Lumber futures are a frightening market as low volume, and open interest levels exacerbate price variance. On July 12, in an article on Barchart, I wrote, “If lumber can hold above the mid-June $517 low, it will send a signal to other commodities that the recent corrections could be ending.” Lumber fell below that price to the lowest level since September 2021, but the wood price held critical support at the August 2021 $448 low.

On August 11, nearby September lumber futures were above the $630 per 1,000 board feet level as the implosive period could be ending. Meanwhile, the CME has rolled out a new lumber futures product that some market participants could increase volume and open interest. A liquid lumber product would likely cause volatility to decline over the coming months and years.

Lumber held the August 2021 low

In August 2022, lumber fell below the June 2022 $517 short-term technical support level, but the price held above the September and August 2021 lows.

As the chart highlights, the most recent selling took nearby lumber futures to $470.60 per 1,000 board feet on August 4. Lumber held above the critical August 2021 $448 low, medium-term support level for the volatile industrial commodity. Lumber tends to be a bellwether market for other raw materials that trade in the futures market.

Metals have stabilized after reaching lows- The dollar index corrected from the high

Copper is the metal that tends to diagnose the health and wellbeing of the global economy. Nearby COMEX copper futures traded at an all-time high of $5.01 in March 2022. Like lumber, copper corrected. The red nonferrous metal for September delivery reached a low of $3.1315 per pound on July 15.

The chart shows the continuous contract bottomed at $3.15 and was trading near the $3.70 per pound level on August 11.

