Evergy, Inc. (EVRG) is a major electric utility holding company that generates, transmits, distributes and sells electricity. Formed through the 2018 merger of Westar Energy and Great Plains Energy, Evergy serves residential, commercial and industrial customers and operates a diversified mix of power generation assets, including renewables, natural gas, coal and nuclear sources. The company is headquartered in Kansas City, Missouri and has a market cap of approximately $17.7 billion.

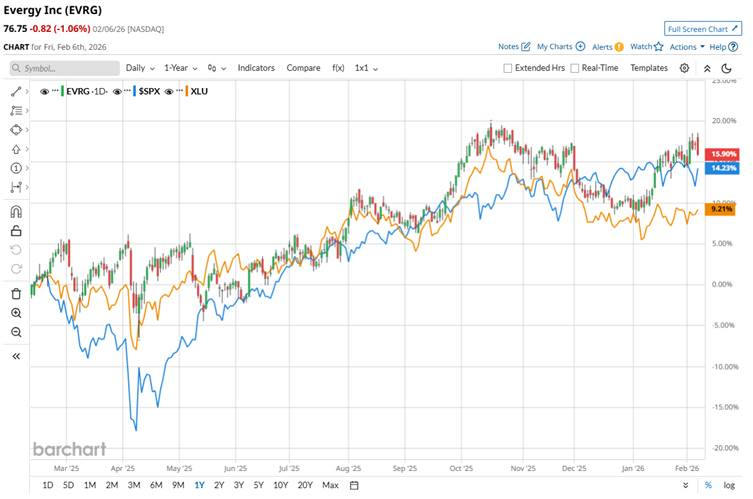

Shares of the company have outperformed the broader market over the past 52 weeks. EVRG has returned 17.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14%. Moreover, shares of Evergy are up 5.9% on a YTD basis, compared to SPX’s 1.3% gain.

Looking closer, the electric utility stock has also outpaced the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.7% rise over the past 52 weeks and 1.6% YTD.

Evergy’s stock has been supported by optimism around its long-term growth outlook and strategic initiatives, including a large economic development pipeline with potential new large customers such as data centers and advanced manufacturing facilities, which can drive higher future demand and revenues. Investors have also responded positively to Evergy’s capital investment plans and some optimistic coverage, helping support the stock’s performance.

For the fiscal year 2025, analysts expect EVRG’s EPS to grow 5.3% year-over-year to $4.01. The company’s earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

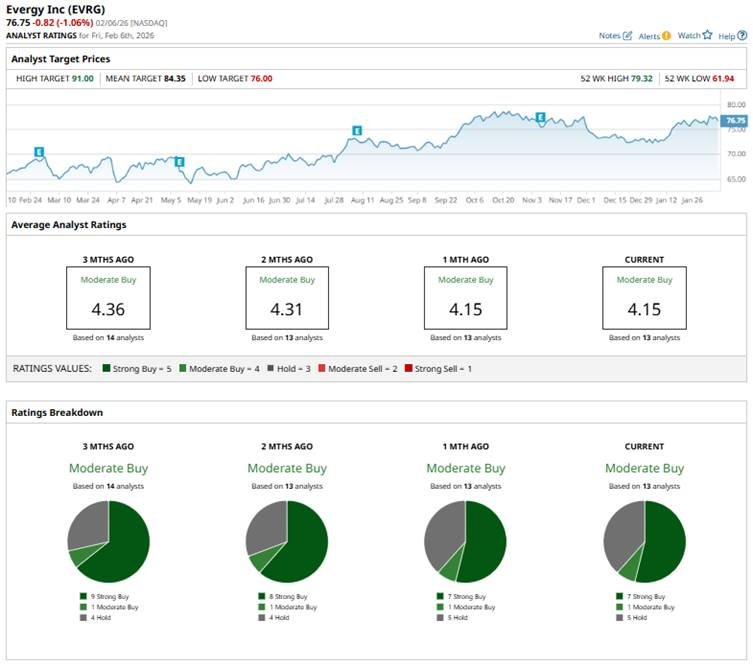

Among the 13 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is slightly less bullish compared to three months ago, when there were nine “Strong Buy” ratings.

Nevertheless, on Jan. 27, BMO Capital’s Edward DeArias reaffirmed an “Outperform” rating on Evergy and raised the price target from $79 to $82.

The mean price target of $84.35 represents a premium of 9.9% to EVRG’s current price. The Street-high price target of $91 suggests a 18.6% potential upside.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)