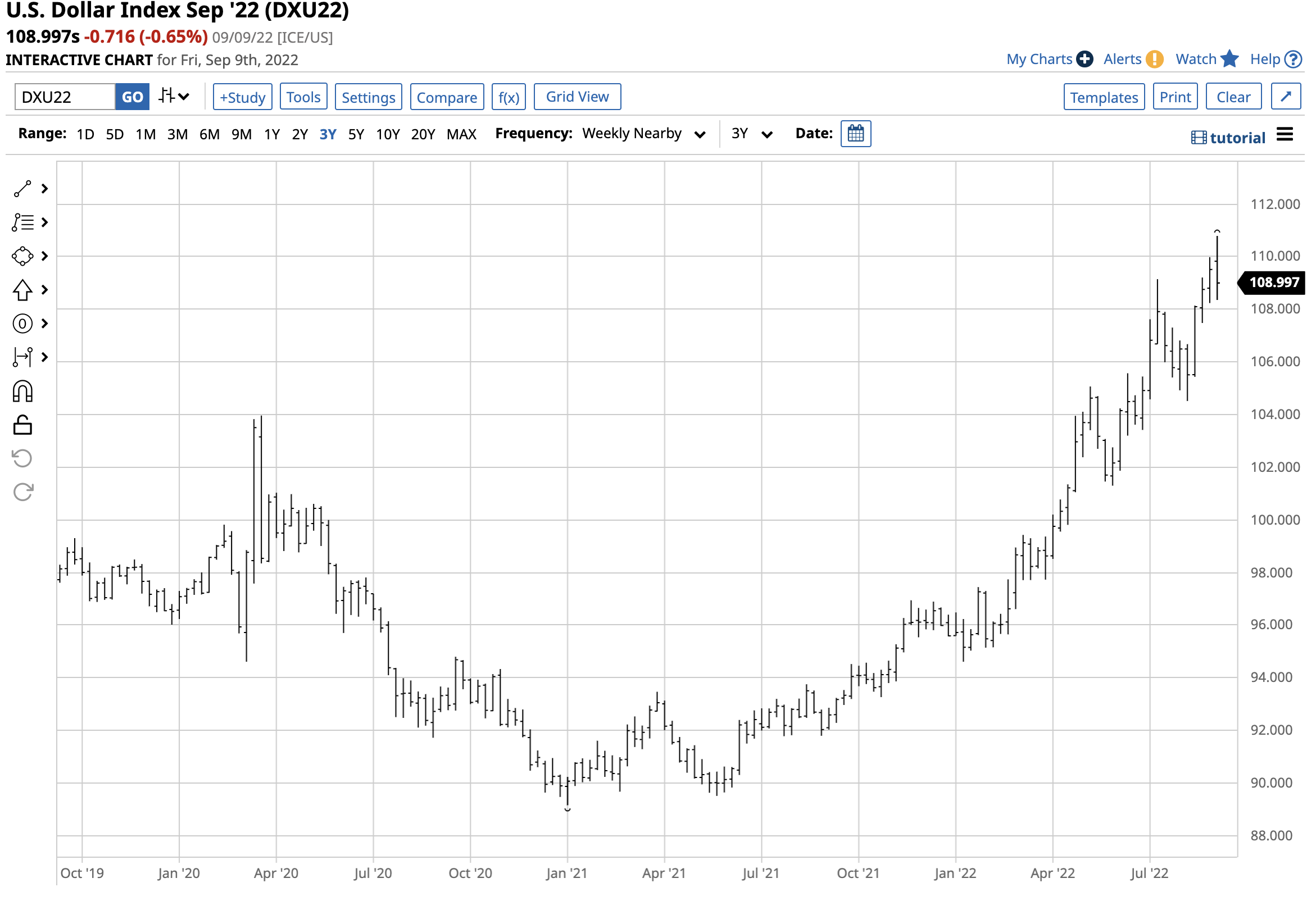

Currencies tend to exhibit slow and stable price trends, but the dollar index has experienced a significant bullish path of least resistance since finding a bottom at 89.165 in early January 2021. Over the past twenty-one months, every dip in the dollar index has been a buying opportunity. While the long-term technical resistance target sits over 10 points above the recent high, the index continues to rise to new twenty-year highs almost daily.

