Sugar trades in the futures market on the Intercontinental Exchange (ICE). Free-market sugar futures have traded as low as 1.50 cents and as high as 66.0 cents per pound since the late 1960s. Sugar comes from two sources, sugarcane and sugar beets. The cane grows in tropical climates, while beet production comes from more temperate regions.

After reaching the most recent peak in late 2021, sugar futures have been trending lower. Last week, the free-market price probed below a short-term technical support level established in early 2022. Sugar’s short-term trend is bearish, but some factors could mean the sweetest commodity is a bargain below 18 cents per pound.

The Teucrium Sugar Fund (CANE) and iPath Series B Bloomberg Sugar Subindex Total Return ETN (SGG) provide exposure to the free-market sugar futures arena.

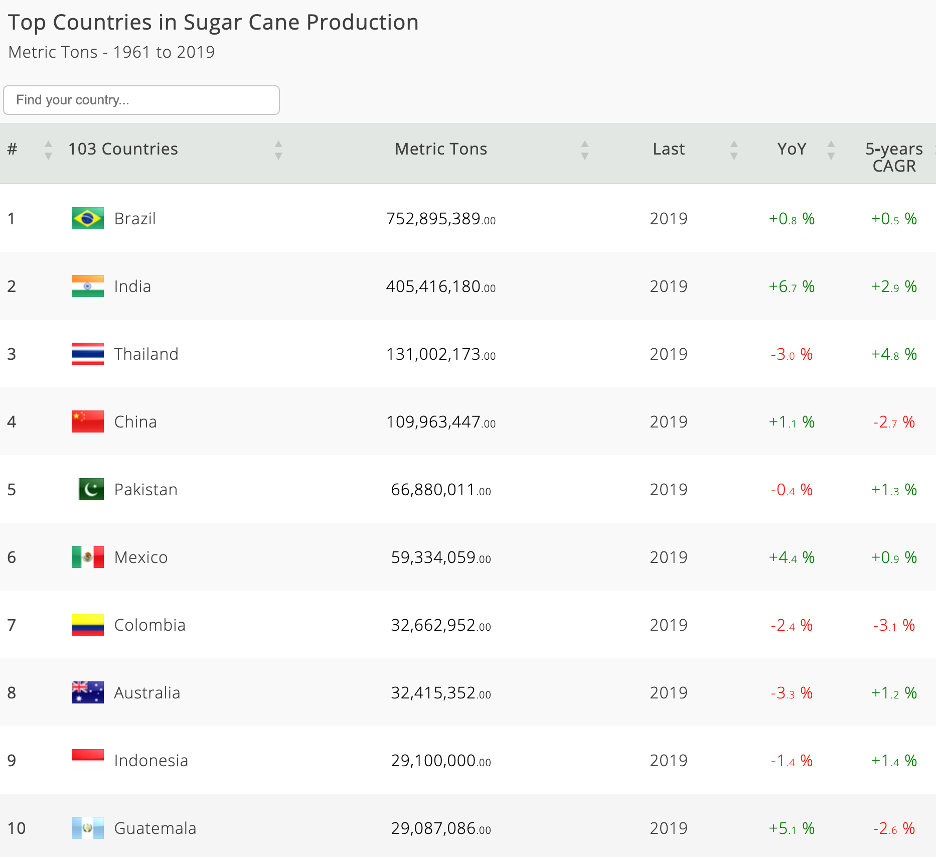

Brazil is the world’s leading sugarcane producer

Brazil is the leading producer and exporter of sugar cane. In the US, corn is the primary ingredient in ethanol, the biofuel blended with gasoline, while in Brazil, sugarcane is the input in biofuel.

The top ten sugarcane-producing countries over the past years were:

Source: Nationmaster.com

As the chart shows, Brazil produces almost double the amount of sugar as India, the second-leading global producer.

