Arabica coffee futures trade in the futures arena on the Intercontinental Exchange (ICE). Like most agricultural commodities, coffee experiences lots of price volatility on the back of the weather conditions in critical growing conditions worldwide. Since Brazil is the top producer and exporter of Arabica beans, the weather in the leading South American country impacts the price. In July 2021, a frost across Brazil’s coffee-growing region caused prices to soar to over a decade high.

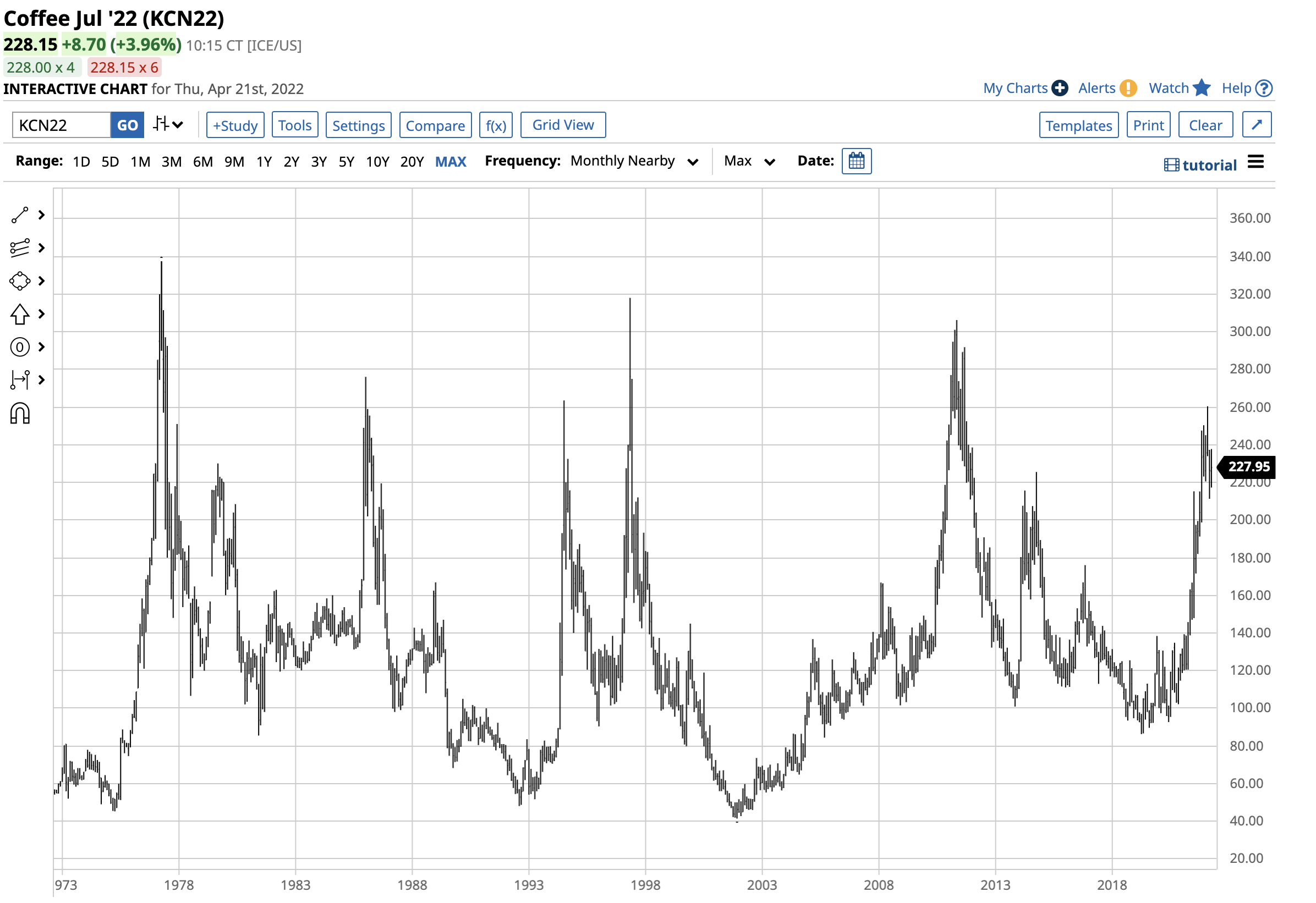

Coffee futures have traded over $3 per pound three times since the early 1970s. The price action over the past months is a sign that the fourth trip over that level is on the horizon.