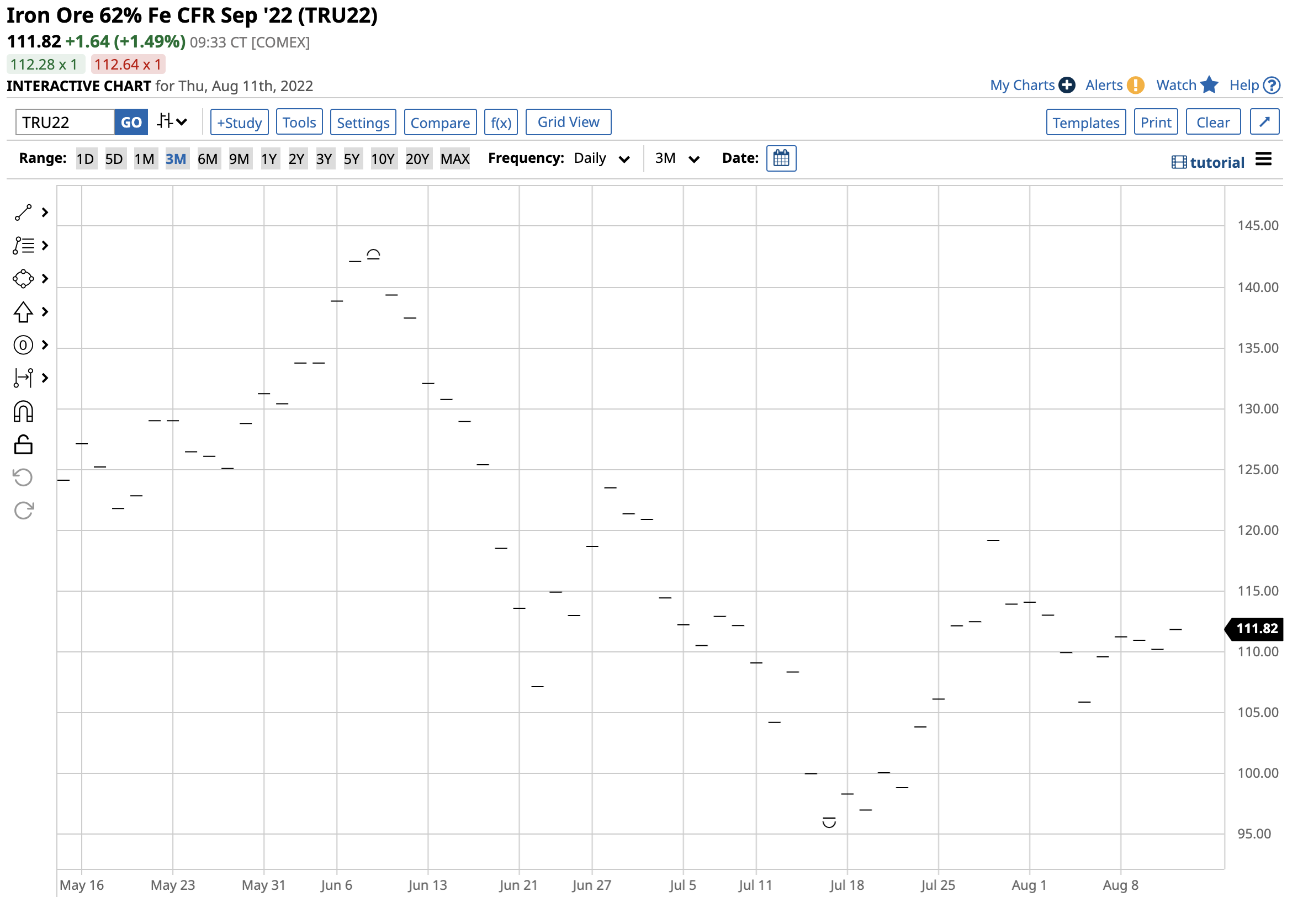

Iron ore is the primary ingredient in steel, one of the critical infrastructure building blocks.

The chart shows iron ore’s price rose from a low of $96.30 on July 15 to over the $111.80 level on August 11. Meanwhile, gold, silver, and other metal prices have recovered over the past weeks. Industrial commodity prices have stabilized despite the 75-basis point Fed Rate hike in July and the prospects for further increases over the coming months.

Meanwhile, the US dollar index corrected lower after reaching a two-decade high on July 14. Since the dollar is the world’s reserve currency and the benchmark pricing mechanism for most raw materials, the slide in the dollar supported a recovery in commodity prices over the past weeks.

Whether lumber is leading or following other raw materials, the low liquidity continues to foster dramatic price moves as bids to buy disappear during selloffs and offers to sell evaporate during rallies.

The CME rolls out a new lumber product on August 8

The CME’s lumber futures contract size is 110,000 board feet. On August 8, the exchange rolled out a new lumber product to facilitate deliveries and encourage more producer, consumer, and speculative participation that could increase volume and open interest and cause volatility to decline.

The new contract allows trucks to fulfill contracts instead of only railcars. A truck can carry enough lumber for two houses, while a railcar carries enough for eight homes. Since trucks have a capacity of only one-quarter the amount, the new futures contract allows hedgers to lock in prices for smaller projects. Moreover, the new physically settled contract specifications allow for new types of lumber, including eastern species of spruce, pine, and fir, instead of only lumber harvested from the West. The full details of the new lumber contract are available via the CME’s website.

Meanwhile, the exchange will delist the existing lumber futures contract after a sunsetting period, replacing it with a new and improved contract.

Inflation continues- Rising interest rates weigh on new home and mortgage demand

Inflation continues to be the US administration and central bank’s primary focus. The Fed remains committed to battling the economic condition via a hawkish monetary policy path. However, two factors could derail the central bank’s plans over the coming months. The second consecutive decline in quarterly GDP is a sign that the US economy is in recession. If the recession deepens, the Fed may decide to curtail rate hikes as they are incompatible with a slowing economy and could worsen the recessionary condition. The other factor is that supply-side geopolitical issues create problems immune to monetary policy initiatives. Trade and relations between the US/Europe and China/Russia have deteriorated in 2022, causing price volatility and increasing the potential for raw material shortages, fueling inflation.

When it comes to lumber, rising interest rates have begun weighing on the demand for new home construction. The lumber futures market was ahead of the curve as wood’s price began falling in March when it reached a lower high of $1,477.40 per 1,000 board feet.

Lumber’s volatility will continue- The price is closer to the bottom than the top

The new lumber futures contract could increase liquidity and foster lower price variance over the coming months and years. However, wood prices will continue to reflect economic and geopolitical issues facing the US and the world. At the $630 per 1,000 board feet level on August 11, lumber’s price is a lot closer to a low than the March 2022 high or the May 2021 record peak of $1,711.20 per 1,000 board feet.

Before 2018, the all-time high in the lumber futures arena was the 1993 $493.50 peak. Lumber was above that level on August 11, and the critical support level stands at only $45.50 below the 1993 high. Even a slight improvement in liquidity will go a long way to encouraging more participation in the lumber market, but don’t look for miracles or rush in to participate too soon. Lumber will likely continue to experience wide price variance given its sensitivity to economic conditions. While trading lumber remains highly dangerous, ignore the price action at your risk, as the wood market is a valuable barometer for other industrial commodity prices.

More Softs News from Barchart

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)