October 2022, the US 30-Year treasury bond futures fell to the lowest level in over a decade.

The chart highlights the decline to 117-19, the lowest level since early 2011 when it reached 116-26, which now stands as the long bond future’s critical technical support level.

Short-term Fed Funds Rate hikes, quantitative tightening, and the highest inflationary pressures since the 1980s have pushed the bonds lower and interest rates higher in 2022.

Stocks hate higher rates

Stocks and bonds compete for capital, and rising interest rates tend to be toxic for the stock market. While capital tends to move to fixed-income assets, higher financing rates also weigh on companies’ earnings, creating a double-barrel bearish environment for equities.

The S&P 500 is the most diverse stock market index and barometer for US equity prices.

The long-term chart illustrates the decline in the S&P 500 from 4,766.18 on December 31, 2021, to the 4,029.05 level on November 25. Rising interest rates could be the most significant factor for the $&P 500’s 15.5% drop.

Commodity prices reflect higher financing costs

Rising interest rates also tend to weigh on commodity prices as they increase the costs of financing inventories, causing consumers to shun stockpiling and move to a more hand-to-mouth approach. Moreover, rising US rates push the dollar index higher. Since the dollar is the world’s reserve currency, most commodities use the US foreign exchange instrument as the pricing mechanism. When the dollar rises along with interest rates, it tends to put downward pressure on raw material prices.

After commodities reached all-time or multi-year highs earlier this year, energy, grains, soft commodities, metals, precious metals, and even livestock prices have moved lower. While commodities remain at elevated levels, they have declined under the weight of rising rates and a strong US dollar.

Higher rates have pushed the dollar index to a two-decade high

The dollar is a fiat currency and the leading world reserve foreign exchange instrument. Since interest rate differentials are one of the primary factors that drive currency values higher or lower within the foreign exchange arena, the trajectory of US interest rate increases lit a bullish fuse under the US dollar.

The US dollar index measures the US currency against other world reserve currencies, including the euro, British pound, Japanese yen, Canadian dollar, Swedish krona, and Swiss franc.

The chart highlights the dollar index’s rise to the highest level in two decades. The move above the 103.96 technical resistance level in May 2022 pushed the dollar index to the highest level since 2002. The index moved to a high of 114.745 in September and at just below the 106 level on November 25; the dollar remained in a bullish trend at a twenty-year high.

A strong dollar is bearish for US multinational stocks, making competition against foreign companies challenging. Rising interest rates and a strong dollar create a bearish cocktail for the stock market.

The hawks at the Fed risk damage to the US economy- The TLT moves with rates

After falling to the 117-19 low in October, the bonds recovered and were at over the 126 level on the December futures contract on November 23. Bear markets rarely move in straight lines, and bounces from lows can be fast and furious.

The short-term US Treasury bond futures chart shows the long bond futures have made higher lows and higher highs since the late October bottom.

The iShares 20+ Year Treasury Bond ETF (TLT) moves higher and lower with US government bond prices. At the $102.58 level on November 25, the highly liquid TLT product had over $26.38 billion in assets under management. TLT trades an average of over 21.2 million shares daily and charges a 0.15% management fee.

The TLT’s short-term chart is very similar to the long bond futures, with the TLT reaching a low of $91.85 on October 24 and bouncing to the latest high of $103.25 on November 23.

Meanwhile, like the bond futures, the long-term chart shows that the TLT has been in a bearish trend since March 2020.

The path of least resistance for the US bond market, TLT ETF, stocks, and commodities could be in the hands of the US Federal Reserve. The hawkish path of monetary policy in 2022, pushing rates higher, has had significant ramifications for markets across all asset classes. The Fed will meet again in early December to decide if it will increase the Fed Funds Rate by 75 basis points for the fifth consecutive time or if the recent improvement in CPI and PPI data causes a lower 50-point increase. The decision will determine the path of least resistance of markets over the coming month and into 2023. The slight 25 basis point difference could cause a significant shift in sentiment over the coming weeks. The Fed must balance its commitment to fighting inflation with the risk of igniting a deep recession and a very hard landing for the US economy.

The sustainability of the latest relief rally in the US bond market depends on the Fed’s next decision, determining if the bond bear continues to roar.

More Stock Market News from Barchart

- High Inflation May Reduce Holiday Retail Sales

- Stocks Mixed as China Covid Surge Weighs on Tech Stocks

- GOOGL Put Options Offer Good Value To Bullish Alphabet Investors

- Markets Today: Stocks Pressured by Record Covid Infections in China

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)