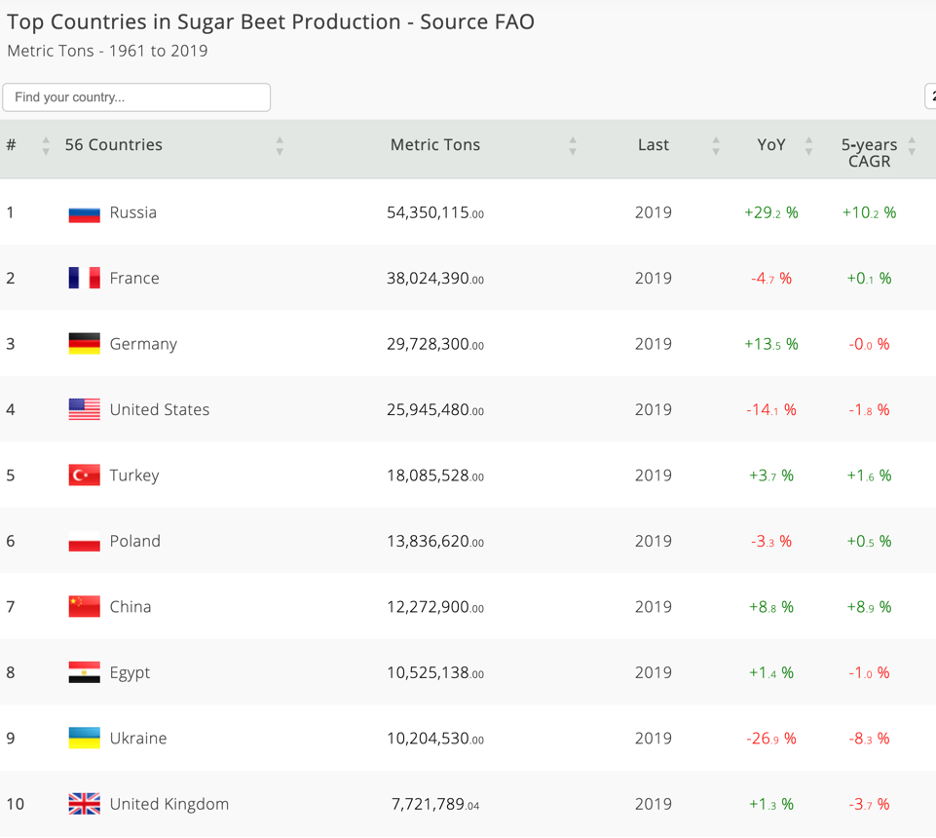

Russia leads in beet output

Russia is the top sugar beet producer worldwide. The top ten are:

Source: Nationmaster.com

Russian sugar beet output is over 43% more than the second-leading producer, France.

Sugar is a critical food and fuel commodity, and many countries subsidize local production. Free-market or world sugar reflects the sugar supplies that are unsubsidized, and Brazil is the 800-pound gorilla in the free market. Annual Brazilian output is the most significant factor for the world sugar price, and the weather in Brazil is always the primary driver of the path of least resistance of prices. However, global energy prices influence the price of the soft commodity.

