Base metals are the building blocks of infrastructure. The LME offers market participants cash and forward contracts and options on copper, aluminum, nickel, lead, zinc, and tin. All six of the nonferrous metals posted gains in Q1. In 2021, a composite of the six metals moved 38.09% higher. The sector moved 19.86% high from December 31 through March 31, making base metals the commodity market’s second-leading sector behind energy and just ahead of grains. Nickel forwards moved over 50% higher, aluminum rallied over 20%, and zinc and tin were up over 10%. Copper and lead prices moved higher in Q1.

Rising inflation, the war in Ukraine, rising demand for metals for green initiatives, and supply chain issues have created an almost perfect bullish storm for the base metals sector. Iron or prices, the primary ingredient in steel, a ferrous metal, moved over 30% higher in Q1.

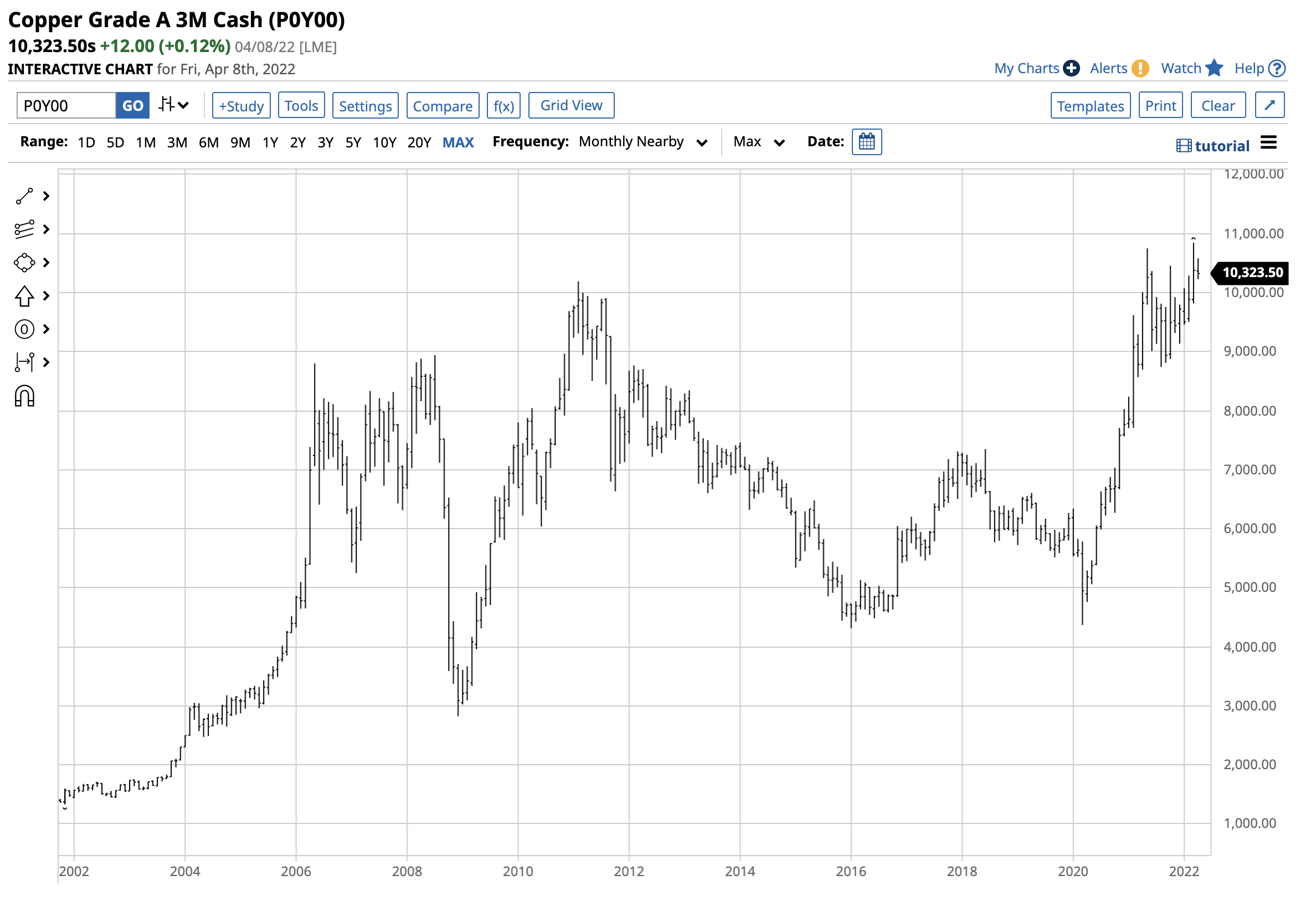

New record highs in copper

LME copper forwards moved 25.31% higher in 2021 and added another 6.73% over the first three months of 2022.

The chart shows that three-month LME copper forwards reached a record high of $10,845 per ton in March before correcting and settling at $10,375 on March 31.

COMEX copper futures rallied 26.84% in 2021 and moved 6.44% higher in Q1 2022.

The chart shows that the futures probed over the $5 level for the first time in March, reaching a high of $5.01 per pound. The COMEX futures settled at $4.7510 on March 31, 2022.

Copper is the leader in the base metals sector. Goldman Sach’s analysts believe that copper’s role in decarbonization will push the price to the $15,000 level on LME forwards and over $6.80 per pound on COMEX futures by 2025.

