- I'm sure there were many in the industry not happy about Tuesday's selloff in new-crop corn, but to me it provides the next trading opportunity.

- Given long-term fundamentals remain bullish, traders (both commercial and noncommercial) could view the move as another chance to get positions in place, either long futures or short put options.

- The tricky part is renewed noncommercial buying could still be weeks away, and seasonally December corn has not reached its usual low point yet.

Back in April, I wrote about the strategy of selling corn call options to take advantage of a market that seemed to be overpriced and establishing bearish technical patterns, with the risk being seasonal indexes that remained bullish through mid-June. As the dust settles on Tuesday’s commodity complex macro selloff, putting my idea of a return of noncommercial money on hold for now, the strategy could now be to sell put options below the corn market.

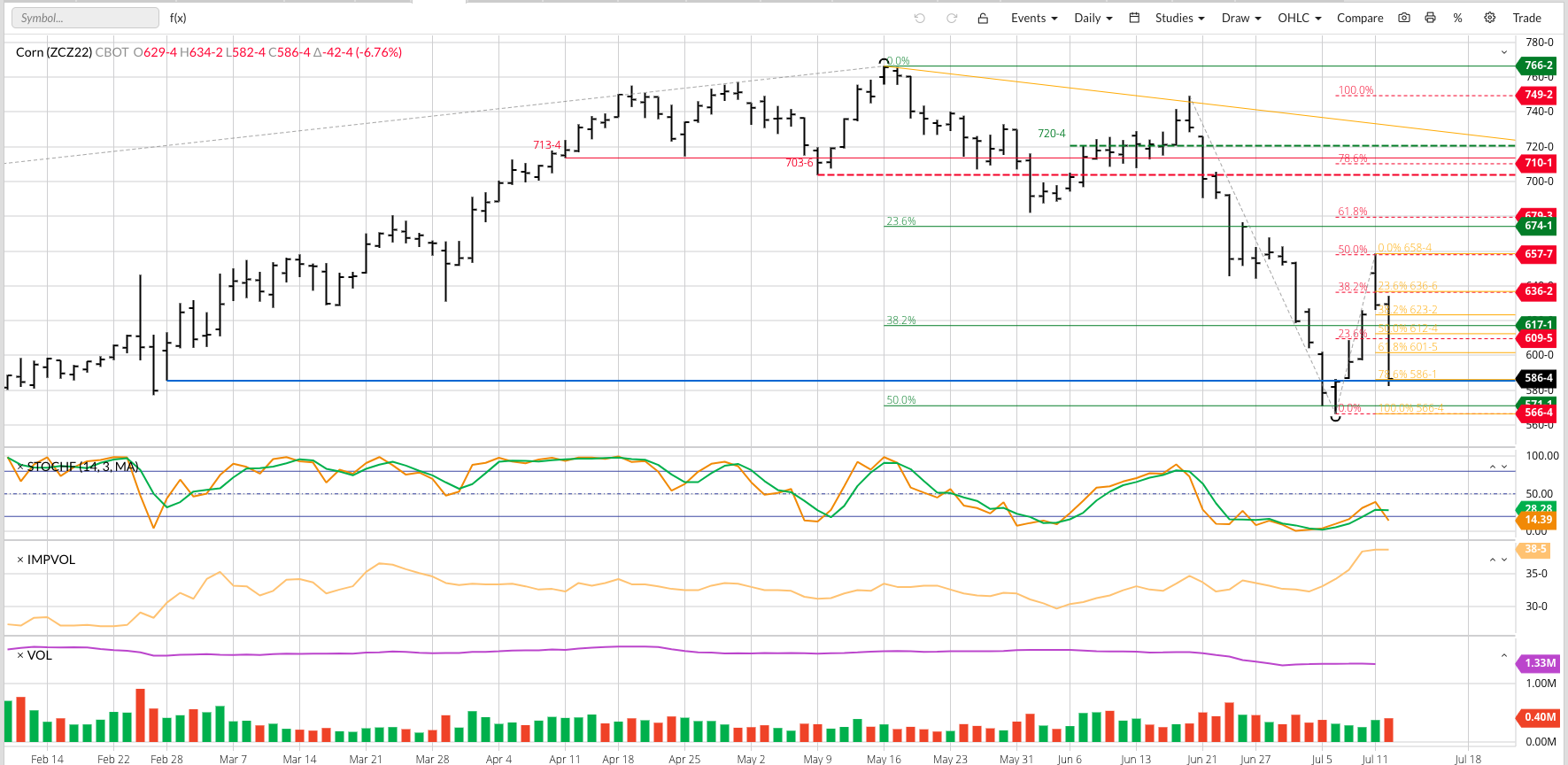

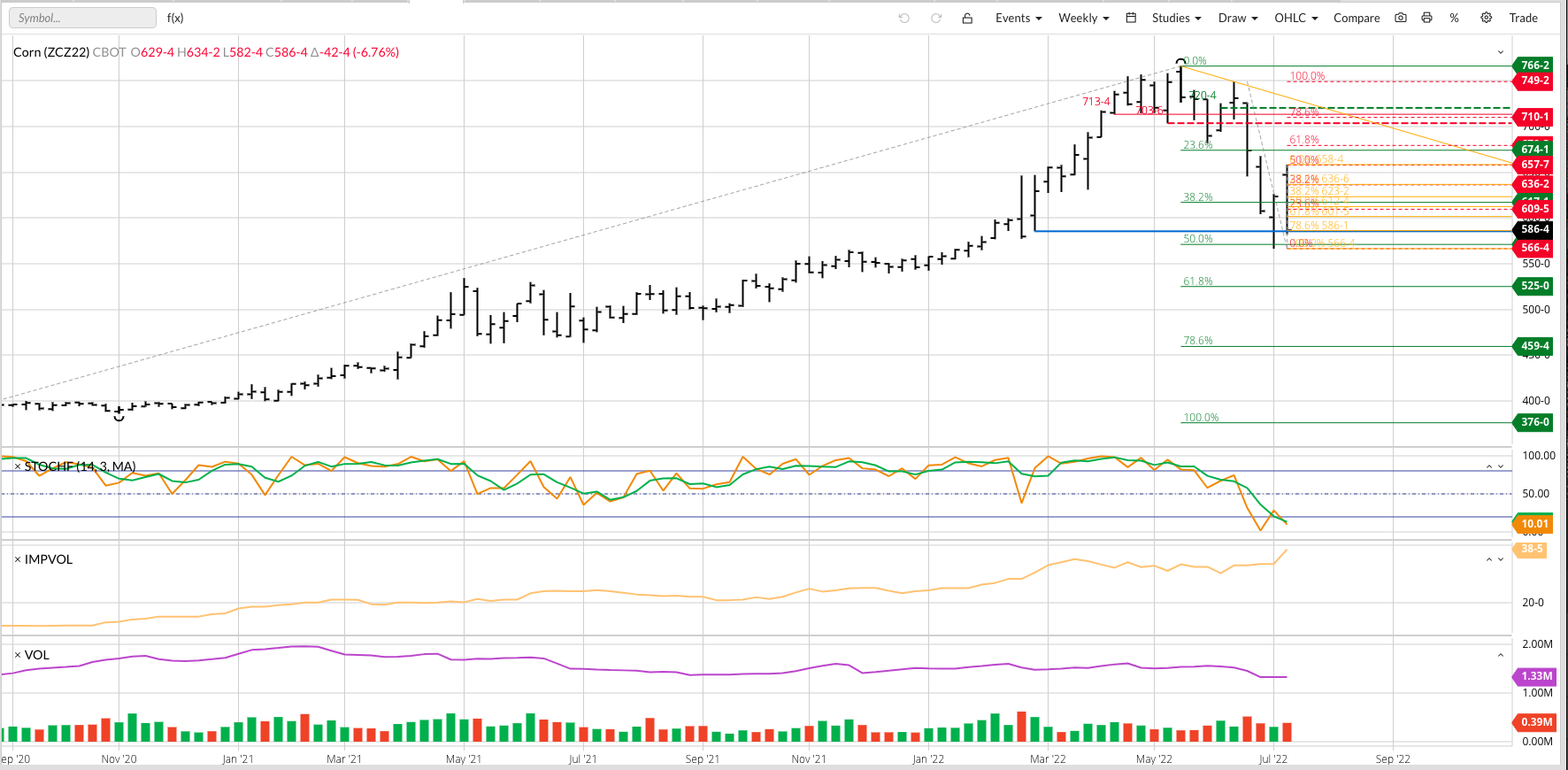

This time, though, I’m looking out at the new-crop December 2022 futures contract (ZCZ22). A quick recap of the technical picture shows December corn moved into both short-term and intermediate-term uptrends on its daily and weekly charts respectively last week. It posted bullish spike reversals on both, the more important being on the weekly chart, with the short-term uptrend quickly accelerating to this past Monday’s high of $6.5850. Using a loose form of Elliott Wave Theory, the Wave 2 selloff even more quickly erased 80% of Wave 1 as the contract hit a low of $5.8250 Tuesday. If Dec corn is to maintain its recently established uptrends, it needs to hold last week’s low $5.6650.

Why do I like sell put options rather than buying futures at this time? Let me count the ways:

- Implied volatility of Dec $5.90 puts 38.5% while $5.80 puts were showing 38.0%. Both should be considered high, and as a general rule I’d rather sell high volatility than buy.