The iPath Series B Coffee Subindex TR ETN product (JO) moved higher and lower with the Arabica futures.

A bullish trend since April 2019

ICE coffee futures have been making higher lows and higher highs over the past three years.

The chart highlights the move from the April 2019 86.35 cents per pound low to the most recent high of $2.6045 in February 2022. At the $2.28 level on April 21, coffee futures remain in a bullish trend.

The weather in Brazil lit a bullish fuse

The chart illustrates the most significant rally occurred in July 2021 when a frost in Brazil destroyed crops, leading to Arabica bean shortages. The weather conditions in critical growing regions are always the primary factor for coffee beans and all agricultural products, and Brazil is the leading producer and exporter of Arabica beans.

The weather ignited the bullish fuse, but other factors contributed to the ascent of the soft commodity to the highest price since 2011, the last time coffee futures reached the $3 per pound level.

Inflation is lifting all agricultural product’s prices

The 2020 global pandemic caused the world’s central banks to flood the financial system with liquidity via low interest rates and other monetary policy tools. Government stimulus programs and central bank policies planted inflationary seeds that sprouted in 2020 and continued to blossom throughout 2021 and early 2022. Inflation erodes money’s purchasing power, causing prices to rise. Coffee and most other commodity prices have soared over the past two years, reaching multi-year, or in many cases, new all-time highs.

Meanwhile, rising energy, labor, fertilizer, and other input expenses increased coffee’s production costs. Supply chain bottlenecks created shortages, only exacerbating the price rise that took coffee futures to the highest price in over a decade in February 2022.

The trend is always your best friend in markets, and it remains higher in the coffee futures market.

The long-term chart dating back to the early 1970s shows coffee futures eclipsed the $3 per pound level in 1977, 1997, and 2011 and was trending in that direction in April 2022.

A rising Brazilian currency puts more upside pressure on coffee prices

ICE coffee futures trade in US dollar terms. Meanwhile, Brazilian local production costs, including labor and other expenses, are in the Brazilian real. A falling real weigh on Arabica coffee’s price as Brazilian supplies experience lower production costs and can sell at higher levels in dollar terms. A rising real has the opposite impact, pushing coffee prices in dollar terms higher.

The chart of the currency relationship between Brazil’s real and the US dollar shows a long-term bearish trend in the real from 2011 through 2020. After consolidating over the past two years, the real broke out to the upside in March and was at over the $0.21 level against the dollar on April 21. A rising real supports dollar-based coffee prices. Brazil is also the leading producer and exporter of sugar and oranges. A stronger Brazilian currency is bullish for sugar, coffee, and orange prices, as are rising global inflationary pressures across all markets.

The JO does an excellent job tracking the ICE coffee futures

The most direct route for a risk position in the coffee market is via the ICE futures and futures options. The iPath Series B Coffee TR ETN product (JO) offers an alternative for those looking to participate in the coffee market without venturing into the futures arena.

At $61.79 per share, JO had $76.239 million in assets under management and trades an average of 38,956 shares each day. JO charges a 0.45% management fee. July ICE coffee futures rose from $2.0995 on March 15 to $2.3770 on April 12, or 13.2% higher.

Over the same period, the JO ETN moved from $57.02 to $64.60 per share, or 13.3%, as the ETN did an excellent job tracking the price of the coffee futures.

If coffee futures are heading for the fourth trip above the $3 per pound level, the JO ETN product will appreciate with the soft commodity’s price.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)