Many market participants were surprised by the higher-than-expected August consumer price index report that showed that inflation stood at 8.3%. After all, nearby NYMEX gasoline futures prices fell from $3.1132 at the end of July to $2.4308 on August’s final day, a 21.9% decline. While gasoline prices impact consumers daily, so do food prices, which remained elevated.

The high level of a leading inflation barometer will likely cause the US central bank to hike short-term interest rates by 75 basis points for the third consecutive time at the September 21 FOMC meeting. While higher rates impact the demand side of the economy, they will do little to dampen the high grain and oilseed prices as they have rallied on the back of supply-side economic concerns caused by the ongoing war in Ukraine. The latest September WASDE report told the market that worldwide corn and soybean stockpiles declined while global wheat inventories rose from the August report. Wheat, corn, and soybean prices rallied in the aftermath of the September WASDE report and remain at multi-year highs during the 2022 harvest season.

Soybeans remain in the teens

Soybean processing involves crushing the oilseed into oil and meal. Soybean oil is an ingredient in many foods and is increasingly used to produce biodiesel, and the meal is a critical requirement for animal feed. Meanwhile, the latest USDA WASDE report told the soybean market global inventories declined by 2.5 million tons to 98.9 million on falling US and Chinese stockpiles.

The chart shows at over the $14.48 per bushel level on September 16; soybean futures remain at the highest price since 2014 after rising to $17.5925 earlier this year. The all-time 2012 high was at $17.89.

Meanwhile, crush spreads measure the soybean price versus the oil and meal prices. The price action in soybean products tends to provide clues about the oilseed’s price path as consumers require the products instead of the raw oilseeds. At the end of last week, the December soybean crush spread was hovering around the $2 level, which is near the all-time peak. A rising crush spread supports higher soybean prices as it tells us that the product demand is strong, and the prices are outperforming the raw oilseeds.