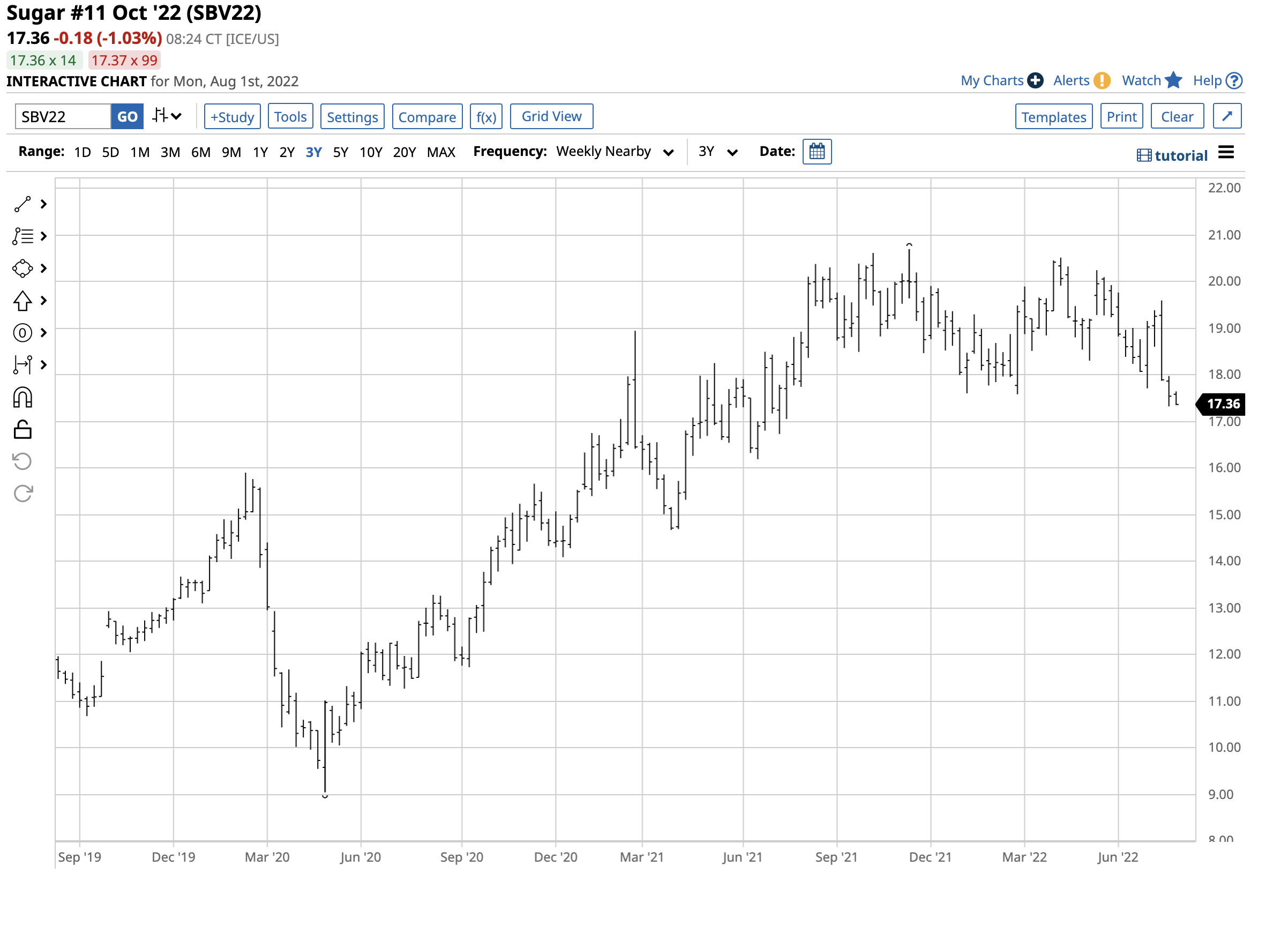

A decline below support in the sugar futures arena

Nearby ICE sugar futures prices rose to the highest price since early 2017 in November 2021 when they traded to 20.69 cents per pound.

The chart shows after more than doubling from the April 2020 9.05 cents low, sugar futures have made lower highs and lower lows since the November 2021 peak.

The shorter-term chart highlights the recent decline to a low of 17.32 cents, violating the January 2022 technical support level at 17.60 cents per pound. ICE sugar for October delivery was trading at the 17.36 cents level on August 1.

Three reasons why sugar should recover and could explode to the upside

At least three factors support the world sugar price after eight months of correcting from the November 2021 high:

- Crude oil, natural gas, and coal prices are at multi-year highs, increasing the demand for sugarcane-based ethanol.

- Global inflation at the highest level in decades increases the cost of producing, processing, and transporting sugar to worldwide consumers.

- Climate change has caused weather volatility worldwide, impacting agricultural crop production, and sugar is no exception.

Meanwhile, three other factors are bullish for sugar:

- US energy policy favors alternative and renewable energy sources and inhibits hydrocarbon production and consumption. Biofuel demand is increasing in the world’s leading energy-consuming country.

- The war in Ukraine could curtail Russian sugar exports to “unfriendly” countries supporting Ukraine, even though Russia is not a leading sugar beet exporter.

- Local production costs are in Brazilian real, and the real has been trending higher against the US dollar since reaching a low in May 2020. A rising real causes labor expenses to rise, putting upward pressure on sugar’s price.

While sugar has declined from the November 2021 high and probed below the January 2022 low, the price remains substantially above the April 2020 low, and the potential for a rebound remains high in early August 2022.