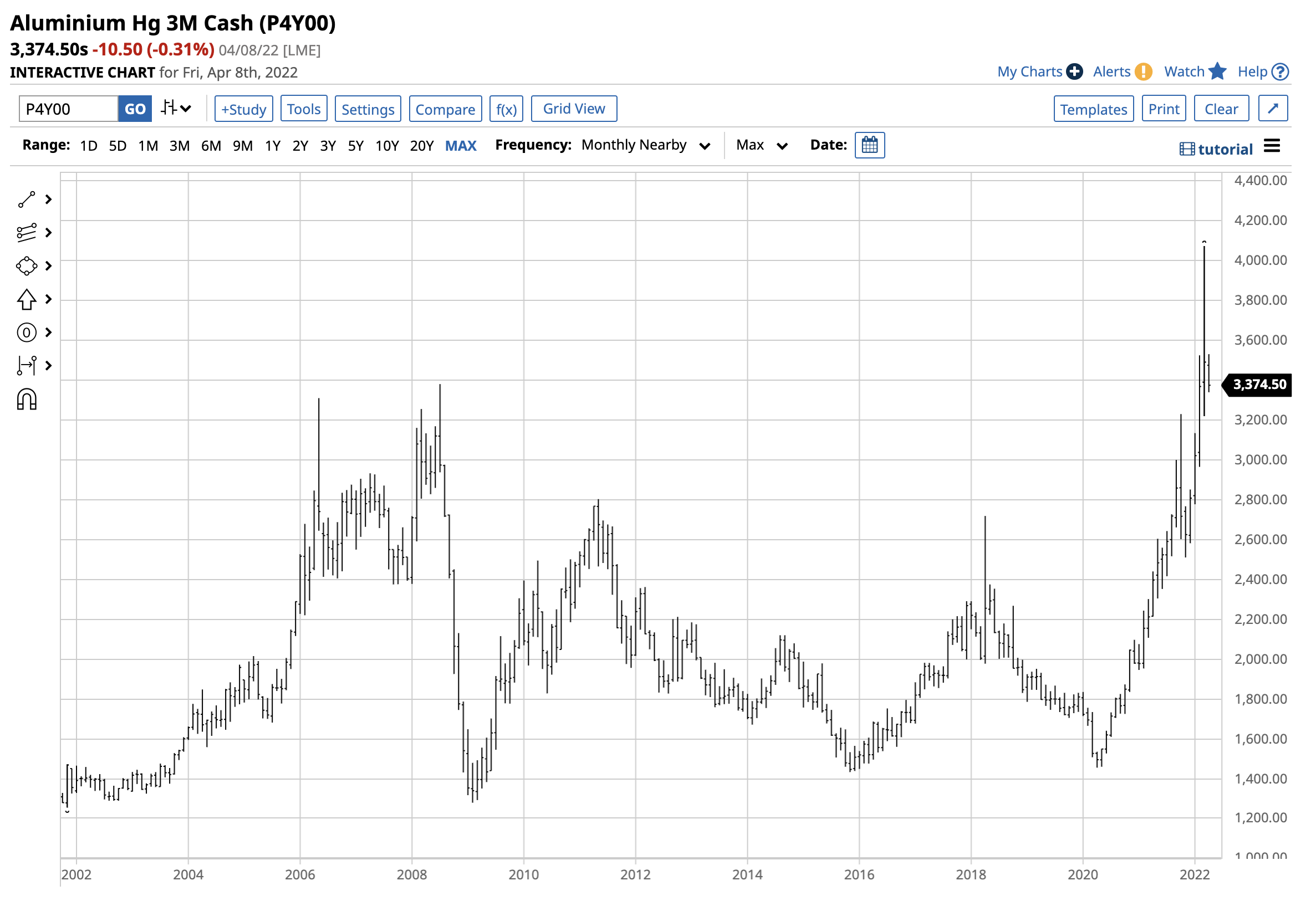

Aluminum and tin rise to a new peak

After rising 41.76% in 2021, LME aluminum forwards added another 24.35% on the upside in Q1 2022.

Three-month LME aluminum forwards spiked to a new record high of $4,073.50 per ton in March and settled at $3,491 on March 31, 2022. Aluminum is the most liquid metal on the LME as it trades the most volume, and tin is the least liquid, and it also reached a record high in Q1.

The chart shows that LME tin forwards reached a record high of $51,000 per ton in March. Tin was 91.52% higher in 2021 and moved another 10.42% to the upside in Q1, closing at the $42,910 per ton level on March 31.