- Seasonally, Dec corn is still a ways from its normal low weekly close that tends to occur the first week of September. Selling put options provides a time buffer rather if the contract wants to spend a few more weeks not rallying because…

- Noncommercial traders have been actively liquidating their net-long corn futures position, and may not be interesting in returning as buyers again until early August, when they don’t have to deal with the September issue.

Before I go any further, I need to say remind everyone again that selling uncovered (naked) options is an unlimited risk/limited reward position. And, this is not a recommendation to buy futures or sell put options. So there’s that to consider.

Based on what I’m seeing on my quote screen, the Dec $5.90 put closed at 56.5 cents while the $5.80 put finished at 50.25 cents (roughly). Theoretically:

- Selling the $5.90 put option would result in a floor price of approximately $5.34 ($5.90 - $0.56) while

- Selling the $5.80 put puts the floor near $5.30 ($5.80 - $0.30)

- Of the two, I like the $5.80 strategy better given the next intermediate-term downside target is near $5.25

Who could be looking at this strategy?

- End users looking to get some coverage in place, or enhancing their expected position

- Fund traders looking to get back into the market while avoiding September futures

- Traders who have shorted December for a seasonal move and are looking to enhance their futures position

As I said back in April, this strategy isn’t for everyone, and it does come with seasonal risk. But given corn’s forward curve remains bullish, traders could be looking at this selloff as an opportunity.

More Grain News from Barchart

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

/Nike%2C%20Inc_%20swish%20by-%20Tartezy%20via%20Shutterstock.jpg)