Specifications and Statistics

By extracting oil from whole soybeans, soybean oil is formed. Requiring dehulling and then crushing soybeans. This process will separate the oil from the remainder of the soybean. Further refinement is necessary to remove any contaminants affecting the flavor of soybean oil. Once soybean oil is refined, it is primarily used as a vegetable and cooking oil.

Wikipedia reports that Chinese records dating before 2000 BCE mention using cultivated soybeans to produce edible soybean oil. Ancient Chinese literature reveals that soybeans were extensively cultivated and highly valued as used for the soybean oil production process before written records were kept.

This may support why China imports large amounts of soybeans from the US and Brazil. China is the world's largest soybean oil producer, followed by the US.

Soybean oil has been traded on the Chicago Board of Trade (CBOT), which is part of the CMEGroup exchange since 1951.

Today, soybean oil averages 45K contracts traded daily and approximately 405K contracts of open interest. Making it a liquid futures contract to trade.

Currently, the front month contract is December, trading at a price of .6600 US cents per pound, making the notional value of the futures contract $39,600. The required overnight margin is $3,000 per contract creating a leverage of 13:1.

Recent Performance

Soybean oil has enjoyed the agricultural bull market over the past year. Year-to-date returns are +21%, and the third quarter turned in +12% returns.

Soybean oil spent August and September in a narrow sideways market. When markets trade in small sideways ranges for an extended period, they usually have a significant move once they break out of the range.

Fundamentals Impacting Market Behavior

Traders will watch the Brazillian weather as meteorologists confirm that La-Nina weather patterns persist for a third year. Brazil just finished planting its next crop of spring soybeans, which will be harvested in early February.

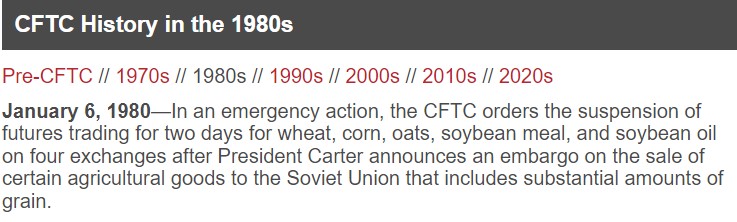

Ukraine is still on traders' minds, with geopolitics changing daily. Soybean oil is no stranger to geopolitical events:

The US harvest of soybeans may have more trouble getting out of the US. The Mississippi River is at historically low levels causing problems for grain barges to get crops to the Gulf of Mexico for global shipping. More than half of the world's grain exports go down this river.

The barge freight rates have increased to record levels adding to the supply chain issue due to labor shortage and shortage of barges. Barges are being used to move oil and natural gas down the river for European export creating grain barge shortages.