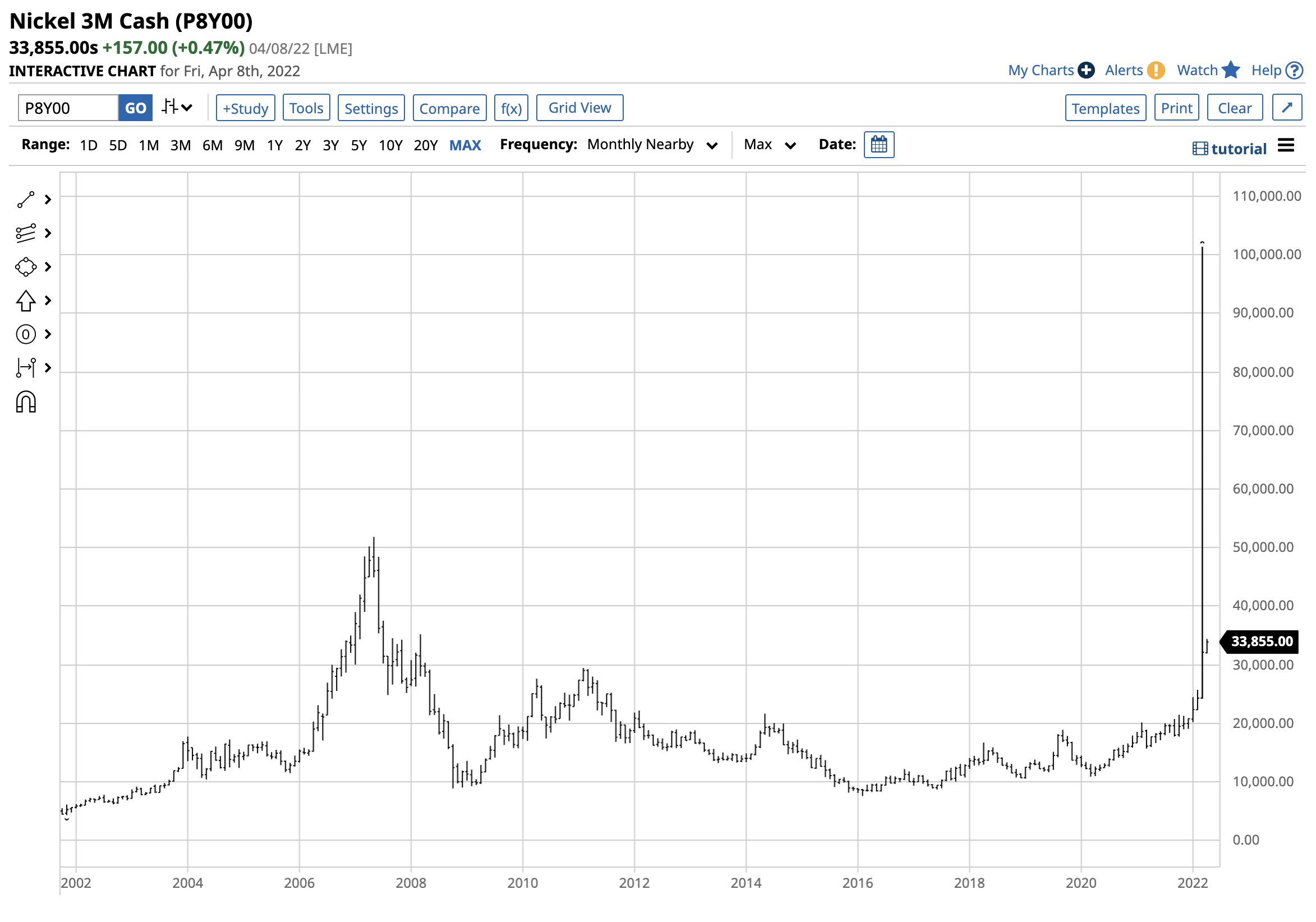

Nickel explodes and almost takes down the LME

Russia is one of the leading nickel-producing countries. The war in Ukraine and sanctions pushed nickel prices to record highs. A short Chinese nickel producer faced margin calls that threatened the viability of the LME, causing the cancelation of trades and suspension of nickel trading in early March. After rising 24.99% in 2021, LME nickel exploded higher before imploding in Q1.

Three-month nickel forwards moved above the 2008 $51,800 per ton all-time high to $101,365 in March before correcting to $32,107 on March 31. A consortium of banks and the exchange provided loans and exceptions to the Chinese nickel producer to avoid a margin default. Still, the event created problems because of the lack of position and price limits. Nickel posted a 54.68% gain in Q1.

