Tech stocks are a challenging investment these days.

On the one hand, tech stocks provide massive growth opportunities. And they’re on the cutting edge of innovation. That makes investors – and Wall Street – pretty excited.

On the other hand, this isn’t a good environment for tech stocks at all. Rising interest rates, inflation, supply chain challenges and the aftermath of the Covid-19 pandemic have all combined to massively weigh down tech names.

The Invesco QQQ Trust ETF (QQQ), for instance, is down more than 21% so far this year. The Vanguard Information Technology Index Fund (VGT) shows the same kind of losses. And then there’s the ARKK Innovation ETF (ARKK) managed by Cathie Wood, that’s seen a drop of 50% so far in 2022.

But there are still bargains to be had. You just have to know where to look.

For this review, I screened for U.S.-based technology stocks. I limited the screen to companies that have a market capitalization of at least $2 billion. Because I wanted to find stocks that are seen as good value, I limited the screen to stocks that have a forward price-earnings ratio of less than 15.

And because I wanted to identify stocks that are seen as having the most potential even in today’s trying environment, I limited the screen to companies that have a “strong buy” consensus rating from analysts that cover them.

That left us with three tech stocks. Here’s a closer look at each.

Jabil Circuit (JBL)

Based in Saint Petersburg, Florida, Jabil Circuit (JBL) is an electric technology company that works in the aerospace, automotive, computer, consumer, defense and medical industries. With more than 260,000 employees and working in 30 countries, Jabil has a market capitalization of $8.25 billion.

For the company’s fiscal second quarter, Jabil reported net revenue of $7.6 billion, which beat analysts’ expectations of $7.44 billion. Earnings per share came in at $1.68, which also beat analysts’ expectations of $1.47.

Jabil projected third quarter revenue between $7.9 billion and $8.5 billion, with income between $300 million to $360 million. The company is projecting Q3 EPS to come in between $1.40 and $1.80 per share.

“I like what we’re doing and where we’re going. Our strong financial outlook is supported by both strong secular tailwinds and momentum in many of the end-markets we serve,” Chairman and CEO Mark Mondello said. “As a result, we are raising our financial outlook for the fiscal year. We now expect FY22 to deliver revenue in the range of $32.6 billion and core EPS of approximately $7.25.”

Citi analyst Jim Suva says JBL stock is his top pick in the sector now that the semiconductor shortage is beginning to improve, and demand continues to remain high.

Analysts who cover Jabil have a consensus price target of $82.17, which represents nearly 40% upside in JBIL stock.

Insight Enterprises (NSIT)

Insight Enterprises (NSIT) is another information technology stock with operations around the world. Based in Chandler, Arizona, Insight provides IT, computer services and cloud solutions to businesses, government offices and schools.

Insight has a market capitalization of $3.6 billion and employs more than 11,600 people.

The company reported record earnings in the first quarter, posting revenue of $2.65 billion that beat analysts’ expectations for $2.41 billion. Earnings per share came in at $1.81, while analysts had only predicted EPS of $1.59.

For the full year, Insight issued guidance for earnings between $7.95 per share and $8.15 per share.

“I am very pleased with our performance in the quarter as we delivered a record Q1 for revenue, gross profit and adjusted diluted earnings per share,” President and CEO Joyce Mullen said. “With supply constraints somewhat easing for devices, we recorded higher than expected hardware net sales and product demand remained healthy.”

Analysts have a consensus “strong buy” rating on NSIT stock, with an average price target of $122. That represents 18% upside from current prices.

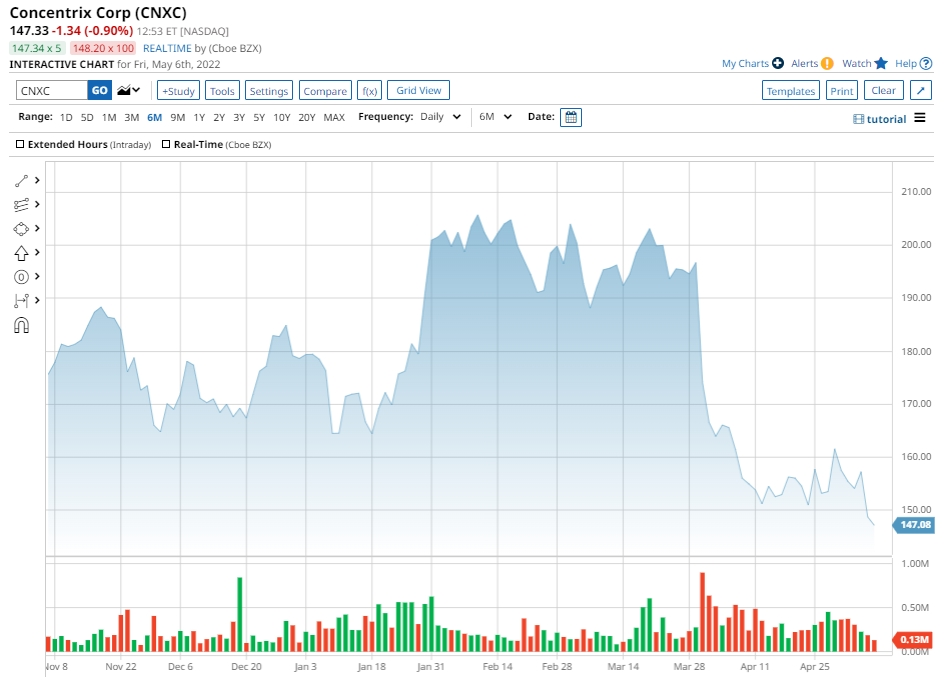

Concentrix Corporation (CNXC)

Based in Newark, California, Concentrix (CNXC) specializes in customer experience solutions, including work with voice, chat, email, social media and messaging applications. It works with companies to design strategy, manage operation and provide the technology for companies to provide good customer experiences.

Concentrix operates in more than 40 countries and has 290,000 employees.

The company late last year finalized its acquisition of PK, a global customer experience company, and credited the acquisition to boosting its recent first quarter results.

Q1 earnings beat analysts’ expectations. The company reported revenue of $1.54 billion, which was up 10% from a year ago and beat analysts’ estimates. Earnings per share were $2.85.

"We delivered double-digit revenue and profit growth in the first quarter," President and CEO Chris Caldwell said. "Integration of PK into our Concentrix Catalyst team is on track, and we are seeing strong demand from strategic client partners for our unique mix of CX digital solutions. These unmatched capabilities combined with our commitment to innovation and industry-leading execution have us confident that we will stay differentiated, grow faster than the market, and expand profit margins in 2022 and beyond.”

The company reiterated Q2 guidance of between $1.57 billion and $1.6 billion in revenue, and income between $205 million to $220 million. Full year guidance remained between $6.4 billion and $6.6 billion in revenue and income between $890 million and $930 million.

Analysts have a consensus “strong buy” rating on CNXC stock with an average price target of $211. That represents potential upside of 43% from today’s prices.

As of this writing, Patrick Sanders did not have a position in any of the aforementioned equities.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)