A rising dollar has significant implications for US multinational companies as the strong currency makes US goods less competitive in global markets. A strong dollar also tends to weigh on commodity prices as the dollar is the benchmark pricing mechanism. A strong dollar causes raw material prices to increase in other currency terms.

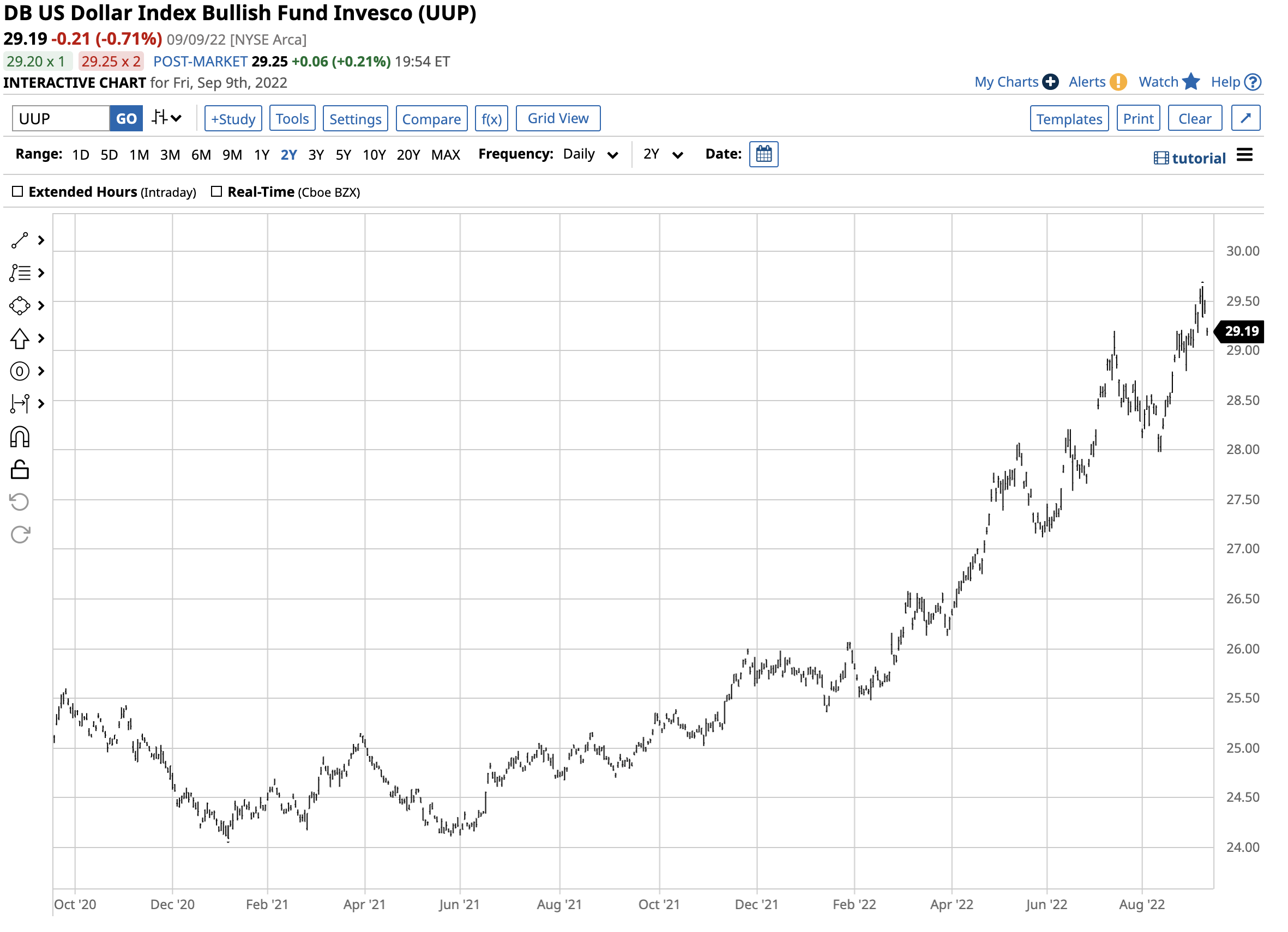

The Invesco DB US Dollar Index Bullish Fund (UUP) has done an excellent job tracking the rise in the US dollar.