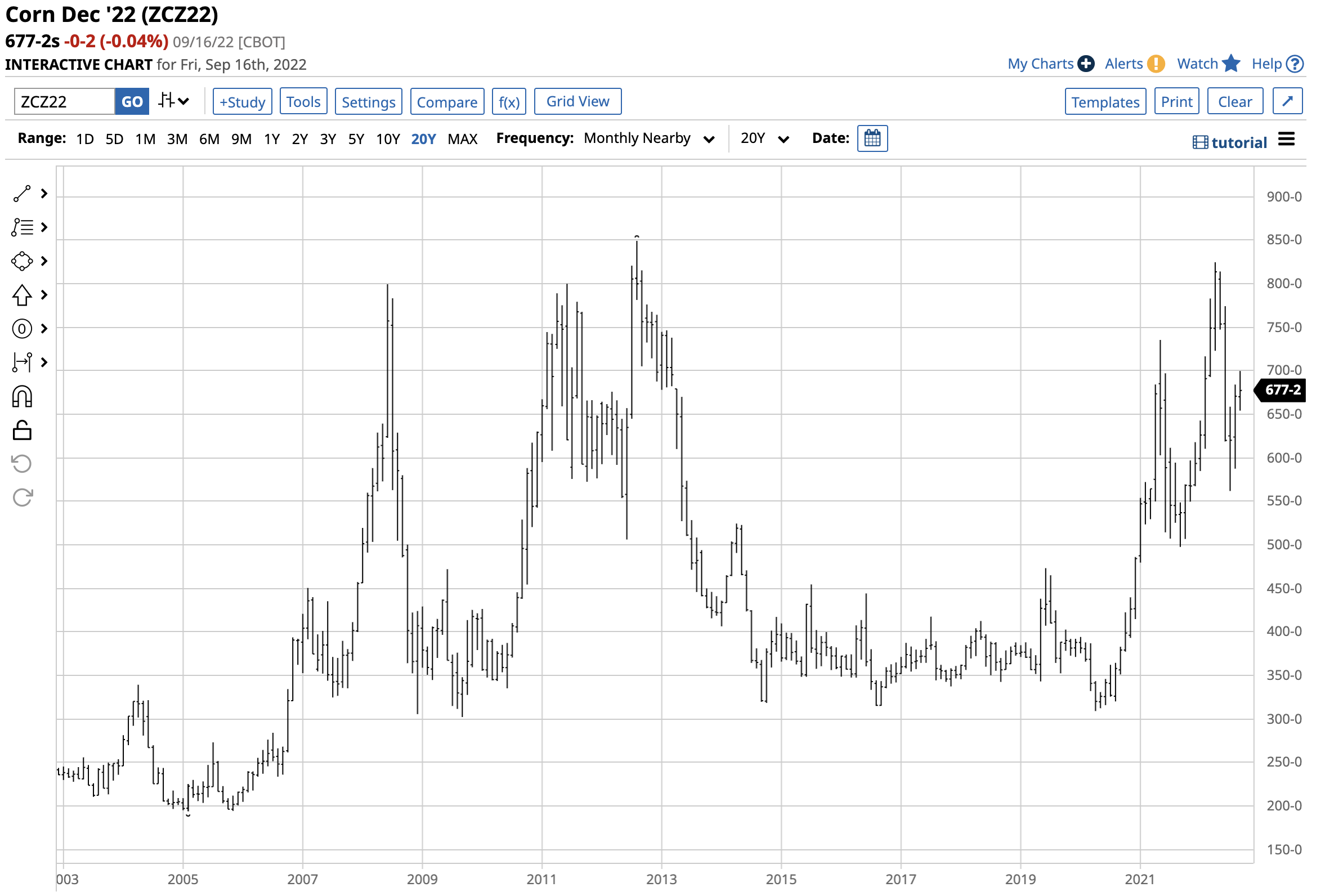

Corn is at the $6.80 per bushel level

Corn is a critical source of nutrition for humans and animals and is an ingredient in many foods. Corn on the cob, tortillas, high fructose corn syrup, corn oil, animal feed, and many other products require the coarse grain. Moreover, in the US, corn is the primary ingredient in ethanol, the energy commodity the government mandates to be blended with gasoline for automobile fuel. The September WASDE report was also bullish on corn, saying worldwide corn stocks fell 2.2 million tons to the 304.5 million level.

Corn prices remain at a multi-year high in mid-September as the market is now in the harvest season.

At $6.7725 per bushel, corn is trading at its highest price since 2013 after rising to $8.2450 earlier this year. The record peak in the corn futures market was in 2012 at $8.49 per bushel. Ukraine and Russia are significant corn producers and exporters, and the war in Europe’s breadbasket weighs on worldwide production.

CBOT wheat is north of $8

Russia and Ukraine are also leading wheat-producing countries. The war pushed CBOT soft red winter wheat futures to an all-time high at over $13.60 per bushel in March 2022.

The chart shows at nearly the $8.60 per bushel level, CBOT wheat futures are at the highest price since 2012. Wheat is the agricultural commodity in the eye of the geopolitical storm as the fertile soils in Europe’s breadbasket and critical logistical transportation hubs in the Black Sea have been a war zone since February 2022 when Russia invaded Ukraine.

