A bull call spread is an options strategy that a trader uses when they believe the price of an underlying stock will move higher in the short term.

To execute the strategy, a trader would buy a call option and sell a further out-of-the-money call option with the following conditions:

- Both call options must use the same underlying stock

- Both call options must have the same expiration

- Both call options must have the same number of options

Since the strike price of the sold call is higher than the strike price of the bought call, the initial position will be a net debit.

The bull call spread profits as the price of the underlying stock increases, similar to a regular long call.

The difference between a bull call spread and a regular long call is that the upside potential is capped by the short call.

The purpose of the short call is to mitigate some of the overall costs of the strategy at the expense of putting a ceiling on the profits.

Losses are also capped, in this case by the debit taken when you execute the trade.

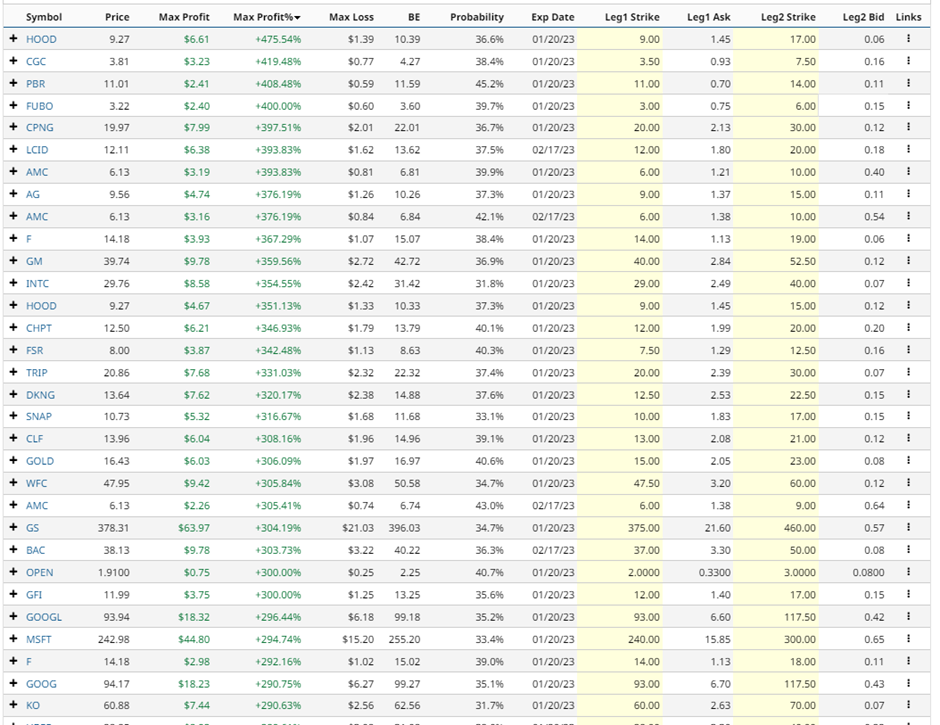

Let’s take a look at Barchart’s Bull Call Spread Screener for November 11th:

As you can see, the scanner shows some interesting Iron Condor trades on stocks such HOOD, PBR, FUBO, LCID, AMC, F, GM, INTC, CHPT, DKNG, CLF, WFC, GS, BAC, GOOGL and MSFT.