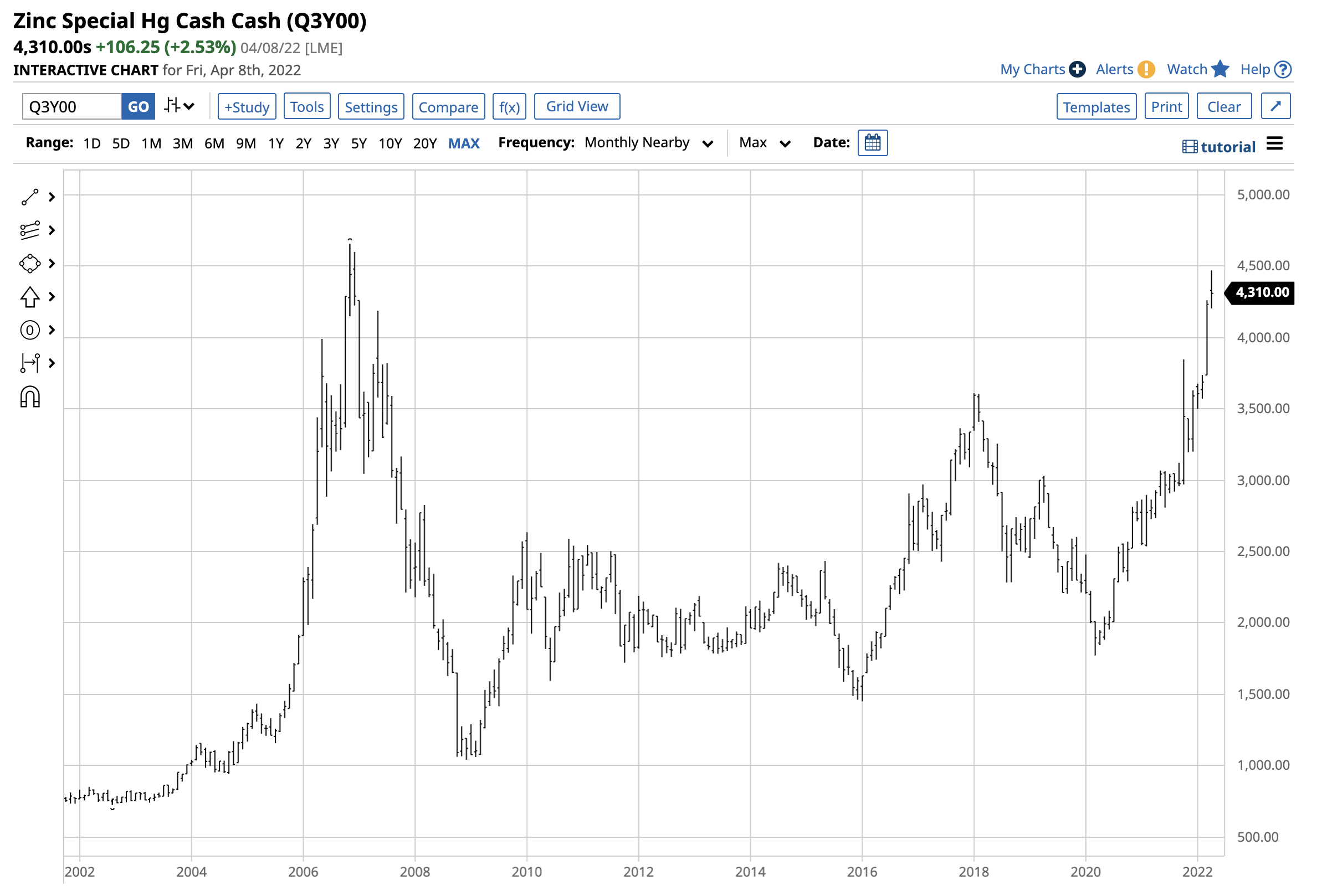

Zinc posts a double-digit percentage gain and lead moves higher

Zinc prices gained 28.74% in 2021 and added 18.10% in Q1 2022.

Zinc forwards reached a high of $4,260 per ton in March 2022, and the all-time high was in 2006 at $4,658. Lead was the laggard in the sector in Q1.