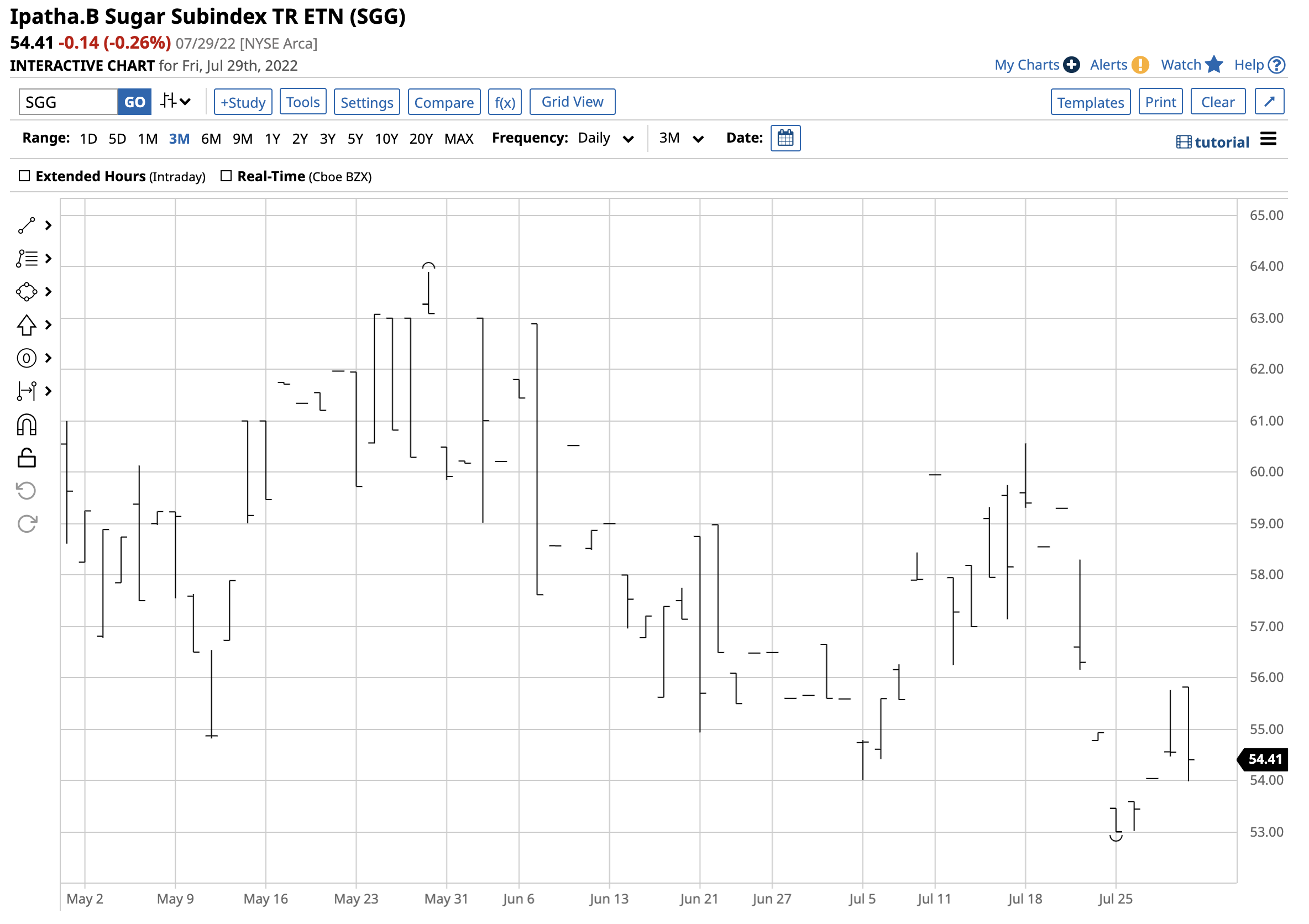

The CANE ETF and SGG ETN follow the sugar futures price with different risk profiles

The most direct route for a risk position in sugar is via the futures and futures options on the Intercontinental Exchange. Sugar is the most liquid soft commodity with the highest volume and open interest. Market participants looking for sugar exposure without venturing into the futures arena have two choices, the Teucrium Sugar Fund (CANE) and iPath Series B Bloomberg Sugar Subindex Total Return ETN (SGG).

The CANE product holds a portfolio of sugar futures contracts. Since most of the price volatility occurs in the front month, CANE tends to underperform the nearby contract on the upside and outperforms when the price corrects.

At $8.61 on August 1, CANE had $29.127 million in assets under management. The ETF trades an average of 78,813 shares daily and charges a 1.14% management fee. The most recent rally in the October ICE sugar futures contract took the price from 17.71 cents on July 5 to 19.59 cents per pound on July 18, a 10.6% gain. Sugar futures declined to 17.32 cents on July 27, an 11.6% drop.

Over the same period, the CANE ETF rallied from $8.95 to $9.58 per share or 6.6% and then declined to $8.68 per share or 9.4%. CANE underperformed the October futures contract on the upside and outperformed during the recent price correction.

At $54.40 per share on August 1, the SGG ETN product had $26.114 million in assets under management. SGG trades an average of 4,380 shares daily and charges a 0.45% management fee.

From early July, SGG moved from $54.01 to $60.56 per share or 12.1% during the rally and fell to the $53.00 level, a 12.5% decline from the high. SGG’s performance was more in line with the nearby ICE October futures contract, while CANE’s portfolio approach minimizes roll risk and lowers the loss during price corrections.

I remain bullish on sugar, but the trend remains lower in early August. Keep an eye on fuel prices and the weather in Brazil as they could cause the sweet commodity that has soured to become sweet again on the upside.

More Softs News from Barchart

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)