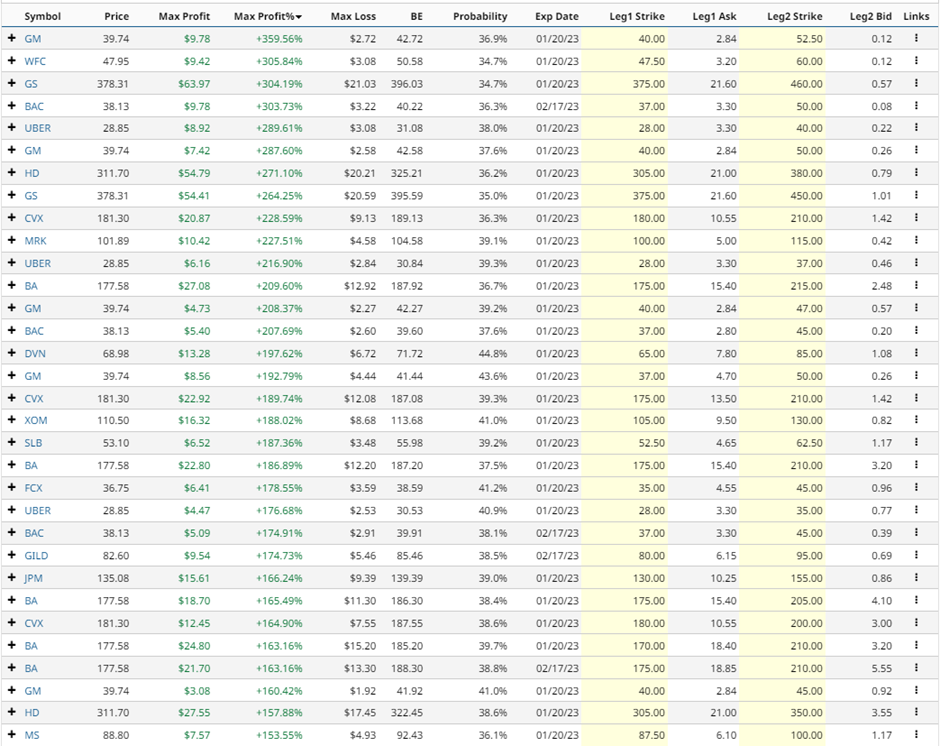

Let’s adjust the scanner to make sure we are only looking for bull call spreads on stock with a Buy rating and Mark Cap above 40 billion.

This scan gives us the following results:

GM Bull Call Spread Example

Let’s take a look at the first line item – a bull call spread on GM.

This bull call spread trade involves buying the January expiry 40 strike call and selling the 52.50 strike call.

Buying this spread costs around $2.72 or $272 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium paid and multiplying by 100. That give us:

12.50 – 2.72 x 100 = $978.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 359.56%.

The probability of the trade being successful is 36.9%, although this is just an estimate and does not indicate the probability of achieving the maximum profit.

The spread will achieve the maximum profit if GM closes above 52.50 on January 20. The maximum loss will occur if GM closes below 40 on January 20, which would see the trader lose the $272 premium on the trade.

The breakeven point for the Bull Call Spread is 42.72 which is calculated as 40 plus the $2.72 option premium per contract.

The Barchart Technical Opinion rating is a 56% Buy with a strengthening short term outlook on maintaining the current direction.

GM is showing an IV Percentile of 24% and an IV Rank of 26.97%. The current level of implied volatility is 40.81% compared to a 52-week high of 60.36% and a low of 33.59%.

WFC Bull Call Spread Example

Let’s look at another example, this time using Wells Fargo.

This bull call spread also uses the January expiry and involves buying the 47.50 strike call and selling the 52.50 strike call.

This trade would cost $308 and have a maximum potential profit of $942.

The Barchart Technical Opinion rating is a 56% Buy with a strengthening short term outlook on maintaining the current direction.

WFC is showing an IV Percentile of 12% and an IV Rank of 15.78%. The current level of implied volatility is 29.86% compared to a 52-week high of 51.30% and a low of 25.85%.

Mitigating Risk

Thankfully, bull call spreads are risk defined trades, so they have some build in risk management. The most the GM example can lose is $272 while the WFC call spread has risk of $308.

For each trade consider setting a stop loss of 25-30% of the max loss.

Also keep an eye on key support levels and moving averages.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Skyrocket as Yields Plunge on a Soft U.S. CPI Report

- Hopes are Building for Tech Earnings to Stabilize

- Stocks Soar as Bond Yields Plunge on Soft U.S. Consumer Prices

- Markets Today: Stocks Rocket Higher as U.S. Inflation Concerns Ease

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)