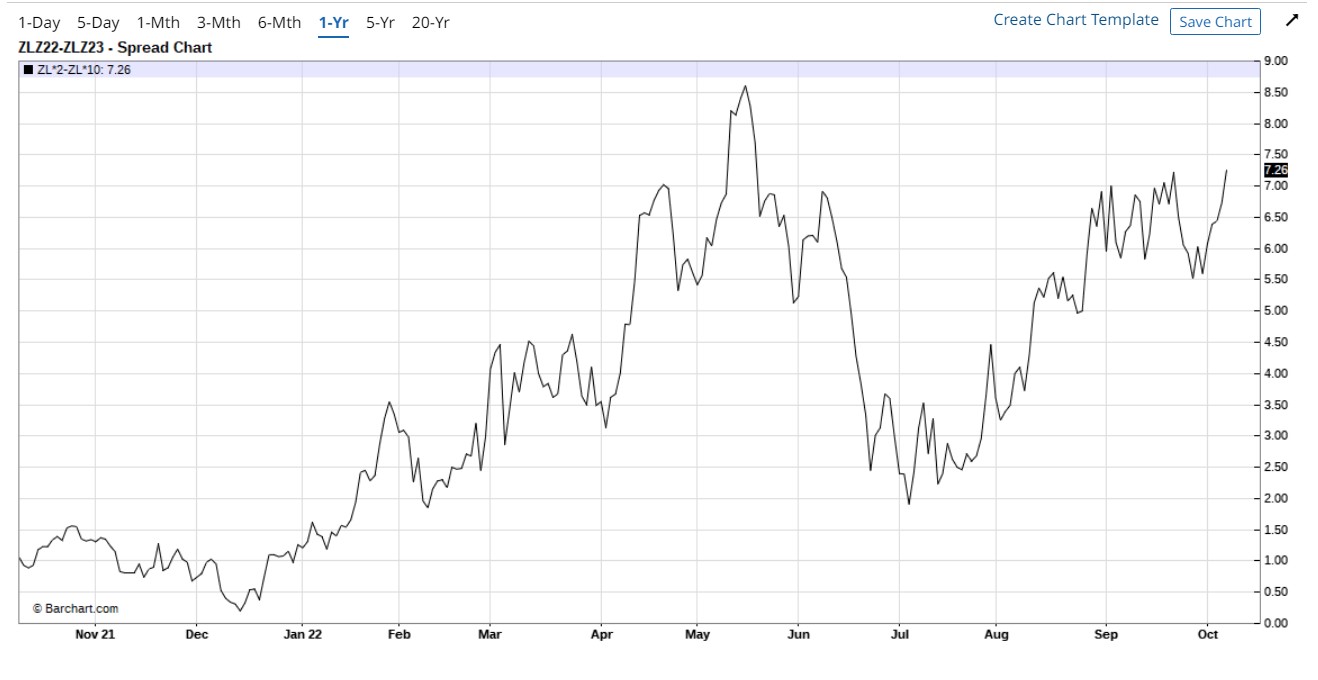

Spreads

The year-over-year soybean oil spread is still firmly in backwardation, indicating a tight supply in the future, and added demand is still in the market. Today the spread made a new high for the move off the July lows. An added note, the outright December soybean oil market was sideways all of August and September while the spread was in a strong uptrend in August. Leading indicator to higher prices? Possibly.

Technicals

Soybean oil continues in the sideway trend from August. The market is finding support at the .6100 to .6200 level while in this range. If the market closes above the top of the trading range, looking for support before the breakout may create an opportunity.

These trading comments are not meant to be trading advice. They are intended for educational purposes only.

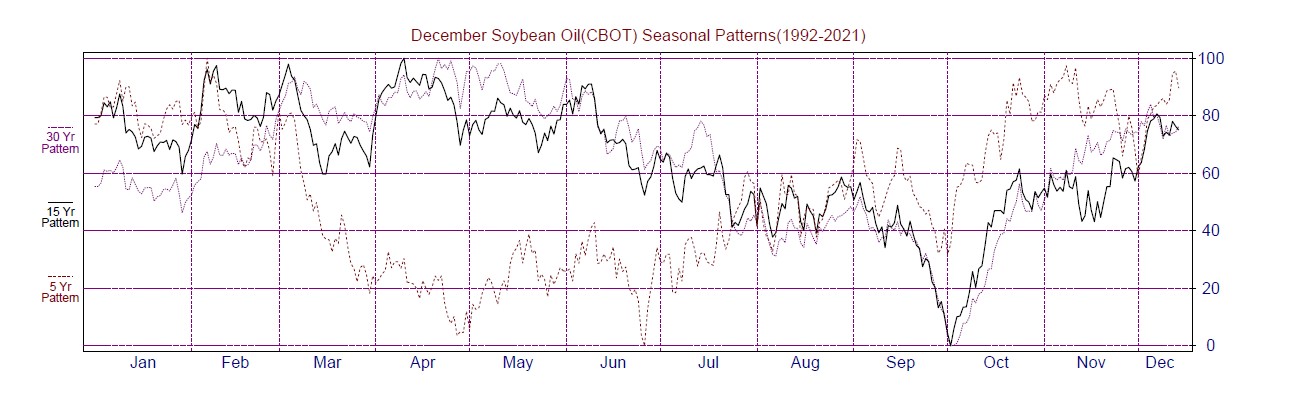

Seasonality

Source: Moore Research Center, Inc. (MRCI)

Seasonally soybean oil makes its yearly low in early October. Moore Research Company (MRCI) shows a 15-year historical average seasonal low. When using seasonal patterns, it is highly recommended that you apply your fundamental and technical analysis to confirm that the seasonal pattern still has an edge the year you wish to trade it.