A bullish trend- A breakout- A two-decade high

Last week, the US dollar index moved to its highest level since 2002 as the medium-term trend that began in early 2021 continued.

The chart highlights the slow and steady pattern of higher lows and higher highs after the dollar index reached an 89.165 bottom during the first week of 2021. Last week’s latest high of 110.785 put the dollar index 24.25% above the January 2021 low. The dollar index broke out to the upside when it eclipsed the March 2020 103.960 high in May 2022, and the price action followed through on the upside.

The upside target is far away, but the dollar index is making great strides

The dollar index’s next technical target stands at the 2001 peak.

From a technical perspective, the long-term chart illustrates the next target at the July 2001 121.90 high, around 11.8% above the level on Friday, September 9. The dollar index is making great strides, but the world’s reserve currency has rallied against the index’s components for two reasons, interest rate differentials and the first major European war since WW II.

Rising interest rates support the US currency

The US Fed’s Open Market Committee will meet this month to push the short-term Fed Funds Rate another 50 or 75 basis points higher. After a zero percent Fed Funds Rate in 2020 and 2021, the short-term interest rate benchmark will go into the September FOMC meeting at 2.25% to 2.50%. The rate will rise to 3%, with some hawkish Fed members calling for 4% by the end of 2022. Higher yields make the dollar more attractive as a reserve currency.