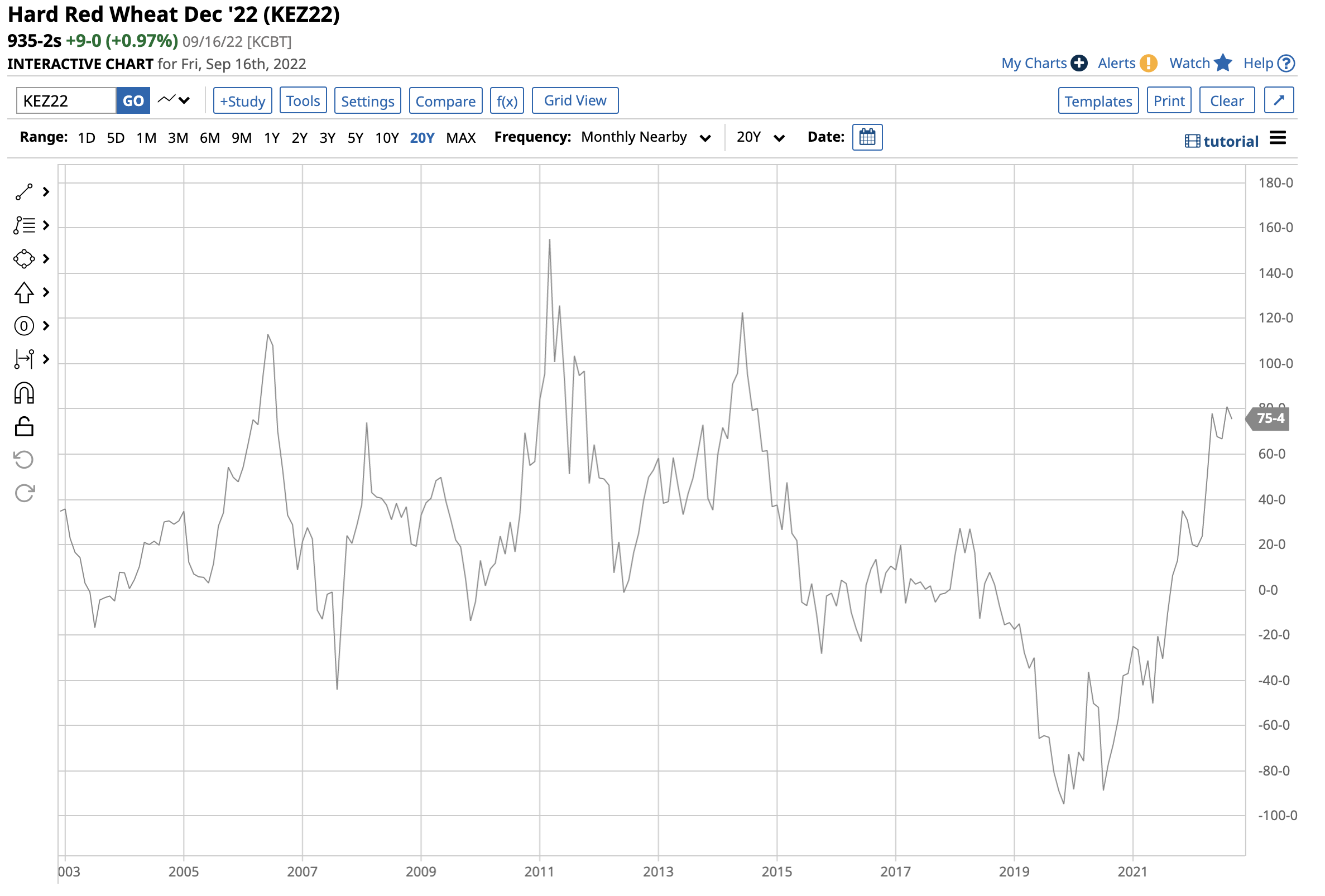

The KCBT-CBOT spread continues to signal supply concerns

The KCBT hard red winter wheat versus the CBOT soft red winter wheat futures spread tends to reflect the level of US consumer hedging as many supply contracts for US bread manufacturers’ price requirements use the KCBT price.

When wheat prices trend lower, the spread tends to move to a premium for the CBOT wheat because consumers buy wheat on a hand-to-mouth basis. However, when prices trend higher or supply concerns dominate the market, the KCBT wheat tends to move to a premium for the CBOT wheat.

The chart ({KEZ22}-{ZWZ22}) shows at a 75.5 cents per bushel premium for the KCBT over the CBOT wheat on September 16, consumers are nervous about price and supplies and are hedging their future wheat requirements. The average level of the spread over the past two decades has been around a 20-30 cents premium for the KCBT wheat; at above 75 cents, it reflects supply concerns. From 2014 through 2020, when wheat prices trended lower, the spread moved to a nearly $1 premium for CBOT wheat, reflecting no supply concerns and falling prices. In September 2022, the spread tells us the wheat market is nervous about rising prices and shortages.

The September WASDE reported that global wheat inventories declined by 1.2 million tons to the 268.6 million level. However, the market remains nervous because of the war in Europe and the importance of Russian and Ukrainian supplies.

Prices will remain high, and the impact will filter around the world over the coming months and years

Inflation is increasing the cost of producing agricultural commodities. A fertilizer shortage because of Russian retaliation to sanctions threatens crop yields. Europe’s most crucial fertile soil remains ground zero in the first major European war since WW II. Energy prices are at the highest prices in years.

Grains are at the center of the geopolitical storm, which continues to threaten supplies during the 2022 harvest. If the war continues, grain and oilseeds will experience hardships during the 2023 crop year. The bottom line is geopolitical events and inflation continue to threaten global supplies, underpinning prices during the 2022 harvest season.

Bull markets rarely move in straight lines. While prices can rise to illogical, unreasonable, and irrational levels, corrections can be swift and violent. The optimal approach throughout this year has been to buy corn, wheat, and soybeans on price corrections, taking profits when prices explode. I expect that pattern to continue throughout the rest of 2022 and in 2023.

More Grain News from Barchart

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)