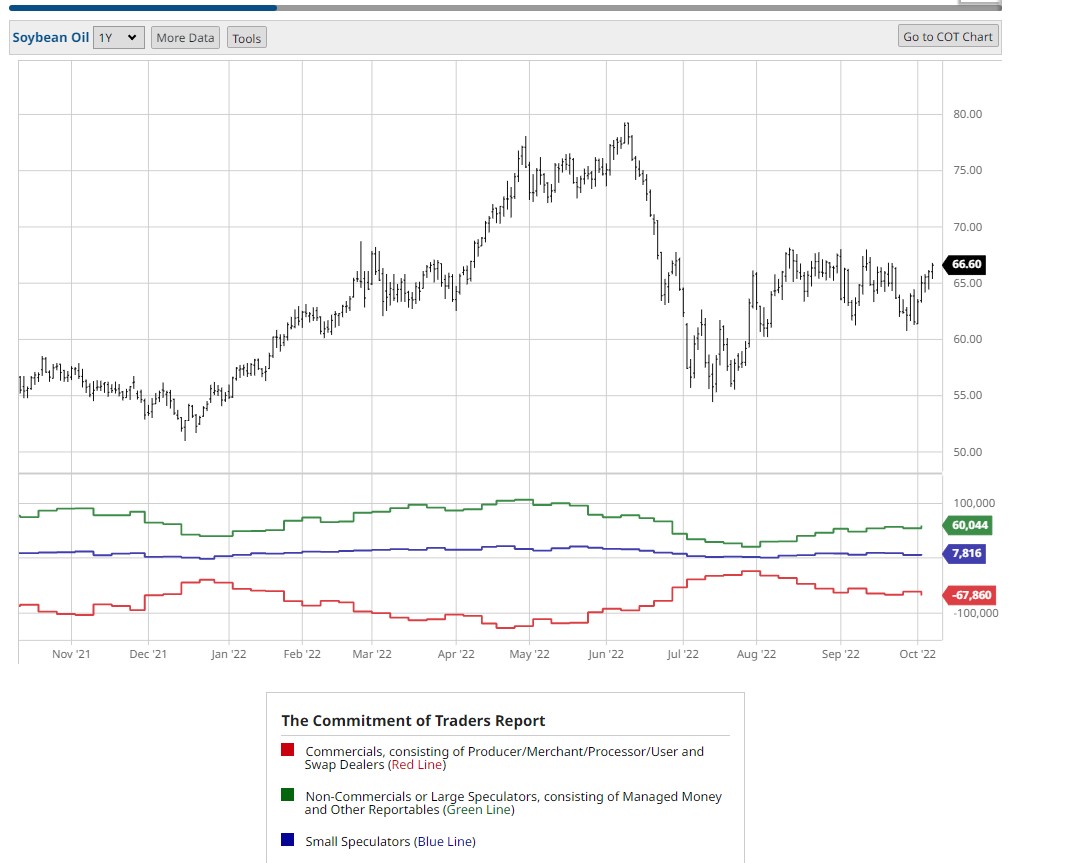

The Commitment of Traders (COT) Report Analysis

The COT report is still friendly to the soybean oil market. In July, the market made three drives to lows (creating an inverse head & shoulder pattern), and with each drive down, the commercials (red line) added to their long positions. Since the trend started in July, large speculators (trend followers) have joined the move higher. Even during the current sideways trend, new longs have been added. I think the uptrend is intact as long as the large speculators' position is less than their yearly high net position.

Summary

With inflation still running rampant, the supply chain issues and water levels on the Mississippi River, and the ongoing geopolitical situation, soybean oil looks like it deserves a trader's attention to see if there are any opportunities.

Unfortunately, there is no mini or micro futures contract for soybean oil. The standard-size soybean oil (ZL) is the only way to participate in a market move unless a trader is familiar with the Options market.

More Grain News from Barchart

- Coffee Prices Erase Early Losses on Reports of Crop Damage in Brazil

- Sugar Prices Strengthen on a Rally in Crude Oil

- Cocoa Prices Underpinned on Concern About Next Year's West African Crop

- Midday Wheats Higher for Friday

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)