- I've long argued that we can avoid most of the noise in markets by focusing on weekly closes only, and this week is no exception.

- Unfortunately, we have the monthly annoyance of USDA's Supply and Demand report standing in the way today.

- Rather than focusing on USDA's imaginary numbers, we can instead turn our attention to how Friday's closes in Dec corn and Nov soybeans relate to the last couple week's settlements.

I don’t know about you, but I’m already looking forward to Friday’s close. It has been a wild week for most markets and based on both the Wilhelmi Element[i] and the Goldilocks Principle[ii] the only price that should matter to us any week is the weekly close. If we think about it, most of my studies are based on Friday settlements, including the key seasonal studies[iii] so I often find myself playing the waiting game each so I can plug in the next set of numbers. Before we get there though, we have to make it through Friday.

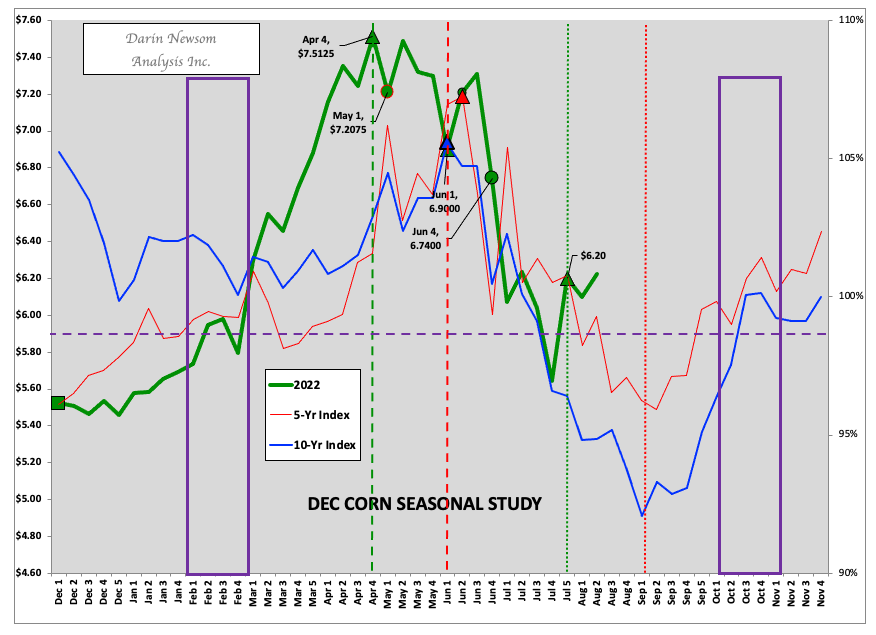

There will be a lot of talk about numbers in the corn market Friday, but the only numbers that matter are $6.20 and $6.10. If we look at my seasonal study for December corn (ZCZ22) we see the previous 4-week high weekly close was $6.20 from two weeks ago. If Dec22 closes above that mark this week, then it would confirm the contract has made an early start on its seasonal uptrend and indicates the harvest low has likely been established. However, last week saw Dec22 close at $6.10 (in both cases, note corn’s Round Number Reliance[iv]) so a close below that mark would open the door to a possible test of the low weekly close at $5.6425 (fourth week of July). Thursday saw December close at $6.2775, so we would naturally think a bullish close would be fairly safe. Normally, yes, but there is the little problem of USDA’s latest round of imaginary supply and demand numbers standing in the way of Friday’s close. Do I think this monthly bit of silliness changes anything about the corn market? No. Long-term fundamentals will still be bullish at the end of the day and the low weekly close will still be in place.

It’s a similar situation for November soybeans (ZSX22) heading into Friday’s session, with the key numbers to keep in mind the last two weekly closes. Two weeks back saw the contract settle at $14.6850 with last Friday’s mark falling to $14.0875. The contract closed Thursday at $14.4850 before dropping to a low of $14.39 overnight. It’s possible November stays between these two prices through Friday’s close, a fact that leaves the door open to us watching one interpretation of the Wider River Theory[v] play out. As with December corn, nothing about new-crop soybeans will change when we get to Friday’s close, most notably long-term fundamentals. Traders will likely have turned their attention back to weather forecasts and debating whether or not it is too late for rain to improve the situation west of the Mississippi River. Soybeans also have the China wildcard as the market heads toward another weekend. The other item of note is the August issue goes off the board Friday, and though I don’t usually pay much attention to August (or September) soybeans (ZSQ22) there is no denying the bullish fundamental story it told the last number of weeks.

[i] The Wilhelmi Element tells us the only price that matters is the close.

[ii] The Goldilocks Principle: Daily charts are too hot, monthly charts are too cold, but weekly charts are just right.

[iii] Seasonal studies show us a little bit of everything: Seasonal patterns (obviously), that tell us how markets tend to move given ‘normal’ supply and demand; Trend, implying noncommercial activity; volatility; and just about any other factor we can imagine.

[iv] Corn’s characteristic Round Number Reliance: Corn likes to move from round number to round number looking for support and/or resistance.

[v] The Wider River Theory has come to mean a number of things. In this case, think of USDA’s reports as a large rock that falls into a wide river. It makes an initial splash but is then soon swallowed up and the river rolls along like nothing ever happened.

More Grain News from Barchart

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)