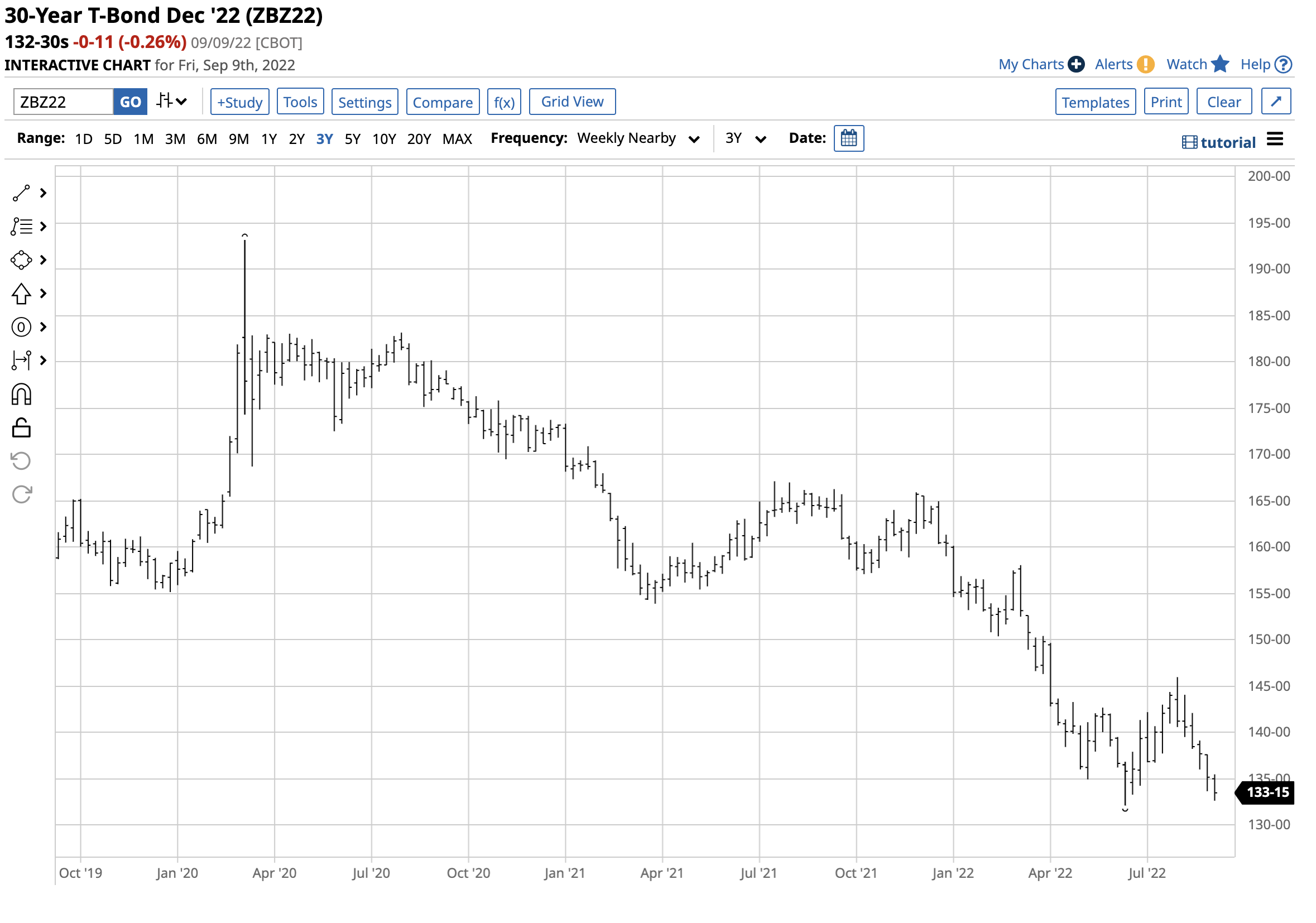

Meanwhile, the Fed’s quantitative tightening program to reduce its swollen balance sheet doubles in September puts additional upward pressure on interest rates further along the yield curve. The trend in the US bond market reflects the Fed’s commitment to battling inflation with short-term monetary policy and QT.

The continuous contract chart of the nearby US 30-Year Treasury bond futures displays the bearish bond market trend, reflecting rising interest rates. The bottom line is the path of least resistance of interest rates supports gains in the dollar index.

The war in Europe and geopolitical turmoil are bullish for the dollar

The US is the world’s wealthiest country, and global market participants tend to flock to stability during tumultuous times. The dollar has long served as a haven during periods when geopolitical tensions rise.

In 2022, Russia’s invasion of Ukraine, sanctions on Russia, and Russian retaliation have made the dollar more attractive for participants in the worldwide financial system. Tensions with China have only increased the dollar’s value as a safe asset.

While a bifurcation between the world’s nuclear powers destabilizes the world and could lead to changes in the global economy, so far, the dollar has benefited from the tensions as the trend remains bullish, and the greenback is trading at a two-decade high. One factor that makes the dollar index so strong is its 57.6% exposure to the euro currency. The euro has weakened and was trading below parity against the US dollar on September 9 because the war in Ukraine is on Western Europe’s doorstep.

In early September 2022, the trend in the US dollar was higher, with an almost perfect bullish storm in the US currency’s sails.

The UUP is the bullish ETF product that follows the dollar index

The most direct route for a risk position in the dollar index is via the futures that trade on the Intercontinental Exchange (ICE) or the over-the-counter currency market. Those looking for long-side exposure to the dollar index can use the Invesco DB US Dollar Index Bullish Fund (UUP), which follows the index higher and lower. The dollar index rallied 24.25% from the January 2021 low to last week’s high.

The chart highlights the rise in the UUP ETF from $24.09 in January 2021 to $29.65 per share last week, a 23% increase.

At the $29.19 level on September 9, UUP had over $2.052 billion in assets under management. The ETF trades an average of more than 4.459 million shares daily and charges a 0.78% management fee. The UUP ETF is a highly liquid tool that tracks the dollar index.

The bull continues to push the dollar index higher but do not expect any upside spikes as currency differentials tend to move slow, and steady, and trends can last for extended periods.

More Forex News from Barchart

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)