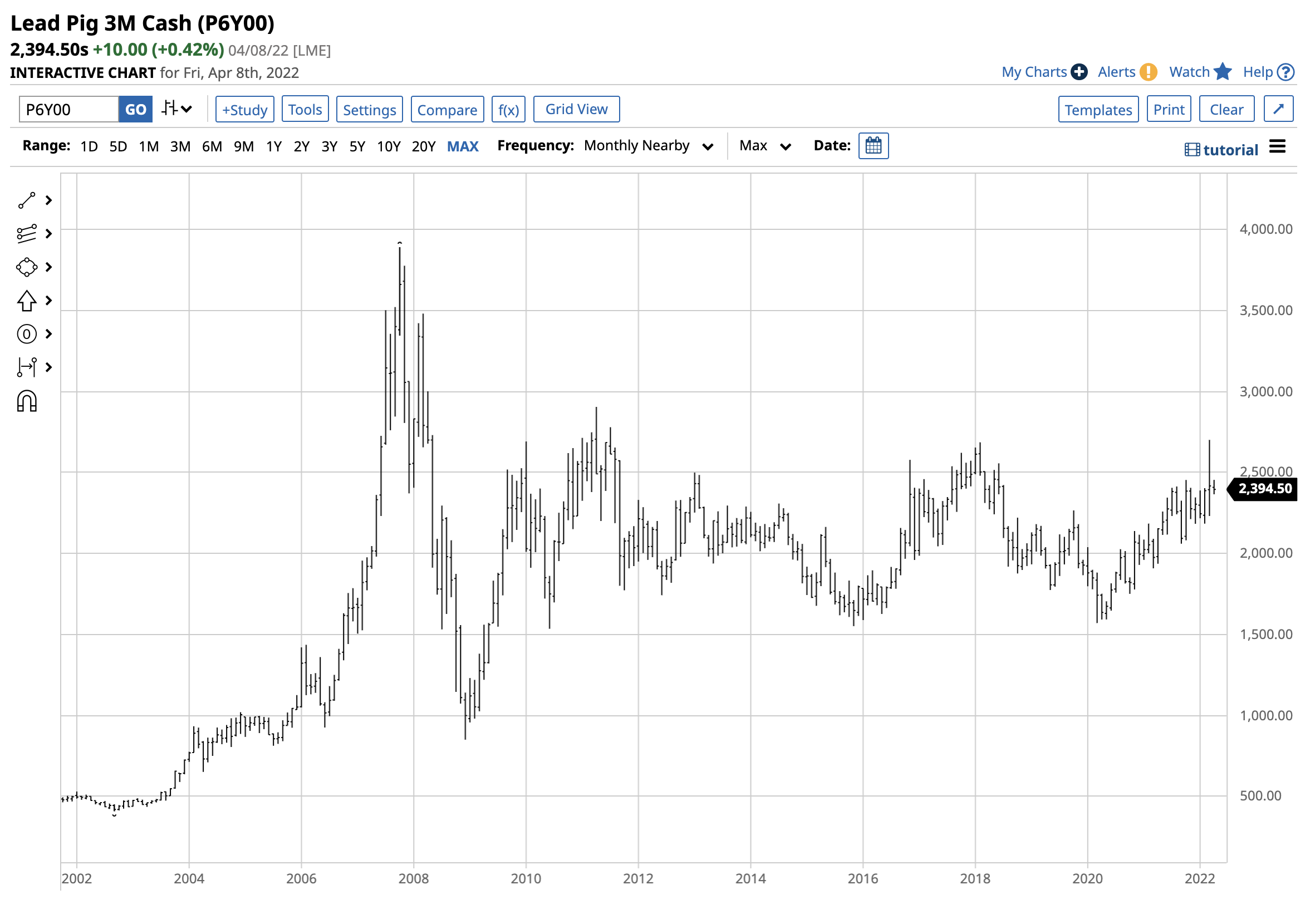

Three-month LME lead forwards were 4.86% higher in Q1 after a 16.22% gain in 2021.

Iron ore rallies- The trend remains higher in early Q2

Iron ore is the ferrous metal that is the primary ingredient in steel.

Iron ore reached a record high at $219.77 per ton in July 2021 before correcting. Iron ore declined by 24% in 2021, but the price moved 32.12% higher in Q1 2022.

The trend in metals markets remains higher in early Q2 2022. However, the higher the prices climb, the more the potential for severe price corrections. Bull markets rarely move in straight lines, and downdrafts are often fast and furious. Meanwhile, inflation, the war in Europe, supply chain issues, and addressing climate change underpin prices and could lead to even higher highs over the coming months and years.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)